NJ ST-4 2008 free printable template

Show details

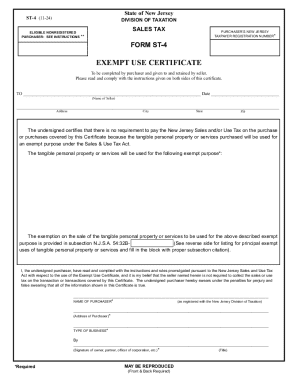

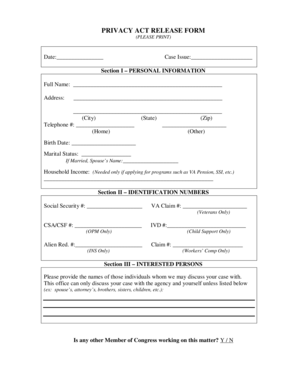

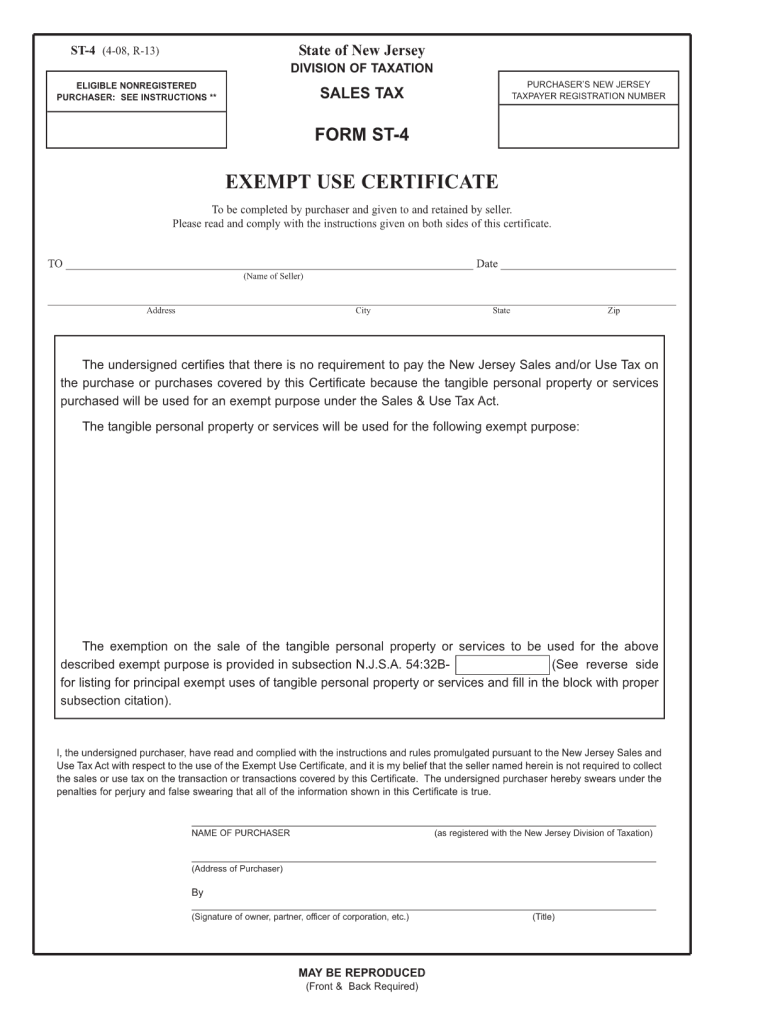

State of New Jersey ST-4 05-12 R-15 DIVISION OF TAXATION ELIGIBLE NONREGISTERED PURCHASER SEE INSTRUCTIONS SALES TAX PURCHASER S NEW JERSEY TAXPAYER REGISTRATION NUMBER FORM ST-4 EXEMPT USE CERTIFICATE To be completed by purchaser and given to and retained by seller.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ ST-4

Edit your NJ ST-4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ ST-4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NJ ST-4 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NJ ST-4. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ ST-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ ST-4

How to fill out NJ ST-4

01

Obtain the NJ ST-4 form from the New Jersey Division of Taxation website or local tax office.

02

Fill in the required personal information, including your name, address, and social security number.

03

Indicate your employer's information, including the name and address of the company.

04

Complete the certification section, confirming that you meet the criteria for exemption.

05

Sign and date the form to certify that the information provided is accurate and complete.

06

Submit the completed NJ ST-4 form to your employer for processing.

Who needs NJ ST-4?

01

Employees who are exempt from New Jersey state income tax withholding.

02

Workers who have earned income from outside of New Jersey and are not subject to state taxes.

03

Individuals making claims based on certain criteria, such as being a full-time student or low-income status.

Fill

form

: Try Risk Free

People Also Ask about

What is an st3 form NJ?

Form ST-3 Instructions Completing the Certificate. To claim an exemption from Sales Tax on the purchase of taxable property or services, the purchaser must provide a fully completed exemption cer- tificate to the seller. Otherwise, the seller must collect the tax.

How do I fill out a resale certificate in NY?

2:55 8:33 How To Fill Out ST-120 New York State Resale Certificate - YouTube YouTube Start of suggested clip End of suggested clip Number is blank. So if you're a new york state vendor. You click that one. And then you put in yourMoreNumber is blank. So if you're a new york state vendor. You click that one. And then you put in your certificate of authority number right here.

What is the difference between St-3 and St-4 in NJ?

Form ST-3: Used for in-state suppliers. Form ST-3NR: Used for out-of-state suppliers. Form ST-4: Used for tax exemption on production machinery and packaging supplies.

How to fill out a ST-4 form in Massachusetts?

How to fill out a Massachusetts ST-4. Name of Purchaser should be your registered business name. Account ID or Federal ID should be your registered business identification number. Address should be the registered address of your company. Type of business should describe your business activities.

What is a NJ st4?

INSTRUCTIONS: NEW JERSEY EXEMPT USE CERTIFICATE (Form ST-4) In New Jersey transactions which are eligible from payment of state or local sales and use tax, the purchaser is required file a form ST-4 with the seller documenting their exemption. This document can be found on the website of the state of New Jersey.

How do I get a tax exempt certificate in Massachusetts?

If you need to apply for a registration, please complete and file Massachusetts Form TA-1, Application for Original Regis- tration. Form TA-1 may be obtained at any DOR office or by calling (617) 887-MDOR or toll-free, in-state 1-800-392-6089.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NJ ST-4 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing NJ ST-4.

Can I edit NJ ST-4 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share NJ ST-4 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete NJ ST-4 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your NJ ST-4. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is NJ ST-4?

NJ ST-4 is a form used in New Jersey for exempt purchases of certain goods and services, allowing qualified purchasers to buy without paying sales tax.

Who is required to file NJ ST-4?

Any business or organization that is exempt from sales tax in New Jersey, such as certain non-profit organizations, government entities, and specific types of industries, is required to file NJ ST-4.

How to fill out NJ ST-4?

To fill out NJ ST-4, you need to provide your business's name, address, the type of exemption being claimed, and details about the items being purchased. Ensure to sign and date the form before submitting.

What is the purpose of NJ ST-4?

The purpose of NJ ST-4 is to provide a mechanism for exempt entities to certify their exemption status and make tax-exempt purchases in New Jersey.

What information must be reported on NJ ST-4?

NJ ST-4 must report the name and address of the purchaser, the type of exemption, a description of the items purchased, and the signature of the purchaser to validate the exemption.

Fill out your NJ ST-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ ST-4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.