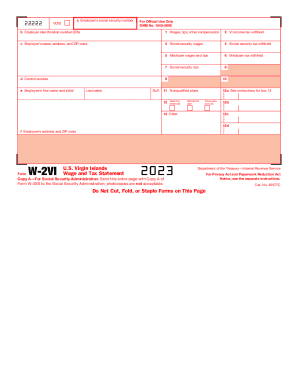

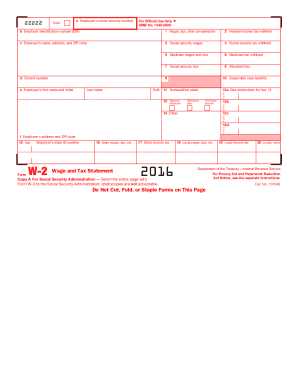

Who needs to complete 2016 W-2VI form?

This form is used by the employers and employees on Virginian Islands. Employers complete the statement and send it to the employees who file the information with the Internal Revenue Service together with federal tax returns. The employer completes this statement if he paid at least $600 to the employee.

What is the purpose of the IRS Form W-2VI for?

The statement is one of the most important documents for the employer. It provides details certifying that the employer has fulfilled all the financial obligations for the employee’s payments. The IRS uses this information to verify the amount of taxes withheld from the employee’s wages. The Social Security Administration needs the data from the form to ensure that the employer paid all the required insurance payments.

Is the Wage and Tax Statement accompanied by other forms?

The employer must accompany the W-2VI form with W-3VI form.

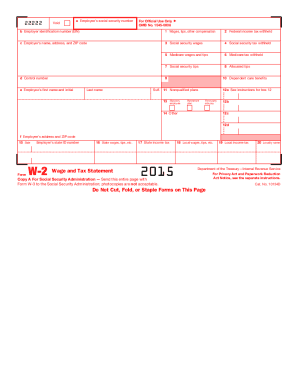

When is the 2015 W-2 due?

Copy A of Form W-2VI along with Form W-3VI must be filed with the Social Security Administration by January 31, 2017. The employer has to send copies B, C and 2 to each employee who worked for him during the year by the 31st of January 2017.

How do I fill out form W-2VI?

The instructions for completing the form W-2VI are found on separate sheets of the form.

In general, the employers have to indicate the following details:

-

Social Security Number of the employee

-

Name and address of the employee

-

Identification number of the employee

-

Employer’s address

-

Control number

-

Information about the payments (wages, social security wages, Medicare wages and tips)

-

Information about the taxes (federal income tax, social security tax, Medicare tax, allocated tips, dependent care benefits)

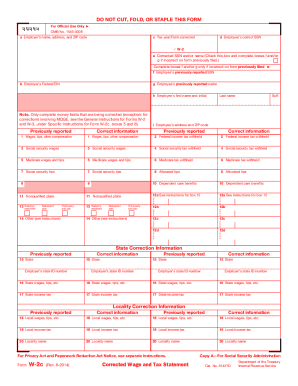

Where do I send the W-2VI form?

The completed copy A along with form W-3 is forwarded to the local office of Social Security Administration. Copy 1 is for the employer?? State, City or Local Tax Department. Copy B is filed by the employee with the IRS., while Copy C is for the employee’s personal records. Copy 2 should be filed with the employee’s State, City, or Local Income Tax Return. Copy D is for the employer’s records.