NJ ST-4 2012 free printable template

Show details

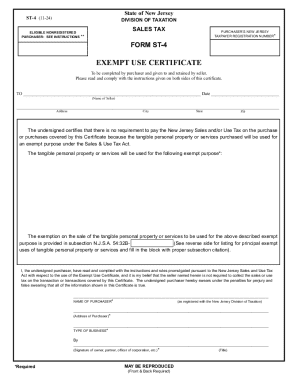

State of New Jersey ST-4 05-12 R-15 DIVISION OF TAXATION ELIGIBLE NONREGISTERED PURCHASER SEE INSTRUCTIONS SALES TAX PURCHASER S NEW JERSEY TAXPAYER REGISTRATION NUMBER FORM ST-4 EXEMPT USE CERTIFICATE To be completed by purchaser and given to and retained by seller. 4. Common exempt uses of property or services for which the ST-4 is applicable follow. NOTE The descriptions are general and do not necessarily cover every exempt use or service or every condition for exemption. Further...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ ST-4

Edit your NJ ST-4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ ST-4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NJ ST-4 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NJ ST-4. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ ST-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ ST-4

How to fill out NJ ST-4

01

Obtain the NJ ST-4 form from the New Jersey Division of Taxation website or a local tax office.

02

Fill in the top section with your name, address, and Social Security number.

03

Indicate the type of exemption you are claiming by checking the appropriate box.

04

List the applicable sales tax exemption number or scenario as required.

05

Provide details regarding the purchases being claimed for exemption, including descriptions and amounts.

06

Sign and date the form at the bottom to certify that the information is accurate.

Who needs NJ ST-4?

01

Businesses purchasing goods or services exempt from sales tax in New Jersey.

02

Organizations such as nonprofits or government agencies that qualify for exemptions.

03

Individuals making tax-exempt purchases for use in specific, exempt activities.

Fill

form

: Try Risk Free

People Also Ask about

How do I file a claim of exemption in NJ?

You must claim the exemption using the Division's NJ Insurance Mandate Coverage Exemption Application. If you qualify for an exemption, you can report it when you file your New Jersey Income Tax return (Resident Form NJ-1040) using Schedule NJ-HCC.

What is NJ senior exemption?

NJ Taxation The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence (main home). To qualify, you must meet all the eligibility requirements for each year from the base year through the application year.

How do I become exempt from NJ gross income tax?

Filing Threshold Filers with income of $10,000 or less for the entire year (single filers, married persons filing separately, and estates and trusts), and $20,000 or less for the entire year (married couples filing jointly, heads of household, and surviving spouses) pay no tax.

Who is exempt from New Jersey income tax?

Income tax: If you were 65 or older on the last day of the year for which you're filing, you're eligible for a $1,000 income tax exemption. New Jersey has also expanded eligibility for its Earned Income Tax Credit (EITC) to include those 65 and older who do not have a dependent.

Is there a standard deduction for New Jersey in 2023?

The federal Tax Cuts and Jobs Act of 2017 (TCJA) increased the standard deduction (set at $13,850 for single filers and $27,700 for joint filers in 2023) while suspending the personal exemption by reducing it to $0 through 2025.

What is the exemption for New Jersey?

Personal Exemptions You can claim a $1,000 regular exemption, even if someone else claims you as a dependent on their tax return. If you are married (or in a civil union) and are filing jointly, your spouse can also claim a $1,000 regular exemption.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NJ ST-4 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your NJ ST-4 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get NJ ST-4?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific NJ ST-4 and other forms. Find the template you need and change it using powerful tools.

How do I execute NJ ST-4 online?

Completing and signing NJ ST-4 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

What is NJ ST-4?

NJ ST-4 is a form used in New Jersey for claiming exemption from sales tax for certain purchases made by non-profit organizations and exempt entities.

Who is required to file NJ ST-4?

Non-profit organizations, government entities, and certain exempt organizations that make tax-exempt purchases in New Jersey are required to file NJ ST-4.

How to fill out NJ ST-4?

To fill out NJ ST-4, provide your organization's name, address, seller's details, the purpose of the purchase, and sign the form to certify the exemption.

What is the purpose of NJ ST-4?

The purpose of NJ ST-4 is to allow qualified organizations to claim exemption from paying sales tax on eligible purchases made in New Jersey.

What information must be reported on NJ ST-4?

NJ ST-4 requires reporting the organization's name, address, exempt status, a description of the item purchased, the seller's name, and signature certifying the use of the exemption.

Fill out your NJ ST-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ ST-4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.