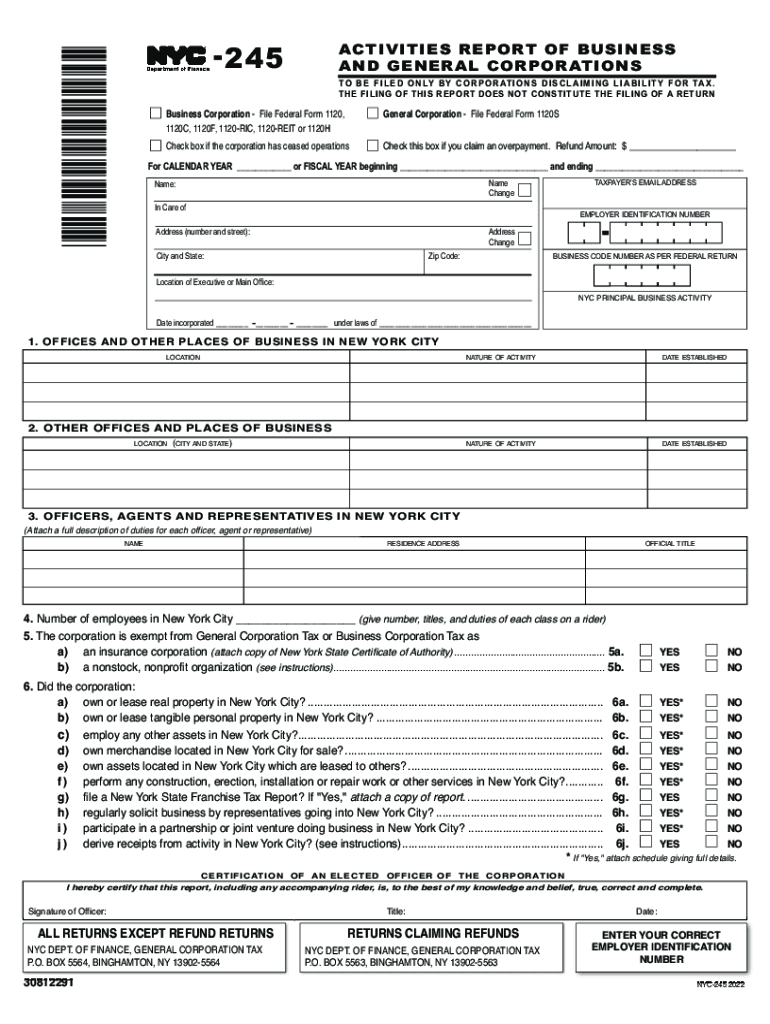

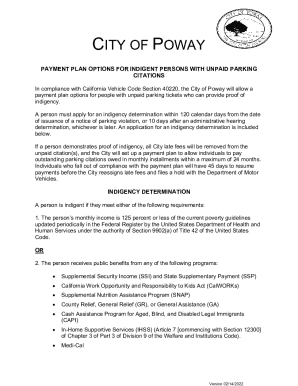

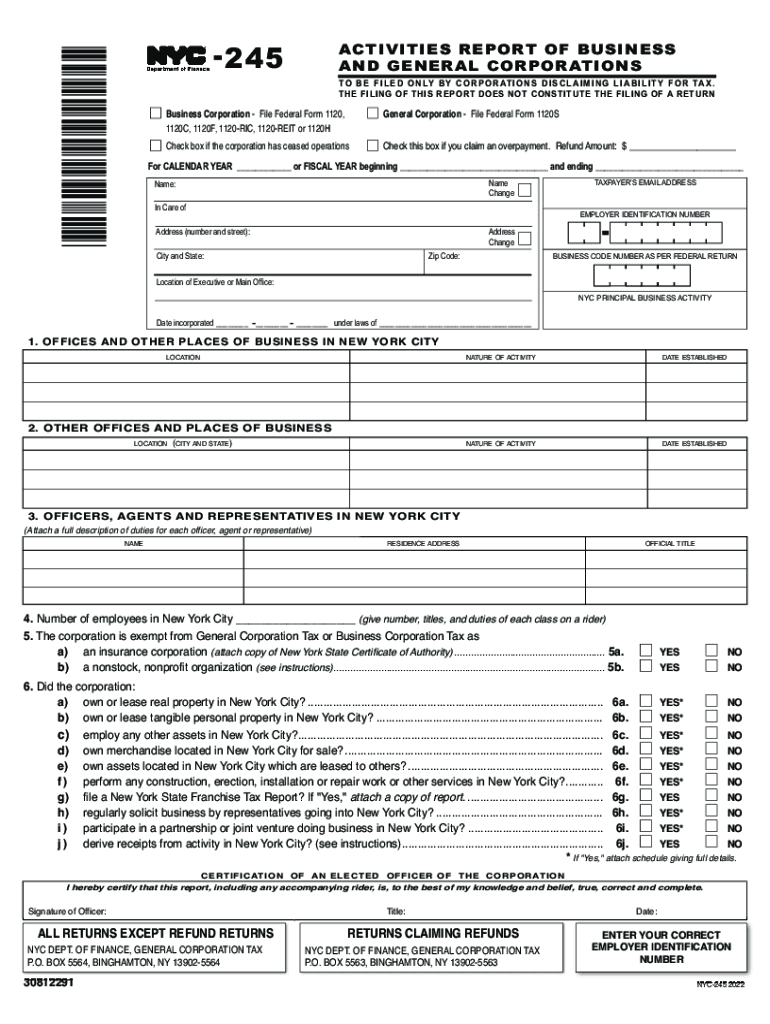

NYC DoF NYC-245 2022 free printable template

Get, Create, Make and Sign NYC DoF NYC-245

Editing NYC DoF NYC-245 online

Uncompromising security for your PDF editing and eSignature needs

NYC DoF NYC-245 Form Versions

How to fill out NYC DoF NYC-245

How to fill out NYC DoF NYC-245

Who needs NYC DoF NYC-245?

Instructions and Help about NYC DoF NYC-245

Music I really wasn't planning on making pizza I really didn't know what I wanted to do I was in the construction business I used to do marble and granite fabrication didn't do a lot of cooking you know I let my grandmother do all the cooking she was amazing at it did a lot of eating not a lot of cooking still to this day when I see the crowd building up outside I can't believe it its still surreal these people are lining up to eat my pizza how did this happen and then the anxiety kicks it, and I'm waiting for the orders like you know it's the quiet before the storm, and then I just suck it and hit with the takeout orders and then the know the place fills up with 30 people at once and the orders stopped coming and then the chaos starts excuse me my meatballs I was like what's that noise Music my name is Marc Icon and this is my pizzeria Luke alleys and Carroll Gardens Brooklyn this was an old candy store that I hung out in as a kid my parents hung out here as kids they may have even met here, and I go for a cup of coffee one day and I run into Rosemarie who this door belonged to and an X of what was going on with the store you know every time I go there its close, and she told me they were renting the space out and like a light bulb went off, and I just really wanted to save it, and you know the rest is history three days later I'm signing a lease it's not that it's important to have a pizza in Carroll Gardens its just that this is my neighborhood this is where I just love being here I want to be here don't want to be anywhere else there were still people here that I was in kindergarten with that I still see on a daily basis but for the most part almost everybody's gone and its like everything else in life everything changes Carroll Gardens was this amazing little neighborhood that not too many people know about, and it had such amazing restaurants here and there's still a small handful of places left I mean you have Fernando's Esposito pork store Missoula bakery Caputo bakery and Caputo deli other than that I don't think there's much left very fresh log bread its on the old neighborhood front I give it to the girls thank you very much this bread made with log salami and a lot of black pepper my brother brought something to our attention, and he was saying like blowing up for this table it was like playing in a minefield, and we didn't realize like all the stuff that was going on and how unsafe it was but at the same time it was super safe, so this is Carroll Park this is where like the whole neighborhood would come this was like the Yankee Stadium of Carroll Gardens some pretty crazy games were played here they fence it all in now, but we all used to hang out on the stoop over here when we were younger, and you know that was like where we would all congregate and meet you know on hot summer nights and that's why I smoked my first cigarette right there kiss my first girl — on the steps of the library still I know I'm shown that you want some...

People Also Ask about

What is NYC 245 form?

Who must file NYC 4S?

What is NYS mandatory first installment?

What is NYS CT-400?

What taxes does an LLC pay in New York?

Who Must File NYC Partnership Return?

What is mandatory first installment New York?

Who must file a NYC UBT return?

What is the minimum corporate tax in New York?

Who is subject to NY MTA surcharge?

What is NY Form CT 300?

How are LLCs taxed in New York?

Who Must File Form NYC 204?

Who is subject to NYC unincorporated business tax?

Who is subject to NYC income tax?

What is the New York City unincorporated business tax credit?

Do unincorporated businesses pay tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NYC DoF NYC-245 without leaving Google Drive?

How do I make edits in NYC DoF NYC-245 without leaving Chrome?

How do I edit NYC DoF NYC-245 straight from my smartphone?

What is NYC DoF NYC-245?

Who is required to file NYC DoF NYC-245?

How to fill out NYC DoF NYC-245?

What is the purpose of NYC DoF NYC-245?

What information must be reported on NYC DoF NYC-245?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.