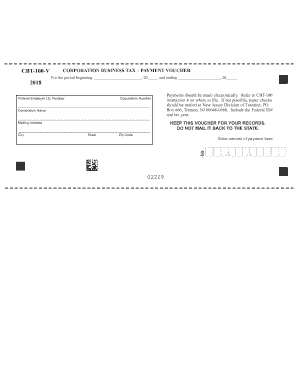

NJ CBT-100-V 2016 free printable template

Show details

Apr 17, 2018 ... NJ. 1040ES. 2018. New Jersey Gross Income Tax. Declaration of Estimated ...your check and is listed first when filing your income tax return.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ CBT-100-V

Edit your NJ CBT-100-V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ CBT-100-V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NJ CBT-100-V online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NJ CBT-100-V. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ CBT-100-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ CBT-100-V

How to fill out NJ CBT-100-V

01

Obtain a copy of the NJ CBT-100-V form from the New Jersey Division of Taxation website.

02

Fill in your name, address, and taxpayer identification number at the top of the form.

03

Indicate the type of tax return you are filing, selecting the appropriate checkbox.

04

Complete the income section by entering all applicable income amounts as requested.

05

Deduct any applicable credits or adjustments to arrive at your net taxable income.

06

Calculate the total tax due based on the provided schedule and rates.

07

Sign and date the form where indicated.

08

Submit the completed form to the New Jersey Division of Taxation by the due date.

Who needs NJ CBT-100-V?

01

Any individual or business entity in New Jersey that has income that is subject to corporation business tax.

02

New Jersey corporations that have nexus with New Jersey and need to report their business activities.

03

Corporate taxpayers who are making estimated payments for the corporation business tax.

Instructions and Help about NJ CBT-100-V

Fill

form

: Try Risk Free

People Also Ask about

What is NJ CBT form?

Corporation Business Tax (CBT)- Extensions You must include a tentative tax payment with your application for extension. If 90% of the tax liability is not paid by the original due date of the return, your request for an extension will be denied and we will impose penalties and interest for late filing and payment.

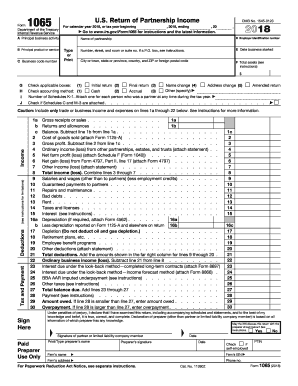

How do I file a CBT-100 in NJ?

Visit the Division's website or check with your soft- ware provider to see if they support any or all of these filings. To file and pay the annual report electronically, visit the Division of Revenue and Enterprise Services website. A new, simplified, standardized return is being created that will replace Form CBT-100.

Who must file NJ CBT-100?

Any officer or director of any corporation who shall distribute or cause to be distributed any assets in dissolution or liquidation to the stockholders without having first paid all corporation franchise taxes, fees, penalties and interest imposed on said corporation, in ance with N.J.S.A.

What is CBT tax in New Jersey?

In general, all Corporation Business Tax (CBT) returns and payments, whether self-prepared or prepared by a tax professional, must be submitted electronically.

What is NJ CBT 100v?

Form CBT-100-V is a New Jersey Corporate Income Tax form. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the SSN/EIN of the taxpayer who sent it.

Who must file CBT 100?

All taxpayers and tax preparers must file Corporation Business Tax returns and make payments electronically. This mandate includes all returns, estimated payments, extensions, and vouchers. Visit the Division's website or check with your soft- ware provider to see if they support any or all of these filings.

Who files CBT-100S?

CORPORATIONS REQUIRED TO FILE THIS RETURN: (b) Foreign corporations that meet the filing requirements and whose income is immune from tax pursuant to Public Law 86- 272, 15 U.S.C. § 381 et seq., must obtain and complete Schedule N, Nexus - Immune Activity Declaration, and remit the minimum tax with the CBT-100S.

Who is required to file NJ CBT?

Every partnership that has income or loss derived from sources in the State of New Jersey, or has any type of New Jersey resident partner, must file Form NJ-1065. Form NJ- CBT-1065 must be filed when the entity is required to calculate a tax on its nonresident partner(s).

How do I pay my CBT tax in NJ?

You may make a payment by EFT, e-check, or credit card through our online Corporation Business Tax Online Filing and Payments Service. (Combined Filers must submit payments using the Unitary ID number assigned to the Managerial Member.)

Who must file NJ CBT 100?

Any officer or director of any corporation who shall distribute or cause to be distributed any assets in dissolution or liquidation to the stockholders without having first paid all corporation franchise taxes, fees, penalties and interest imposed on said corporation, in ance with N.J.S.A.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NJ CBT-100-V from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like NJ CBT-100-V, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit NJ CBT-100-V online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your NJ CBT-100-V to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I edit NJ CBT-100-V on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing NJ CBT-100-V right away.

What is NJ CBT-100-V?

NJ CBT-100-V is a payment voucher for corporations in New Jersey that need to make estimated tax payments.

Who is required to file NJ CBT-100-V?

Corporations that expect to owe $500 or more in corporate business tax are required to file NJ CBT-100-V.

How to fill out NJ CBT-100-V?

To fill out NJ CBT-100-V, you need to provide your corporation's name, address, Federal Employer Identification Number (FEIN), the amount of the payment, and the tax year.

What is the purpose of NJ CBT-100-V?

The purpose of NJ CBT-100-V is to facilitate the process of making estimated corporate tax payments to the State of New Jersey.

What information must be reported on NJ CBT-100-V?

On NJ CBT-100-V, you must report your corporation's name, address, FEIN, the amount being paid, and the corresponding tax year.

Fill out your NJ CBT-100-V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ CBT-100-V is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.