IRS 8379 2016 free printable template

Show details

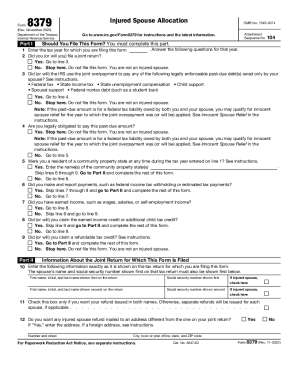

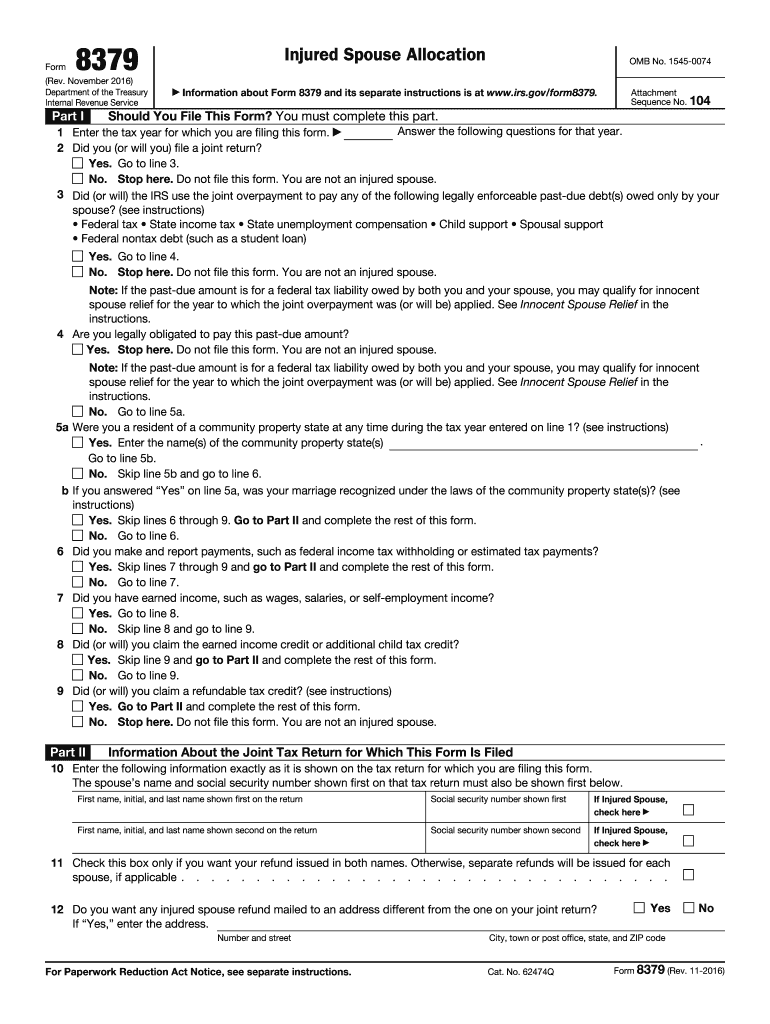

Form Rev. November 2016 Department of the Treasury Internal Revenue Service Part I Injured Spouse Allocation OMB No. 1545-0074 Information about Form 8379 and its separate instructions is at www.irs.gov/form8379. Number and street For Paperwork Reduction Act Notice see separate instructions. Yes No City town or post office state and ZIP code Cat. No. 62474Q Form 8379 Rev. 11-2016 Page 2 Allocation Between Spouses of Items on the Joint Tax Return See the separate Form 8379 instructions for Part...III. Complete this part only if you are filing Form 8379 by itself and not with your tax return. Under penalties of perjury I declare that I have examined this form and any accompanying schedules or statements and to the best of my knowledge and belief they are true correct and complete. 4 Are you legally obligated to pay this past-due amount Yes. Stop here. Do not file this form. You are not an injured spouse. Allocated Items Column a must equal columns b c Income a Amount shown on joint...return b Allocated to injured spouse other spouse a. Income reported on Form s W-2 b. Keep a copy of Injured spouse s signature this form for your records Print/Type preparer s name Paid Preparer Use Only Date Preparer s signature Phone number Check if self-employed Firm s name Firm s EIN Firm s address PTIN Phone no. Go to line 3. No. Stop here. Do not file this form. You are not an injured spouse. 3 Did or will the IRS use the joint overpayment to pay any of the following legally enforceable...past-due debt s owed only by your spouse see instructions Federal tax State income tax State unemployment compensation Child support Spousal support Federal nontax debt such as a student loan Note If the past-due amount is for a federal tax liability owed by both you and your spouse you may qualify for innocent spouse relief for the year to which the joint overpayment was or will be applied. See Innocent Spouse Relief in the instructions. Skip line 9 and go to Part II and complete the rest...of this form. Yes. Go to Part II and complete the rest of this form. 10 Enter the following information exactly as it is shown on the tax return for which you are filing this form. The spouse s name and social security number shown first on that tax return must also be shown first below. First name initial and last name shown first on the return Social security number shown first check here 11 Check this box only if you want your refund issued in both names. Otherwise separate refunds will be...issued for each spouse if applicable. 12 Do you want any injured spouse refund mailed to an address different from the one on your joint return If Yes enter the address. Attachment Sequence No* 104 Should You File This Form You must complete this part. Answer the following questions for that year. 1 Enter the tax year for which you are filing this form* 2 Did you or will you file a joint return Yes. 5a b No* Go to line 5a* Were you a resident of a community property state at any time during...the tax year entered on line 1 see instructions.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8379

How to edit IRS 8379

How to fill out IRS 8379

Instructions and Help about IRS 8379

How to edit IRS 8379

Editing IRS Form 8379 is essential when you need to correct any mistakes. First, download the form from the IRS website or a reliable source like pdfFiller. Make the necessary revisions, ensuring all information is accurate before saving the changes. Once completed, ensure to save the edited version to retain your updates.

How to fill out IRS 8379

Filling out IRS Form 8379 requires careful attention to detail. Begin by providing your identifying information at the top of the form, including your name, Social Security number, and that of your spouse if applicable. Next, detail the amounts from your tax return that will be affected by this form. Follow the instructions on the form for each applicable section to ensure compliance with U.S. tax regulations.

About IRS 8 previous version

What is IRS 8379?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 8 previous version

What is IRS 8379?

IRS Form 8379, known as the "Injured Spouse Allocation," is designed for married couples filing jointly. This special tax form is used to claim their share of a tax refund when one spouse's outstanding debts might affect their ability to receive the full refund. This form allows the injured spouse to protect their share of the refund from being used to pay the other spouse's debt.

What is the purpose of this form?

The primary purpose of IRS Form 8379 is to ensure that individuals who have been negatively impacted by their spouse’s debts can still receive their entitled portion of a tax refund. This can include various situations where one spouse may have tax liabilities due to child support, student loans, or other financial obligations, thus protecting the innocent spouse's refund share.

Who needs the form?

Individuals who are married filing jointly, where one spouse has tax debts or other obligations, need IRS Form 8379. If one spouse has existing debts that could potentially jeopardize the tax refund, the other spouse must file this form to request their portion of the refund.

When am I exempt from filling out this form?

Filing IRS Form 8379 may not be necessary if both spouses are eligible for the full refund, or if the filing spouse does not have outstanding debts. Additionally, if a couple is filing separately, this form is not applicable since it is only for joint filers.

Components of the form

IRS Form 8379 consists of several sections where filers must provide personal information, financial details of the tax return, and allocation percentages. Each section is clearly dedicated to gathering information necessary to calculate the allocation of the refund accurately. It is crucial to follow the instructions carefully when filling out these components to avoid mistakes.

What are the penalties for not issuing the form?

Failure to file IRS Form 8379 when applicable could result in the injured spouse losing out on their portion of the tax refund. While there may not be direct penalties for not submitting this form, the financial losses could be significant if debts were paid from the refund intended for the innocent spouse

What information do you need when you file the form?

To file IRS Form 8379, you need essential information such as your name, Social Security number, the name and Social Security number of your spouse, as well as the amounts from your federal tax return. It is important to gather these details before starting your tax preparation to ensure a smooth filing process.

Is the form accompanied by other forms?

IRS Form 8379 should be submitted alongside your federal tax return, whether filing electronically or by mail. Ensure that all required documents are completed and submitted together to facilitate processing and to avoid delays in receiving your refund.

Where do I send the form?

The destination for IRS Form 8379 varies based on your method of filing. If you are filing by mail, send it to the address on the form instructions based on your state of residence. When filing electronically, ensure that the form is submitted as part of your e-filed tax return.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.