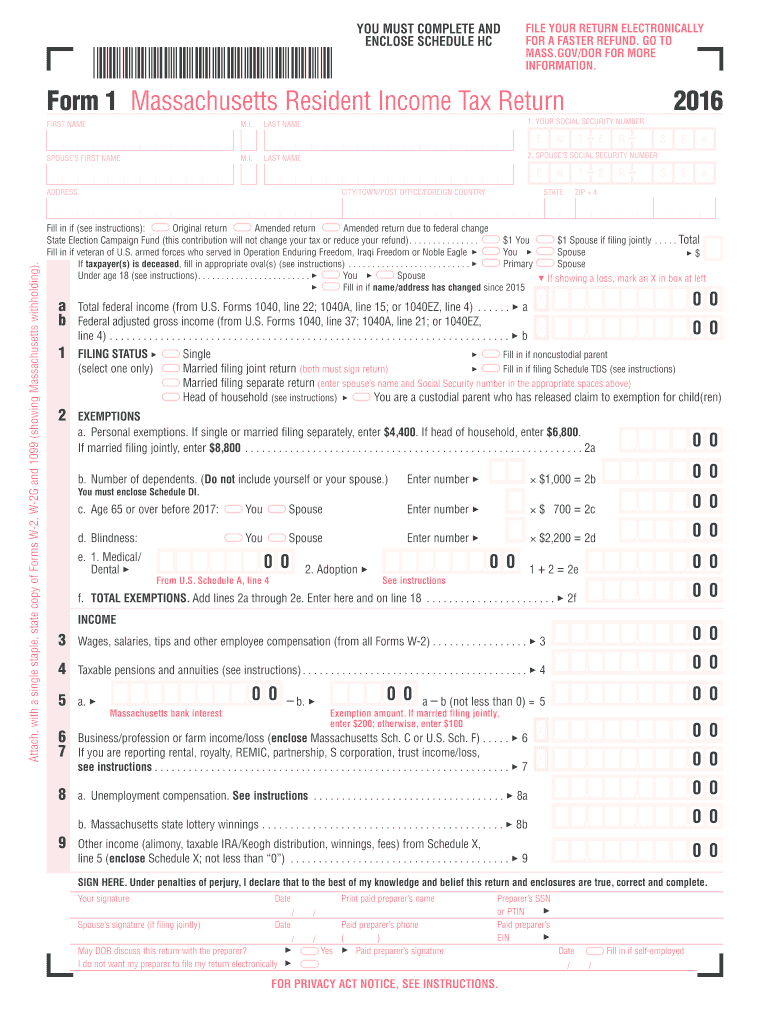

MA Form 1 2016 free printable template

Instructions and Help about MA Form 1

How to edit MA Form 1

How to fill out MA Form 1

About MA Form 1 2016 previous version

What is MA Form 1?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about MA Form 1

What should I do if I find an error on my submitted 2014 ma state tax?

If you discover an error on your submitted 2014 ma state tax, you can file an amended return using Form 1-NR or 1-NR/PY. Be sure to clearly indicate the changes you are making and include any necessary documentation to support your amendment. File the amended return with the Massachusetts Department of Revenue to correct the mistake.

How can I track the status of my 2014 ma state tax return?

You can track the status of your 2014 ma state tax return via the Massachusetts Department of Revenue website. There, you’ll find an option to verify receipt and processing of your return. It might also display common e-file rejection codes if applicable, and guidance on how to resolve them.

What are the privacy measures for my data when filing the 2014 ma state tax?

When filing your 2014 ma state tax, the Massachusetts Department of Revenue adheres to strict privacy and data security measures. They use secure encryption technologies to protect your personal information, and they are compliant with applicable data protection laws to ensure the safety of your information.

Can a nonresident file a 2014 ma state tax return?

Yes, nonresidents may need to file a 2014 ma state tax return if they earned income from sources within Massachusetts. Nonresidents must use the appropriate forms, such as Form 1-NR, and ensure they report only their Massachusetts-sourced income while adhering to any local tax regulations.

What should I do if I receive a notice from the Massachusetts DOR regarding my 2014 ma state tax?

If you receive a notice from the Massachusetts DOR regarding your 2014 ma state tax, read it carefully to understand the issue. Prepare the necessary documentation to support your case and respond within the specified timeframe. If needed, seek assistance from a tax professional to help address the concerns raised in the notice.

See what our users say