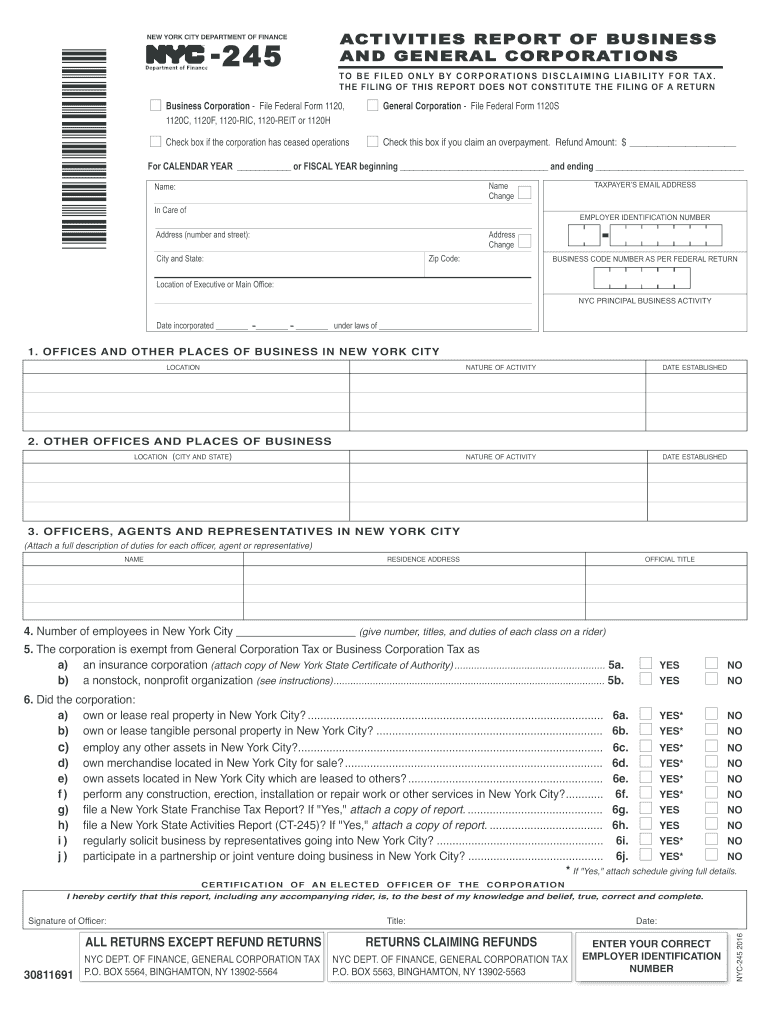

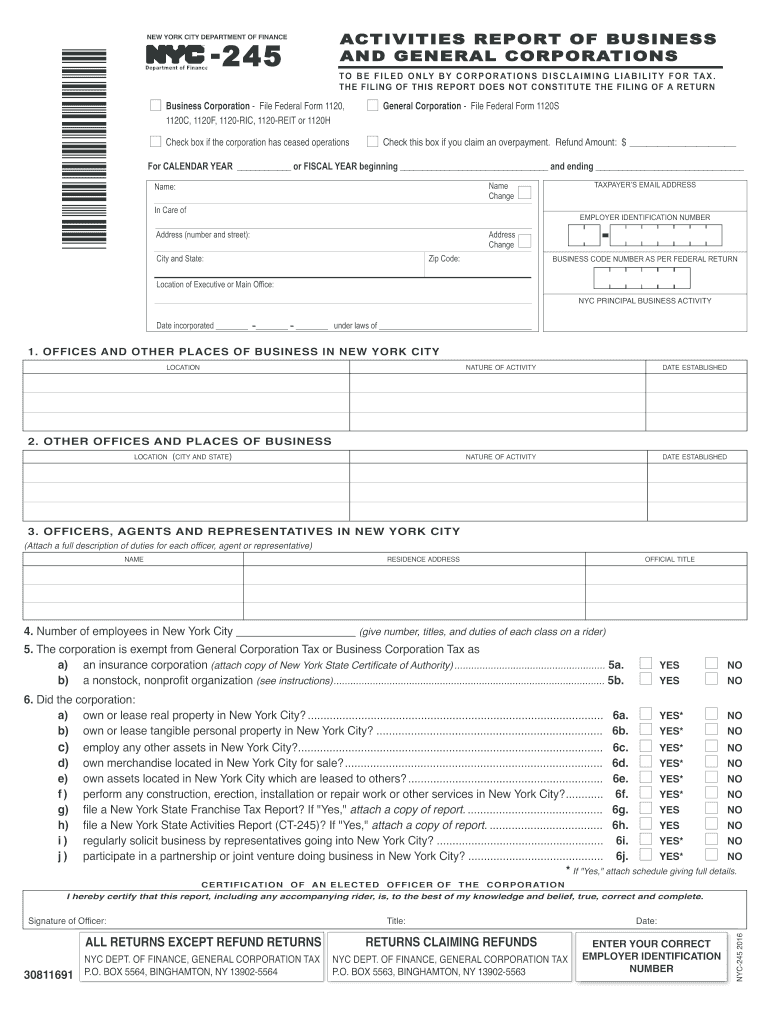

NYC DoF NYC-245 2016 free printable template

Get, Create, Make and Sign NYC DoF NYC-245

Editing NYC DoF NYC-245 online

Uncompromising security for your PDF editing and eSignature needs

NYC DoF NYC-245 Form Versions

How to fill out NYC DoF NYC-245

How to fill out NYC DoF NYC-245

Who needs NYC DoF NYC-245?

Instructions and Help about NYC DoF NYC-245

Well it happens that I bumped into Dr. Yamaha at my job introducing his practice and I thought you know if I wanted to recommend this practice for members of the club that I work for that is the best that I come into the office and see what this particular practice entails it turns out I needed to take advantage of the method myself and so far so good well I experienced being an athlete I had experienced several areas of pain which progressively got worse over the course of the past 15 to 18 years and particularly in my right shoulder by next and my right foot the pain progressively got worse from the started from the age of 18 and going forward I had done everything from orthotics too aggressive stretching to sink physical therapist and even within the past two years seeing a body work specialist the bioware specialist did some phenomenal work however I felt that I still needed to reach the root of the problem and the root of the problem was in the cervical area of my spot and when I got the opportunity to come to this office that first day was just out of this world I was overwhelmed with the fact that the painting had had gone away instantly in my foot and I felt like a changed person and a new person I definitely would the reason why it's definitely life-changing it's been a significant life change life-changing experience for me some areas that I experienced change were how I felt how I slept I started to experience a sense of open-mindedness and my vision and I began to see things clearly and see things the way I had seen them before through some of the tests I realized where I had some deficiencies that I thought I didn't even know about, and I talk about it all the time to my co-workers and to my friends and family Italy would recommend come to this office and getting an evaluation and making the decision to go ahead with the process is its phenomenal I would like to say that without having met Dr. woman my life would be very different right now you know I don't know with the discomfort that I was having you know how that was going to affect my work how that was going to affect my sleep to this point and where I would be I wouldn't be as energetic, and it's happy and as efficient I am on a daily basis you know without having the corrections done the correction is done a lot for me, you can do a lot for anybody and so happy that I was able to meet Dr. and to be here.

People Also Ask about

Who is subject to NY MTA surcharge?

What is NYS mandatory first installment?

Who is required to file NYC 204?

Who must file NYC 4S?

What is NYC 245 form?

Who must file a NYC UBT return?

Who is subject to NYC unincorporated business tax?

What taxes does an LLC pay in New York?

Who must file NYC 204?

Who is required to file a partnership return?

Who Must File NYC Partnership Return?

What is mandatory first installment New York?

What is the minimum corporate tax in New York?

Who Must File Form NYC 204?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NYC DoF NYC-245 straight from my smartphone?

How do I edit NYC DoF NYC-245 on an iOS device?

Can I edit NYC DoF NYC-245 on an Android device?

What is NYC DoF NYC-245?

Who is required to file NYC DoF NYC-245?

How to fill out NYC DoF NYC-245?

What is the purpose of NYC DoF NYC-245?

What information must be reported on NYC DoF NYC-245?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.