What is the W-2VI?

Form W-2VI is one of the essential documents to report U.S. Virgin Islands wages. It provides details certifying that the employer has fulfilled all the financial obligations for the employee’s payments. The IRS uses this information to verify the taxes withheld from the employee’s wages. The Social Security Administration needs the data from the form to ensure that the employer paid all the required insurance payments.

Who needs to complete the W-2VI?

Employers and employees use this form on Virginian Islands. Employers complete the W 2VI statement and send it to the employees who file the information with the Internal Revenue Service and federal tax returns. The employer would complete this statement if he paid at least $600 to the employee.

How do I use a W-2VI on a federal return?

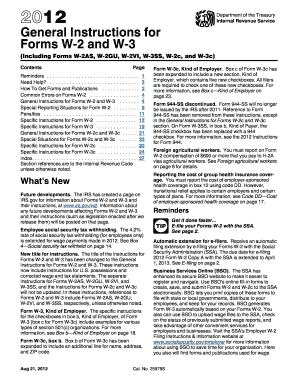

As for employees, W 2VI is crucial when preparing a tax return. It reports your total wages for the year and the amount of federal, state, and other taxes withheld from your paycheck. Please check the General Instructions for Forms W-2 and W-3 for more information.

When is the Form W-2VI due?

Copy A of W-2VI and W-3VI must be filed with the Social Security Administration by January 31, 2012. The employer has to send copies B, C, and 2 to each employee who worked for him during the year by the 31st of January 2012.

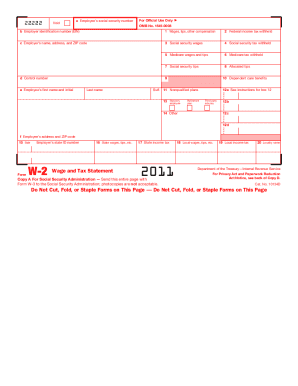

How do I fill out Form W-2VI?

You can find instructions for completing the W 2VI on separate form sheets. Scroll to the top of this web page and open our fillable PDF template in your browser. Review the instructions and complete the form.

In general, you should indicate the following details:

- Social Security Number of the employee

- Name and address of the employee

- Identification number of the employee

- Employer’s address

- Control number

- Information about the payments (wages, social security wages, Medicare wages, and tips)

- Information about the taxes (federal income tax, social security tax, Medicare tax, allocated tips, dependent care benefits)

Where do I send the W 2VI?

The completed copy A along with Form W-3 is forwarded to the local office of the Social Security Administration. Copy 1 is for the employer’s State, City, or Local Tax Department. Copy B is filed by the employee with the IRS, while Copy C is for the employee’s records. Copy 2 should be filed with the employee’s State, City, or Local Income Tax Return. Copy D is for the employer’s records.