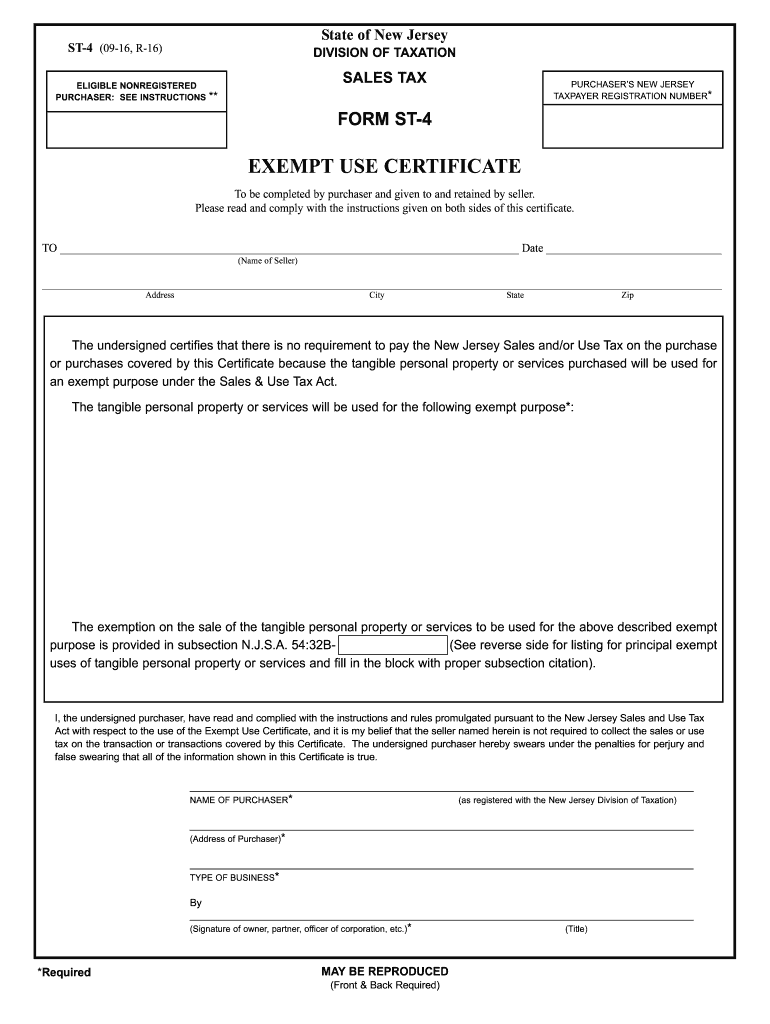

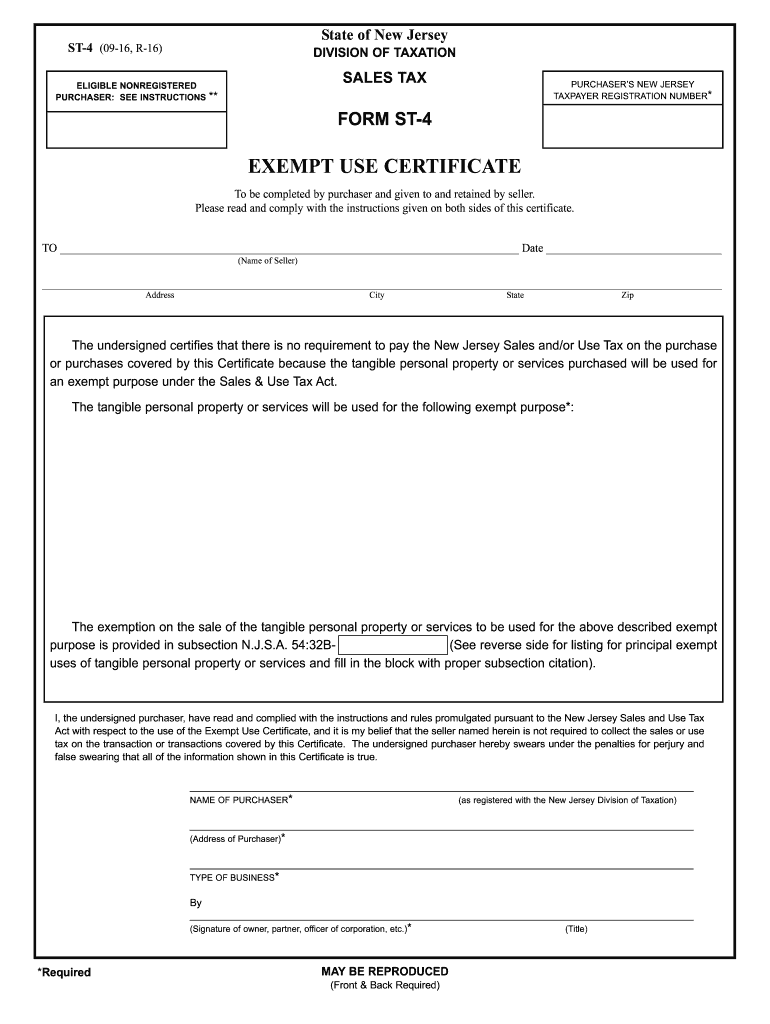

NJ ST-4 2016 free printable template

Get, Create, Make and Sign NJ ST-4

How to edit NJ ST-4 online

Uncompromising security for your PDF editing and eSignature needs

NJ ST-4 Form Versions

How to fill out NJ ST-4

How to fill out NJ ST-4

Who needs NJ ST-4?

Instructions and Help about NJ ST-4

In my more than 30 years of experience in law enforcement I can honestly say that I've never seen the levels of layoffs in real experience and today the numbers of lost officers has reached a staggering levels between January first 2009 and September 10, 2010, New Jersey has lost a total of two thousand two hundred and twenty-eight officers through the layoffs in retirement this number equates to an eleven percent reduction in our municipal police forces the economy and the potential crushing impact of the upcoming two percent cap has led towns throughout New Jersey to cut back on its basic responsibilities we have to do something now before the level of safety and security that the public needs and expect is no longer there and our crime rate expand the reality is that crime is going up and our police numbers are going down in Irvington to say they have to lay off the plate 20 police officers violent crime had rapidly increased for sin in linen everything we were forced they were forced to bring those officers back after a period of 45 days because crime gravity increase violent crime went through the roof Atlantic sea Atlantic City has seen violent crime jump when 20 officers were laid off in June sadly just two hours ago another 40 officers from Atlantic City Police Department turned in their gun and badges and joined the ranks of the unemployed at a time with crime is up and crime is rising put officer safety and public safety in jeopardy I have been very vocal on the issue of understaffing layoffs in public safety and I will continue to do so there are some in the media and government were referred to the PBA is fearmongers alarmist who dismiss our concerns and special interest groups for those who claim these comments are scare tactics all hi contain say is take a look at the facts and know that history has proven that in bad times of economy crime increases and in this case I do represent a special interest group my special interest group is the safety of my officers and the safety of the citizens of the communities we serve this is not not to say that we don't recognize the burdens of the economic downturn is placed on the state in fact many people lead locals have negotiated the contracts to assist and prevent legal senior law enforcement officers has have accepted retirement to ensure that younger officers remain on the streets and the PPA has offered numerous towns are resources for our resources to assist them in cutting our cutting or erased and frivolous spending unfortunately this nutting but might not be enough and to point out to the press, but the impact reduce the impact of this really is a twofold one we have impact on the cities and the communities are conducing foursome please lie on ten drivers may rise to live and teach is less safe today than it was yesterday when he comes less safe yesterday that was back in May when we must be original 20 when you know when I was that we need to take the president of the PBA up on his...

People Also Ask about

How do I file a claim of exemption in NJ?

What is NJ senior exemption?

How do I become exempt from NJ gross income tax?

Who is exempt from New Jersey income tax?

Is there a standard deduction for New Jersey in 2023?

What is the exemption for New Jersey?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my NJ ST-4 in Gmail?

Can I edit NJ ST-4 on an iOS device?

How do I complete NJ ST-4 on an iOS device?

What is NJ ST-4?

Who is required to file NJ ST-4?

How to fill out NJ ST-4?

What is the purpose of NJ ST-4?

What information must be reported on NJ ST-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.