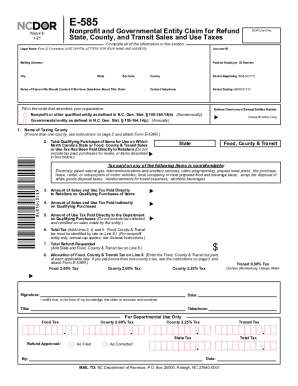

NC E-585 2018 free printable template

Show details

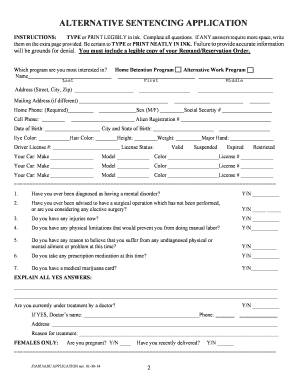

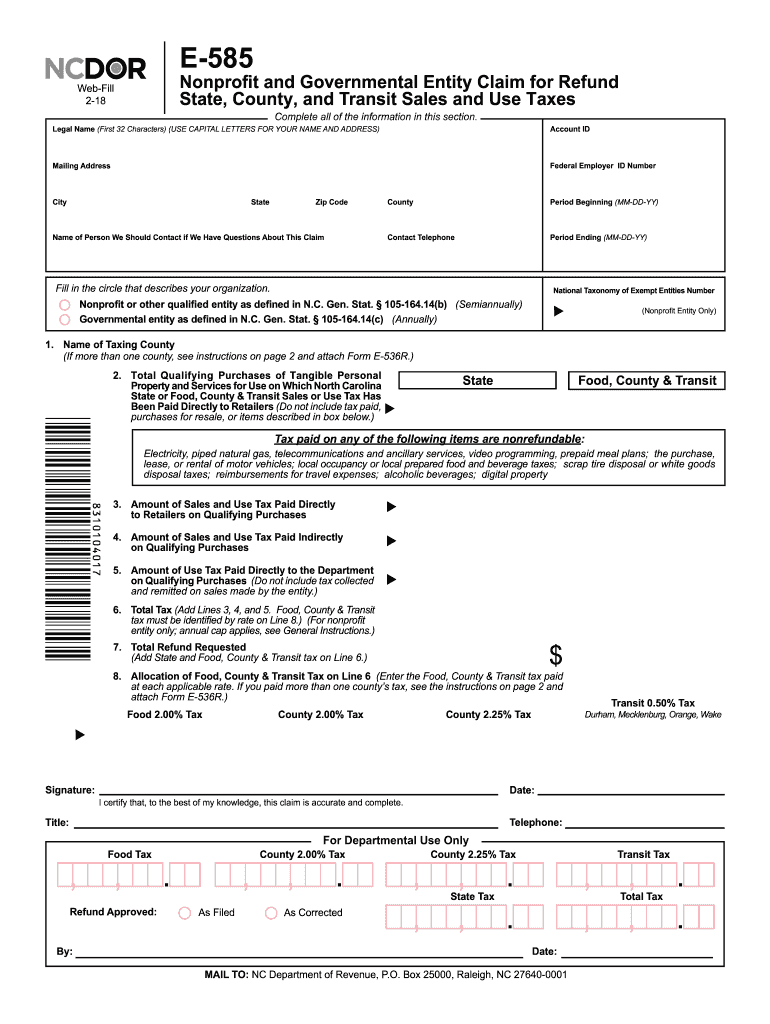

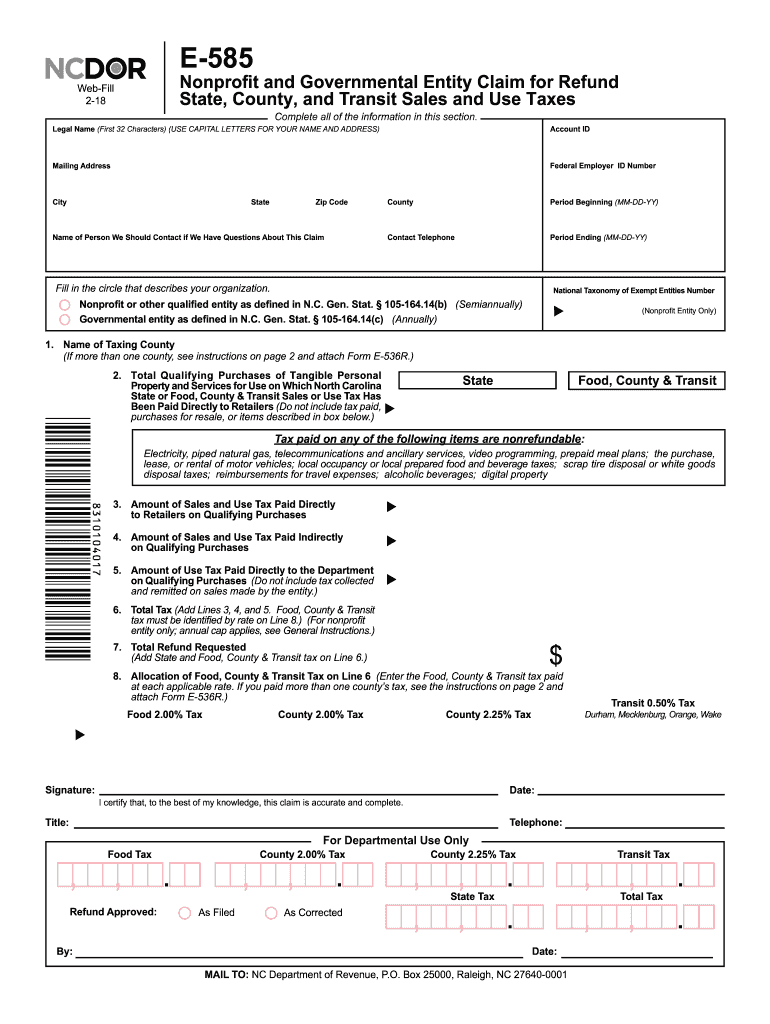

O. Box 25000 Raleigh NC 27640-0001 Total Tax Page 2 E-585 Web-Fill 2-18 General Instructions Complete this Web-Fill form in its entirety on your computer print the completed form and mail to the Department. E-585 Nonprofit and Governmental Entity Claim for Refund State County and Transit Sales and Use Taxes Web-Fill 2-18 PRINT CLEAR Complete all of the information in this section. Legal Name First 32 Characters USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS Account ID Mailing Address Federal...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC E-585

Edit your NC E-585 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC E-585 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC E-585 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NC E-585. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC E-585 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC E-585

How to fill out NC E-585

01

Obtain the NC E-585 form from the North Carolina Department of Revenue website or your local tax office.

02

Fill out the required personal information including your name, address, and Social Security number.

03

Provide details regarding your income sources for the year, including wages, self-employment income, or any other earnings.

04

Complete the sections related to exemptions and deductions if applicable.

05

Double-check all entered information for accuracy.

06

Sign and date the form where indicated.

07

Submit the form according to the instructions provided, either electronically or by mailing it to the appropriate office.

Who needs NC E-585?

01

Individuals or businesses who qualify for a tax refund in North Carolina.

02

Taxpayers needing to report specific types of income or claim certain deductions.

03

Those who have had North Carolina state tax withheld and want to file for a refund.

Fill

form

: Try Risk Free

People Also Ask about

What is the NC business tax exempt form?

North Carolina Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases.

Who has to pay sales tax in NC?

Every person engaged in business in North Carolina is required to collect and pay sales or use tax on retail sales or leases of tangible personal property and certain digital property not specifically exempt by law.

How to get a sales tax exemption certificate in North Carolina?

North Carolina does not require registration with the state for a resale certificate. How can you get a resale certificate in North Carolina? To get a resale certificate in North Carolina, you may fill out the Streamlined Sales and Use Tax Agreement Certificate of Exemption Form (Form E-595E).

Who is exempt from NC sales tax?

Qualifying Farmers or Conditional Farmers. Commercial Fishermen. Commercial Loggers. Wildlife Managers.

How do I claim my NC vehicle tax refund?

To obtain a refund, the purchaser must apply to the Division for a refund within 30 days after receiving the replacement vehicle or refund of the purchase price. APPLICATION MUST BE SIGNED IN INK BY OWNER AND NOTARIZED.

Who is exempt from paying NC sales tax?

Qualifying Farmers or Conditional Farmers. Commercial Fishermen. Commercial Loggers. Wildlife Managers.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in NC E-585 without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing NC E-585 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I sign the NC E-585 electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your NC E-585 and you'll be done in minutes.

How do I edit NC E-585 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing NC E-585 right away.

What is NC E-585?

NC E-585 is a North Carolina tax form used for reporting sales and use tax exemptions on purchases made by certain qualified entities.

Who is required to file NC E-585?

Entities that qualify for sales and use tax exemptions in North Carolina, such as certain nonprofit organizations and government agencies, are required to file NC E-585.

How to fill out NC E-585?

To fill out NC E-585, provide the required information about the purchaser, type of exemption, and a detailed description of the items purchased. Follow the instructions provided on the form.

What is the purpose of NC E-585?

The purpose of NC E-585 is to document tax-exempt purchases made by qualifying entities to ensure compliance with North Carolina sales and use tax laws.

What information must be reported on NC E-585?

Information that must be reported on NC E-585 includes the name and address of the purchaser, type of exemption, details of the items purchased, and the date of purchase.

Fill out your NC E-585 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC E-585 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.