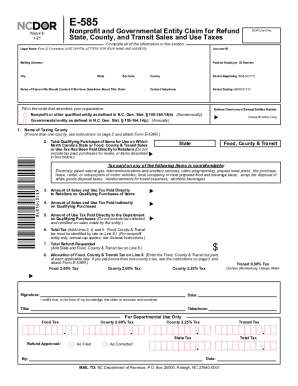

NC E-585 2020 free printable template

Get, Create, Make and Sign NC E-585

How to edit NC E-585 online

Uncompromising security for your PDF editing and eSignature needs

NC E-585 Form Versions

How to fill out NC E-585

How to fill out NC E-585

Who needs NC E-585?

Instructions and Help about NC E-585

Hi this home is located in Deer Ridge at 585 Confederate circle right here at Murphy North Carolina this home is definitely a while factor it is pristine condition top of the mountain incredible long range mountain views it is a two-bedroom three-bath mountain chalet 3 covered porches on the main floor and a lower level deck this home is absolutely gorgeous I think you're just gonna fall in love with it lets take a look at these views you're looking at North Carolina and Tennessee mountains in the distance and inside the home we have an open great room concept with a living room dining room kitchen tongue-and-groove ceilings oak floors and down the hallway to the right we have a master bedroom and then back out in the hall to the right we have a laundry room and then to the left we have a bathroom with a walk-in shower then as we go back out into the great room absolutely beautiful were going to go upstairs to the open loft which has a large master bedroom again it has the tongue-and-groove ceilings a bathroom tub shower combination and a walk-in closet this home is gorgeous, and then we also have the lower level which is a basement which has framing already in so that it kind of mirrors the main floor, and it has a finished bathroom already with the tile floors and then again the open deck with a beautiful view and a large lawn perfect for your pets this home is absolutely gorgeous to give me a cause Kathy at exit relay team Mountain View properties located here in Murphy North Carolina my number is eight two eight three six one oh three six Oh

People Also Ask about

What is the sales tax rate in NC?

What is the NC tax exempt number?

How do I get a sales tax exemption certificate in North Carolina?

How do I get a US tax exempt number?

What is tax exempt in North Carolina?

How do I find my NC tax exempt number?

What is the NC sales tax reimbursement form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find NC E-585?

How do I make changes in NC E-585?

Can I create an electronic signature for signing my NC E-585 in Gmail?

What is NC E-585?

Who is required to file NC E-585?

How to fill out NC E-585?

What is the purpose of NC E-585?

What information must be reported on NC E-585?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.