Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

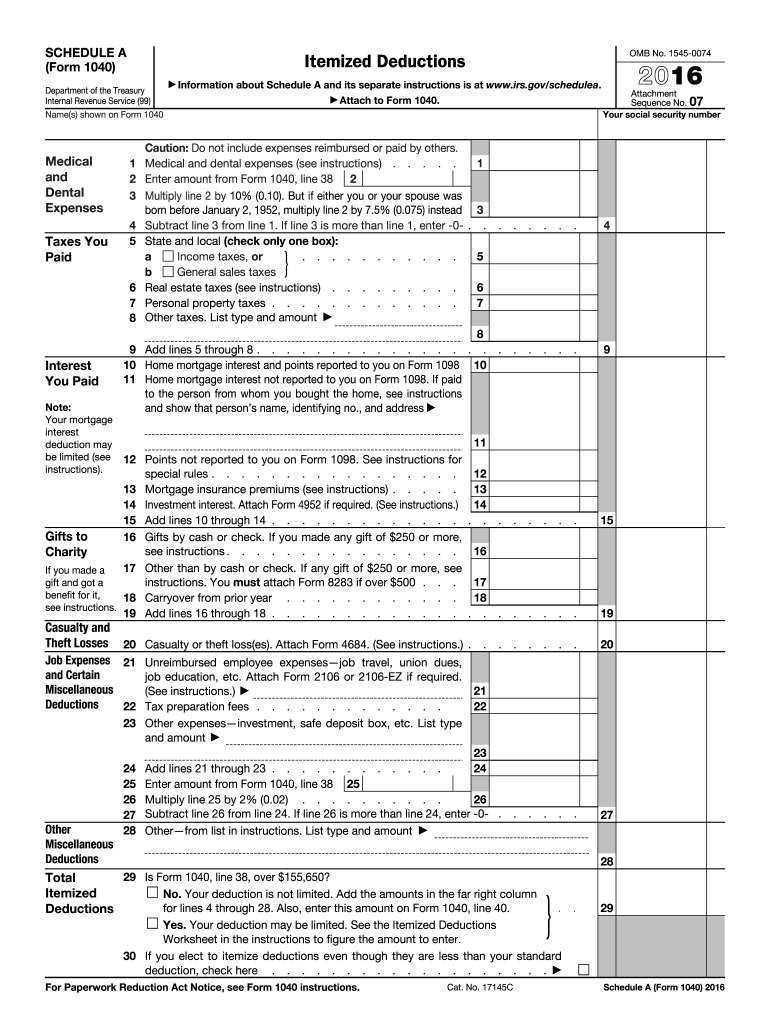

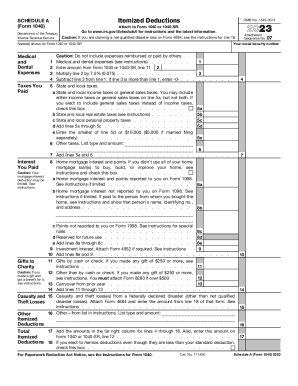

What is 1040 schedule a form?

The 1040 Schedule A form, also known as Itemized Deductions, is a tax form used by individuals in the United States to report their itemized deductions. This form allows taxpayers to deduct certain expenses such as medical and dental expenses, state and local taxes, mortgage interest, charitable contributions, and miscellaneous deductions. By itemizing deductions on Schedule A, taxpayers can potentially lower their taxable income and reduce their overall tax liability.

How to fill out 1040 schedule a form?

Filling out a 1040 Schedule A form involves reporting your itemized deductions. Here is a step-by-step guide to help you fill out this form:

Step 1: Gather necessary documents

Collect all relevant supporting documents, such as charitable contribution receipts, medical expense records, mortgage interest statements, and documentation of other deductions.

Step 2: Provide personal information

Enter your name, Social Security number, and address at the top of Schedule A.

Step 3: Medical and dental expenses

Report your total medical and dental expenses on line 1. These expenses must exceed 7.5% of your adjusted gross income (AGI) to be eligible for deduction.

Step 4: Taxes paid

List any state and local income taxes, real estate taxes, personal property taxes, and other taxes paid on line 5.

Step 5: Interest paid

Report any deductible mortgage interest and points paid on line 8.

Step 6: Gifts to charity

List your charitable contributions made throughout the year on line 11. Make sure you have proper documentation to support your contributions.

Step 7: Casualty and theft losses

If you have experienced any casualty or theft losses, provide details on line 20.

Step 8: Other miscellaneous deductions

Report any other miscellaneous deductions, like unreimbursed job-related expenses or tax preparation fees on line 22.

Step 9: Add up all your deductions

Sum up the amounts from lines 1 through 28 and enter the total on line 29.

Step 10: Compare to standard deduction

Compare your itemized deductions (line 29) with the standard deduction for your filing status. Take the larger of the two amounts and enter it on Form 1040.

Remember to keep copies of all supporting documents and double-check your calculations before submitting your tax return. It is advised to consult a tax professional or refer to the IRS instructions for further guidance if needed.

What is the purpose of 1040 schedule a form?

The purpose of the 1040 Schedule A form is to report itemized deductions. This form allows taxpayers to list deductions such as medical expenses, state and local taxes paid, home mortgage interest, charitable contributions, and other expenses that may qualify for deduction. By itemizing deductions on Schedule A, taxpayers can potentially save on their overall tax liability by reducing their taxable income.

What information must be reported on 1040 schedule a form?

The Schedule A form is used for itemizing deductions while filing an individual income tax return. On this form, the following information must be reported:

1. Medical and Dental Expenses: Any medical and dental expenses that exceed 7.5% of your adjusted gross income (AGI) can be reported on this section.

2. Taxes Paid: This includes state and local income taxes or sales taxes, real estate taxes, personal property taxes, and foreign taxes paid.

3. Interest Paid: Deductible mortgage interest on your primary residence, and possibly on a second home or qualified rental property, can be reported here. Also, any investment interest expense and student loan interest can be reported.

4. Gifts to Charity: Cash and non-cash charitable contributions made during the tax year can be reported, including donations to qualified organizations like churches, schools, and nonprofits.

5. Casualty and Theft Losses: If you experienced a casualty loss due to a sudden event like a fire, theft, or natural disaster, you can report the unreimbursed losses.

6. Job Expenses and Certain Miscellaneous Deductions: Expenses related to your job, such as unreimbursed employee business expenses (e.g., uniforms, work-related travel, or professional dues) and tax preparation fees, can be reported in this section. However, these expenses must exceed 2% of your AGI to be eligible for deduction.

7. Other Miscellaneous Deductions: This section includes deductions such as investment expenses, gambling losses (limited to gambling winnings), and fees paid for safe deposit boxes.

It's important to note that starting from the 2018 tax year, the federal tax code introduced significant changes, including a higher standard deduction, which reduced the number of taxpayers who itemize deductions. Therefore, the schedule might not be necessary for some taxpayers.

When is the deadline to file 1040 schedule a form in 2023?

The deadline to file Form 1040 Schedule A for the year 2023 would typically be April 15, 2024. However, it's important to note that tax filing deadlines can be subject to change, so it's always recommended to check with the Internal Revenue Service (IRS) or a tax professional for the most up-to-date information.

What is the penalty for the late filing of 1040 schedule a form?

The penalty for the late filing of Form 1040 Schedule A depends on various factors such as the reason for the delay, the amount of tax owed, and the length of the delay. Here are some potential penalties:

1. Failure-to-file penalty: If you do not file the Schedule A form by the due date (usually April 15th), there is a penalty of 5% of the unpaid tax amount for each month (or part of a month) the return is late, up to a maximum of 25% of the unpaid tax.

2. Failure-to-pay penalty: If you owe taxes and do not pay the full amount by the due date, you may face a failure-to-pay penalty of 0.5% of the unpaid tax for each month (or part of a month) the tax is not paid, up to a maximum of 25% of the unpaid tax.

3. Interest charges: In addition to the penalties mentioned above, interest charges will accrue on any tax owed from the original due date until payment is made.

It's important to note that if you are due a refund, there is no penalty for filing late. However, it's generally advisable to file your taxes as soon as possible, even if you cannot pay the full amount owed, as this can help minimize penalties and interest.

How can I send 1040 schedule a 2016 to be eSigned by others?

When you're ready to share your 1040 schedule a 2016, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit 1040 schedule a 2016 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your 1040 schedule a 2016 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete 1040 schedule a 2016 on an Android device?

Complete your 1040 schedule a 2016 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.