NC E-585 2009 free printable template

Show details

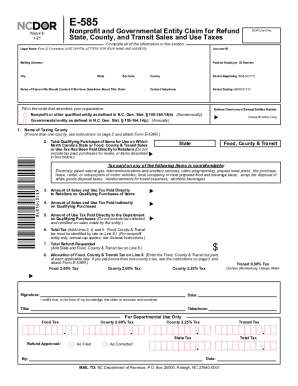

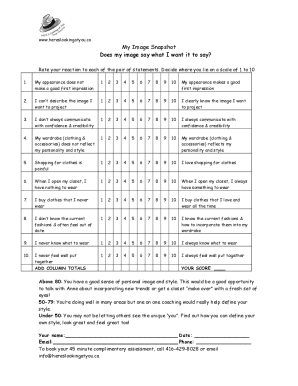

Nonproit and Governmental Entity Claim for Refund State and County Sales and Use Taxes E-585 Web-Fill 12-09 North Carolina Department of Revenue Complete all of the information in this section. Legal Name First 32 Characters USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS Account ID Mailing Address Federal Employer ID Number City State Zip Code Name of Person We Should Contact if We Have Questions About This Claim Fill in the circle that describes your organization. County Period Beginning...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign e 585 2009 form

Edit your e 585 2009 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your e 585 2009 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing e 585 2009 form online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit e 585 2009 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC E-585 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out e 585 2009 form

How to fill out NC E-585

01

Obtain the NC E-585 form from the North Carolina Department of Revenue's website or local office.

02

Fill in your full name and address at the top of the form.

03

Provide your Social Security Number or Employer Identification Number (EIN) in the designated field.

04

Indicate the type of exemption you are claiming by checking the appropriate box.

05

List the items or services for which you are claiming the exemption in the provided section.

06

Enter the total amount of exempt purchases on the form.

07

Sign and date the form to certify that the information provided is accurate and complete.

08

Submit the completed NC E-585 form to the vendor or seller from whom you are purchasing items.

Who needs NC E-585?

01

Individuals or businesses making exempt purchases in North Carolina.

02

Non-profit organizations that qualify for tax exemptions.

03

Government entities purchasing goods or services for official use.

Fill

form

: Try Risk Free

People Also Ask about

How to get a sales tax exemption certificate in North Carolina?

North Carolina does not require registration with the state for a resale certificate. How can you get a resale certificate in North Carolina? To get a resale certificate in North Carolina, you may fill out the Streamlined Sales and Use Tax Agreement Certificate of Exemption Form (Form E-595E).

How do I claim sales tax back in North Carolina?

Filing a claim for refund using Form E-588, Business Claim for Refund State, County and Transit Sales and Use Taxes. The claim must identify the taxpayer, the type and amount of tax overpaid, the filing period to which the overpayment applies, and the basis for the claim.

What is the NC sales tax refund form?

Filing a claim for refund using Form E-588, Business Claim for Refund State, County and Transit Sales and Use Taxes. The claim must identify the taxpayer, the type and amount of tax overpaid, the filing period to which the overpayment applies, and the basis for the claim.

Why would I be exempt from sales tax in NC?

Electricity, Fuel and Natural Gas, Sales and Use Tax Exemption. Retail sales, as well as the use, storage or consumption of electricity, fuel and piped natural gas sold to a manufacturer are exempt from sales and use tax for use in a manufacturing operation.

How do I claim my NC vehicle tax refund?

To obtain a refund, the purchaser must apply to the Division for a refund within 30 days after receiving the replacement vehicle or refund of the purchase price. APPLICATION MUST BE SIGNED IN INK BY OWNER AND NOTARIZED.

What is a DMV fee refund?

You can request refunds for vehicle registration, driver licenses, ID cards, insurance, and other fees and penalties collected by DMV. DMV issues refunds in cases where you accidentally paid the wrong fee, or when a fee wasn't required but you paid one.

Who is exempt from paying NC sales tax?

Qualifying Farmers or Conditional Farmers. Commercial Fishermen. Commercial Loggers. Wildlife Managers.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my e 585 2009 form directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your e 585 2009 form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit e 585 2009 form from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including e 585 2009 form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send e 585 2009 form to be eSigned by others?

e 585 2009 form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

What is NC E-585?

NC E-585 is a form used in North Carolina for reporting sales tax exemptions for certain purchases made by qualifying organizations.

Who is required to file NC E-585?

Entities that qualify for sales tax exemptions under specific categories, such as charitable organizations, educational institutions, and religious organizations, are required to file NC E-585.

How to fill out NC E-585?

To fill out NC E-585, provide the name and address of the exempt organization, specify the type of exemption, and include details of the purchase, such as description and amount. Ensure signatures and dates are included where required.

What is the purpose of NC E-585?

The purpose of NC E-585 is to document and verify the tax-exempt status of eligible organizations for sales tax purposes, allowing them to make purchases without paying sales tax.

What information must be reported on NC E-585?

NC E-585 must report the name and address of the exempt organization, the type of exemption, details of the purchase, including descriptions and amounts, along with the signatures of authorized representatives.

Fill out your e 585 2009 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

E 585 2009 Form is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.