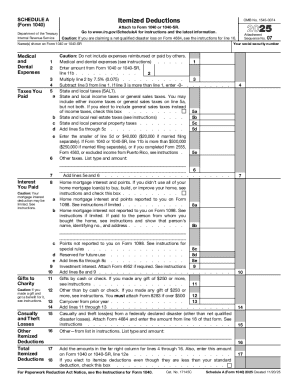

IRS 1040 - Schedule A 2024 free printable template

Instructions and Help about IRS 1040 - Schedule A

How to edit IRS 1040 - Schedule A

How to fill out IRS 1040 - Schedule A

Latest updates to IRS 1040 - Schedule A

About IRS 1040 - Schedule A 2024 previous version

What is IRS 1040 - Schedule A?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1040 - Schedule A

What should I do if I realize I've made a mistake on my IRS 1040 - Schedule A after submitting it?

If you've identified an error on your IRS 1040 - Schedule A after submission, you should file an amended return using Form 1040-X. This form allows you to correct mistakes and is essential for ensuring your tax records are accurate. Be sure to reference your original return and explain the changes you're making.

How can I check the status of my IRS 1040 - Schedule A submission?

To check the status of your submitted IRS 1040 - Schedule A, use the IRS 'Where's My Refund?' tool, available on the IRS website. This tool will provide information on whether your return has been received and is being processed. Keep in mind that processing times may vary.

What are some common errors people make when filing IRS 1040 - Schedule A?

Common errors on IRS 1040 - Schedule A include miscalculating deductions, failing to include necessary documentation, and not signing the form. To avoid these mistakes, double-check your entries, ensure all required attachments are included, and review the form for completeness before submission.

Can I use tax software to file my IRS 1040 - Schedule A, and what should I consider?

Yes, you can use tax software to file your IRS 1040 - Schedule A. When selecting software, ensure it is compatible with the current tax year and provides guidance on itemized deductions. Leading software options often help identify potential deductions, simplifying your filing process.

See what our users say