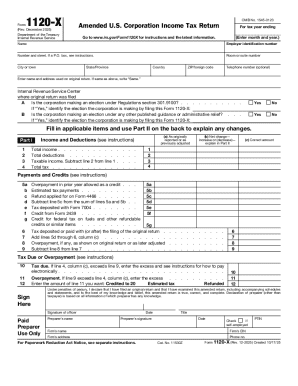

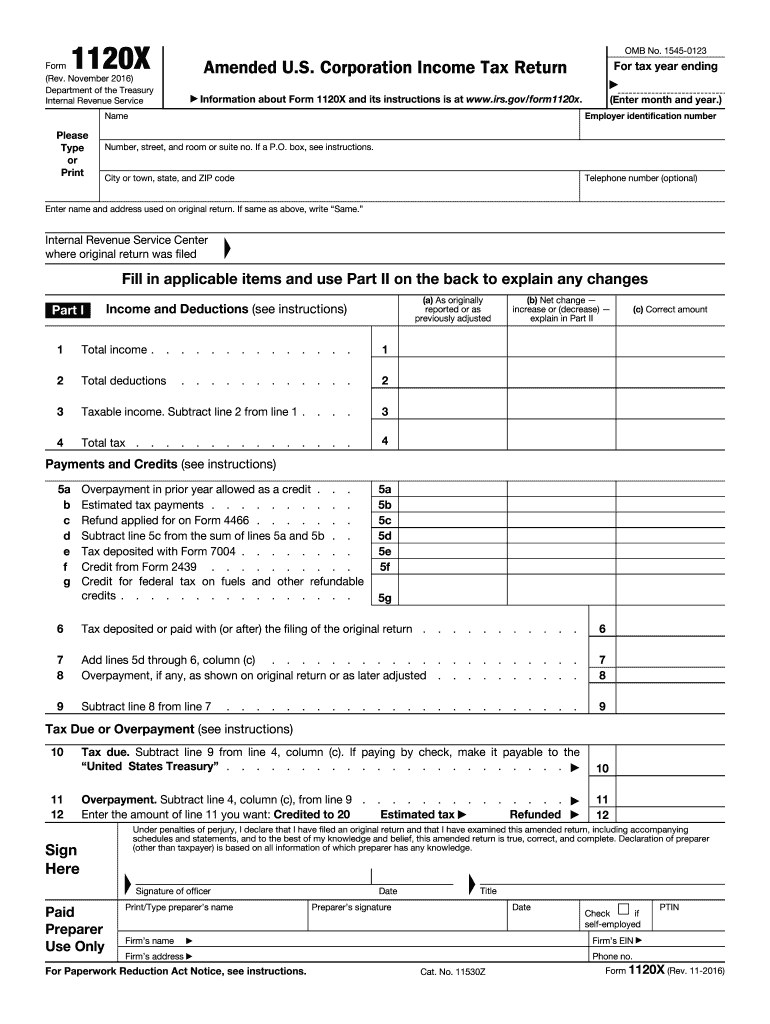

IRS 1120X 2016 free printable template

Instructions and Help about 1120x

How to edit 1120x

How to fill out 1120x

Latest updates to 1120x

All You Need to Know About 1120x

What is 1120x?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1120X

What should I do if I realize I made a mistake on my 1120x after filing?

If you discover an error after submitting your 1120x, you can correct it by filing an amended return with the appropriate form and indicating the adjustments. It's vital to provide clear explanations for each change to ensure proper processing by the IRS.

How can I track the status of my 1120x submission?

To track the status of your 1120x, you can use the IRS 'Where's My Amended Return' tool available on their website. It typically allows you to see where your amended return is in the processing stages and provides updates on any actions taken.

What are some common mistakes that filers make with the 1120x?

Common mistakes with the 1120x include failing to sign the form, not providing adequate explanations for changes, and incorrect calculations that lead to discrepancies in reported income or deductions. Double-check your entries and use IRS resources to minimize these errors.

Are there privacy or data security concerns when e-filing an 1120x?

Yes, when e-filing your 1120x, it is essential to ensure that you are using secure software and reporting platforms. Protecting your sensitive information from potential breaches is critical, so use reputable tax software that complies with IRS security standards.

What should I do if I received an IRS notice after filing my 1120x?

If you receive an IRS notice after filing your 1120x, review the notice carefully for instructions. Prepare the necessary documentation to respond effectively and be sure to address any queries raised by the IRS to resolve the matter promptly.