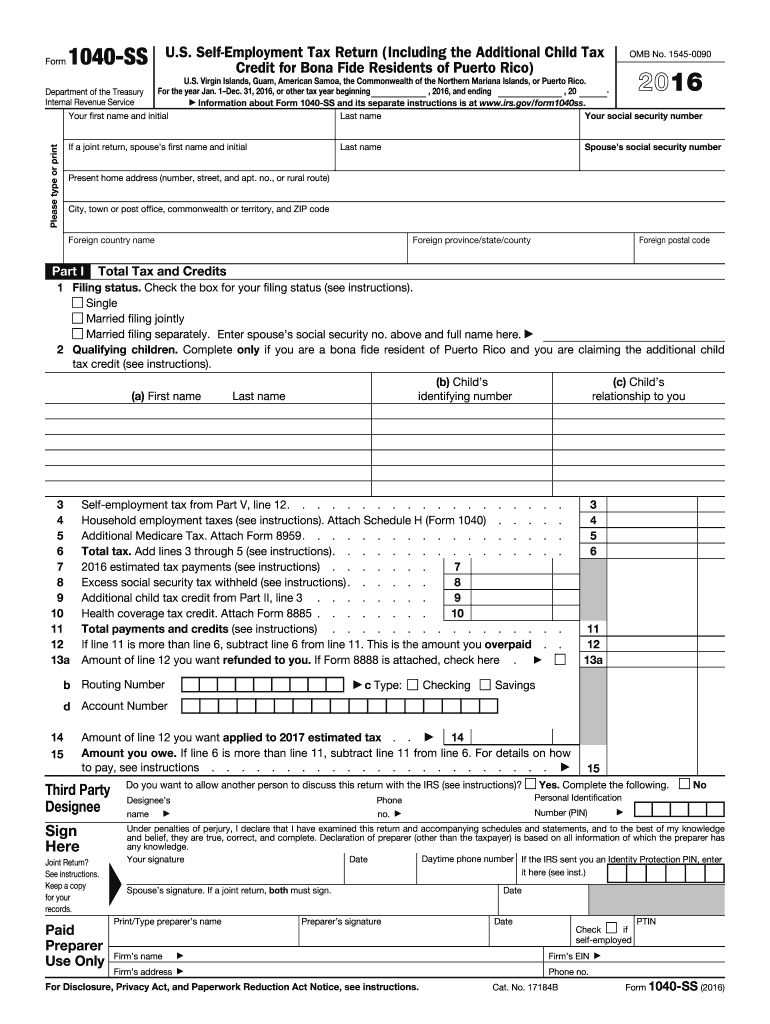

IRS 1040-SS 2016 free printable template

Show details

2016 and ending For the year Jan. 1 Dec. 31 2016 or other tax year beginning Information about Form 1040-SS and its separate instructions is at www.irs.gov/form1040ss. For Disclosure Privacy Act and Paperwork Reduction Act Notice see instructions. Cat. No. 17184B Form 1040-SS 2016 Page Part II Bona Fide Residents of Puerto Rico Claiming Additional Child Tax Credit See instructions. Household employment taxes see instructions. Attach Schedule H Form 1040. Additional Medicare Tax. Attach Form...8959. Total tax. Add lines 3 through 5 see instructions. 2016 estimated tax payments see instructions. Excess social security tax withheld see instructions. Form 1040-SS U*S* Self-Employment Tax Return Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico OMB No* 1545-0090 U*S* Virgin Islands Guam American Samoa the Commonwealth of the Northern Mariana Islands or Puerto Rico. Your first name and initial Last name Your social security number Department of the Treasury...Internal Revenue Service Please type or print If a joint return spouse s first name and initial Spouse s social security number Present home address number street and apt* no* or rural route City town or post office commonwealth or territory and ZIP code Foreign country name Part I Foreign province/state/county Foreign postal code Total Tax and Credits 1 Filing status. Check the box for your filing status see instructions. Single Married filing jointly 2 Qualifying children* Complete only if you...are a bona fide resident of Puerto Rico and you are claiming the additional child tax credit see instructions. a First name 13a b Child s identifying number relationship to you b Routing Number c Type Checking Self-employment tax from Part V line 12. Household employment taxes see instructions. Attach Schedule H Form 1040. Additional Medicare Tax. Attach Form 8959. Total tax. Add lines 3 through 5 see instructions. 2016 estimated tax payments see instructions. Excess social security tax withheld...see instructions. Additional child tax credit from Part II line 3. Health coverage tax credit. Attach Form 8885. Total payments and credits see instructions. If line 11 is more than line 6 subtract line 6 from line 11. This is the amount you overpaid. Amount of line 12 you want refunded to you. If Form 8888 is attached check here. Savings d Account Number Amount you owe. If line 6 is more than line 11 subtract line 11 from line 6. For details on how to pay see instructions. Yes. Complete the...following. No Third Party Designee Do you want to allow another person to discuss this return with the IRS see instructions Sign Here Under penalties of perjury I declare that I have examined this return and accompanying schedules and statements and to the best of my knowledge and belief they are true correct and complete. Declaration of preparer other than the taxpayer is based on all information of which the preparer has any knowledge. Daytime phone number If the IRS sent you an Identity...Protection PIN enter Your signature Date it here see inst.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040-SS

How to edit IRS 1040-SS

How to fill out IRS 1040-SS

Instructions and Help about IRS 1040-SS

How to edit IRS 1040-SS

You can edit IRS Form 1040-SS using pdfFiller's editing tools. To begin, upload the form to your pdfFiller account. Once uploaded, you can click on fields to enter or modify information as needed. Be sure to save your changes to retain the edited version for future reference or submission.

How to fill out IRS 1040-SS

To fill out IRS Form 1040-SS, follow these steps:

01

Download the form from the IRS website or obtain it through a tax professional.

02

Gather necessary documentation, such as income statements and deduction information.

03

Complete each section of the form, ensuring that all information is accurate.

04

Review your entries for completeness and correctness.

05

Sign and date the form where indicated.

About IRS 1040-SS 2016 previous version

What is IRS 1040-SS?

What is the purpose of this form?

Who needs the form?

When am I exempt from filing out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040-SS 2016 previous version

What is IRS 1040-SS?

IRS Form 1040-SS is a simplified version of the standard tax form used by U.S. citizens or residents living abroad, specifically designed for reporting self-employment income and paying self-employment taxes. It is important for individuals with income sourced from U.S. sources who need to fulfill their tax obligations in a straightforward manner.

What is the purpose of this form?

The primary purpose of IRS Form 1040-SS is to report and calculate self-employment tax owed on income earned. This form is especially relevant for those who do not have U.S. wages or have declared a certain income threshold for self-employment status. Filing this form ensures compliance with federal tax laws pertaining to self-employment income.

Who needs the form?

Individuals who should file IRS Form 1040-SS include self-employed individuals, sole proprietors, and individuals who earn income in the U.S. but live abroad. If you earn more than the minimum threshold for self-employment income, you must file this form to report your earnings and pay self-employment taxes.

When am I exempt from filing out this form?

You may be exempt from filling out IRS Form 1040-SS if your self-employment income is below a specific threshold set by the IRS for the tax year. Additionally, U.S. citizens living abroad may qualify for exemptions under certain tax treaties or foreign earned income exclusions. Always check the latest IRS guidelines or consult a tax professional for eligibility.

Components of the form

IRS Form 1040-SS consists of several key sections that collect information about the taxpayer's income, deductions, credits, and tax payments. The primary components include personal identification information, income from self-employment, adjusted gross income, and self-employment tax calculations. Understanding these components is essential for accurate filing.

What are the penalties for not issuing the form?

Failing to file IRS Form 1040-SS may result in penalties, including fines and interest on unpaid taxes. Furthermore, the IRS may impose additional charges for late submissions. It's crucial to file the form timely to avoid possible complications or increased financial liabilities.

What information do you need when you file the form?

When filing IRS Form 1040-SS, be prepared with the following information:

01

Your personal identification details, including name, address, and Social Security Number.

02

Records of all income earned from self-employment activities.

03

Deductions and credits applicable to your tax situation.

04

Any previously paid estimated taxes to ensure accurate tax calculations.

Is the form accompanied by other forms?

IRS Form 1040-SS may be filed along with additional forms, such as Schedule C for profit or loss from business and Schedule SE for self-employment tax calculations. It is advisable to consult the IRS instructions for these forms to ensure that all necessary documentation is included when filing.

Where do I send the form?

Upon completing IRS Form 1040-SS, you should send it to the address specified in the instructions that accompany the form. Depending on your state of residence, the mailing address may vary. Ensure that you review the instructions carefully for accurate submission.

See what our users say