NYC DoF NYC-245 2012 free printable template

Show details

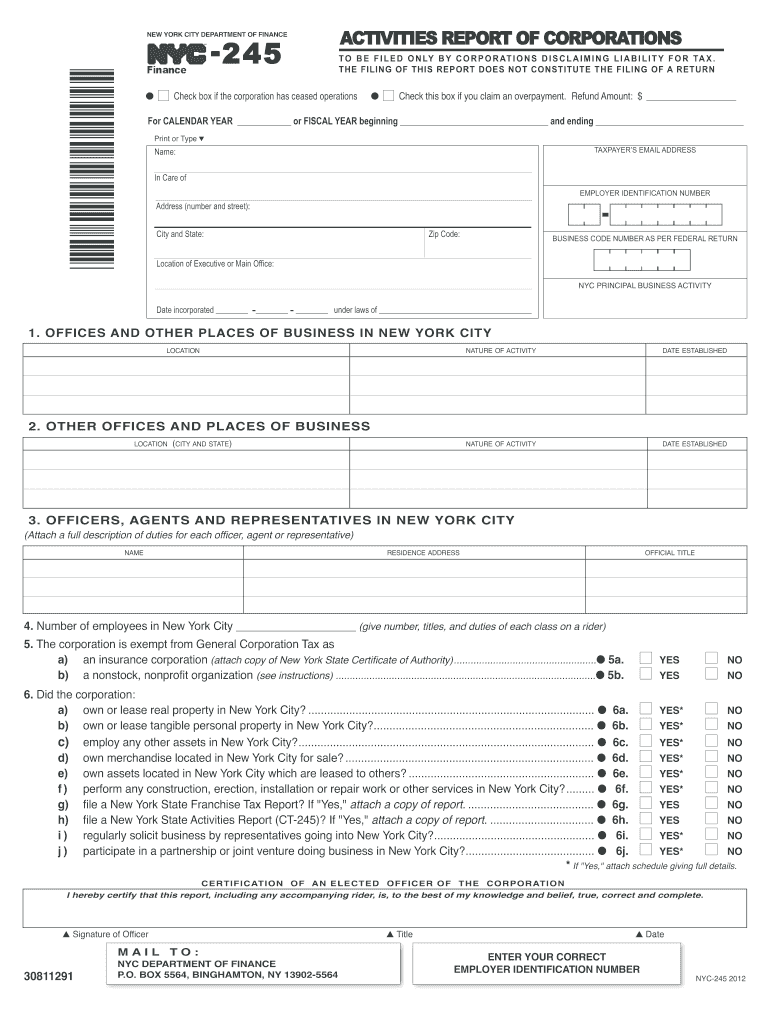

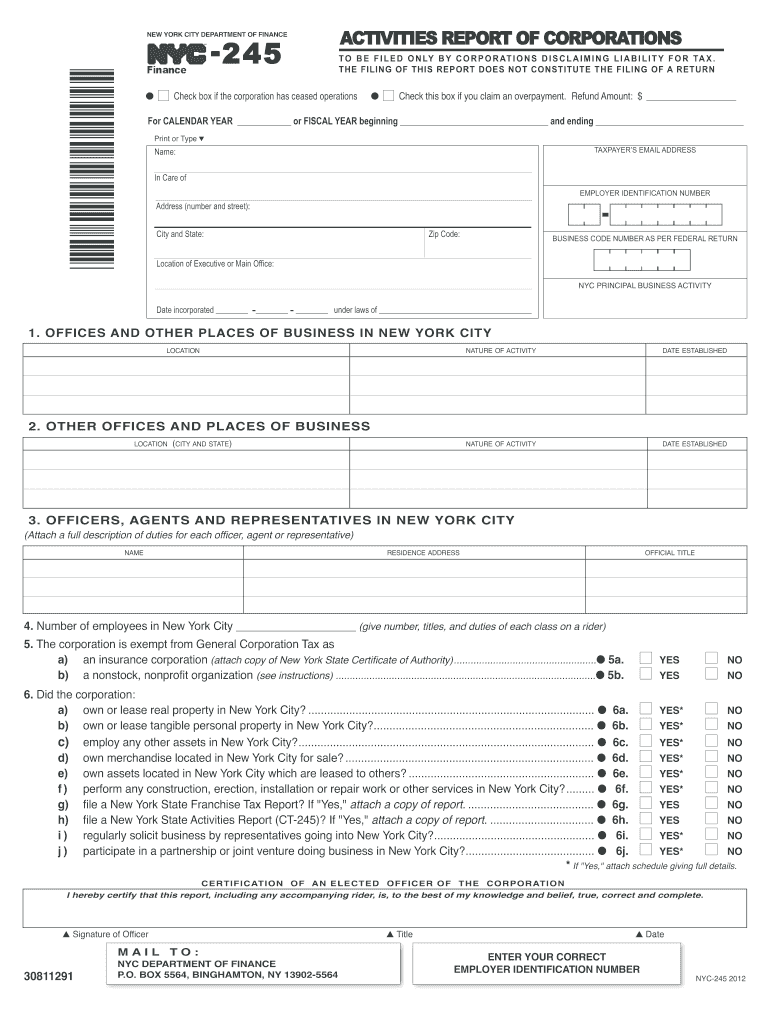

S Signature of Officer MAIL TO NYC DEPARTMENT OF FINANCE P. O. BOX 5564 BINGHAMTON NY 13902-5564 s Title s Date ENTER YOUR CORRECT NYC-245 2012 Instructions for Form NYC-245 - 2012 This report must be filed by any corporation that has an officer employee agent or representative in the City and claims not to be subject to the New York City General Corporation Tax. 30811291 NEW YORK CITY DEPARTMENT OF FINANCE l ACTIVITIES REPORT OF CORPORATIONS T O B E F I L E D O N LY B Y C O R P O R AT I O N...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NYC DoF NYC-245

Edit your NYC DoF NYC-245 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NYC DoF NYC-245 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NYC DoF NYC-245 online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NYC DoF NYC-245. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NYC DoF NYC-245 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NYC DoF NYC-245

How to fill out NYC DoF NYC-245

01

Obtain NYC DoF NYC-245 form from the NYC Department of Finance website or office.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal information, including name, address, and contact details.

04

Provide the specific details required regarding the property or tax issue.

05

Attach any necessary documents that support your application.

06

Review all entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form via mail or in person at the designated office.

Who needs NYC DoF NYC-245?

01

Individuals or businesses involved in property-related transactions in New York City.

02

Property owners seeking tax benefits or adjustments.

03

Tenants requiring documentation for rent-related issues.

04

Anyone needing to contest property tax assessments.

Fill

form

: Try Risk Free

People Also Ask about

What is NYC 245 form?

NYC-245 / Activities Report of Corporations.

Who must file NYC 4S?

S CORPORATIONS An S Corporation is subject to the General Corporation Tax and must file either Form NYC- 4S, NYC-4S-EZ or NYC-3L, whichever is appli- cable. Under certain limited circumstances, an S Corporation may be permitted or required to file a combined return (Form NYC-3A).

What is NYS mandatory first installment?

MTA surcharge – A first installment equal to 25% of the second preceding year's MTA surcharge is also required if your second preceding year's franchise, excise, or gross receipts tax after credits is more than $1,000 and you are subject to the MTA surcharge.

What is NYS CT-400?

Form CT-400, Estimated Tax for Corporations.

What taxes does an LLC pay in New York?

Entire Net Income With the exception of some qualified New York manufacturers to which a flat 6.5 percent rate applies, corporations in New York are generally only taxed at a rate of 6.5 percent on $290,000 or less of federal taxable income.

Who Must File NYC Partnership Return?

Income tax responsibilities must file Form IT-204, Partnership Return if it has either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York sources (see instructions).

What is mandatory first installment New York?

Corporations whose tax liability for the second preceding year exceeds $1,000 are required to pay 25% of the tax liability for the second preceding year as a first installment of estimated tax for the current year (MFI).

Who must file a NYC UBT return?

Any individual or unincorporated entity, other than a partnership, that carries on or liquidates a trade, business, profes- sion or occupation wholly or partly with- in New York City and has a total gross income from all business regardless of where carried on of more than $75,000 (prior to any deduction for cost of

What is the minimum corporate tax in New York?

Tax Bases and Rates If New York City Receipts are:Fixed Dollar Minimum Tax is:More than $100,000 but not over $250,000$75More than $250,000 but not over $500,000$175More than $500,000 but not over $ 1 million$500More than $1 million but not over $5 million$1,5008 more rows

Who is subject to NY MTA surcharge?

MTA Surcharge Filing If a taxpayer has $1 million or more of MTA receipts, it is subject to the MTA surcharge. …

What is NY Form CT 300?

Form CT-300, Mandatory First Installment (MFI) of Estimated Tax for Corporations.

How are LLCs taxed in New York?

Tax responsibilities An LLC or LLP that is treated as a corporation for federal income tax purposes may be required to file a New York State corporation franchise tax return. An LLC or LLP may be required to pay a filing fee and/or estimated income tax on behalf of certain partners or members.

Who Must File Form NYC 204?

Any partnership that carries on or liquidates any trade, business, profession or occupation wholly or partly within New York City and has a total gross income from all business regardless of where carried on of more than $25,000 (prior to any deduction for cost of goods sold or services performed) must file an

Who is subject to NYC unincorporated business tax?

What Activities are Subject to This Tax? Unincorporated Businesses include: trades, professions, and certain occupations of an individual, partnership, limited liability company, fiduciary, association, estate or trust. The business can be active or in the process of being liquidated.

Who is subject to NYC income tax?

New York City residents must pay a Personal Income Tax which is administered and collected by the New York State Department of Taxation and Finance. Most New York City employees living outside of the 5 boroughs (hired on or after January 4, 1973) must file Form NYC-1127.

What is the New York City unincorporated business tax credit?

New York City unincorporated business tax credit a full-year or part-year New York City resident and. the owner of a business, a beneficiary of an estate or trust, or a partner in a partnership whose business, estate or trust, or partnership is subject to the New York City unincorporated business tax (UBT).

Do unincorporated businesses pay tax?

If you do have business income, then you are required to declare your business income on a tax return. As an unincorporated small business owner, this business income is reflected on a separate schedule on your personal tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NYC DoF NYC-245 online?

Completing and signing NYC DoF NYC-245 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for signing my NYC DoF NYC-245 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your NYC DoF NYC-245 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out NYC DoF NYC-245 on an Android device?

On Android, use the pdfFiller mobile app to finish your NYC DoF NYC-245. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is NYC DoF NYC-245?

NYC DoF NYC-245 is a form used by the New York City Department of Finance for reporting certain financial information related to property taxes.

Who is required to file NYC DoF NYC-245?

Property owners in New York City who meet specific criteria regarding their property taxes and financial status are required to file NYC DoF NYC-245.

How to fill out NYC DoF NYC-245?

To fill out NYC DoF NYC-245, individuals need to provide detailed financial information as required on the form, including any requested documentation and accurate figures related to property taxes.

What is the purpose of NYC DoF NYC-245?

The purpose of NYC DoF NYC-245 is to collect essential financial data from property owners to ensure compliance with city tax regulations and to determine eligibility for tax exemptions or abatement programs.

What information must be reported on NYC DoF NYC-245?

The information that must be reported on NYC DoF NYC-245 includes income, expenses, property value, tax identification numbers, and any other financial details pertinent to property taxation.

Fill out your NYC DoF NYC-245 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NYC DoF NYC-245 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.