NJ CBT-100-V 2017 free printable template

Show details

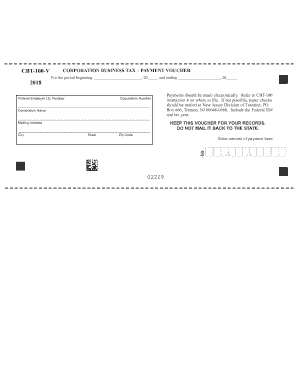

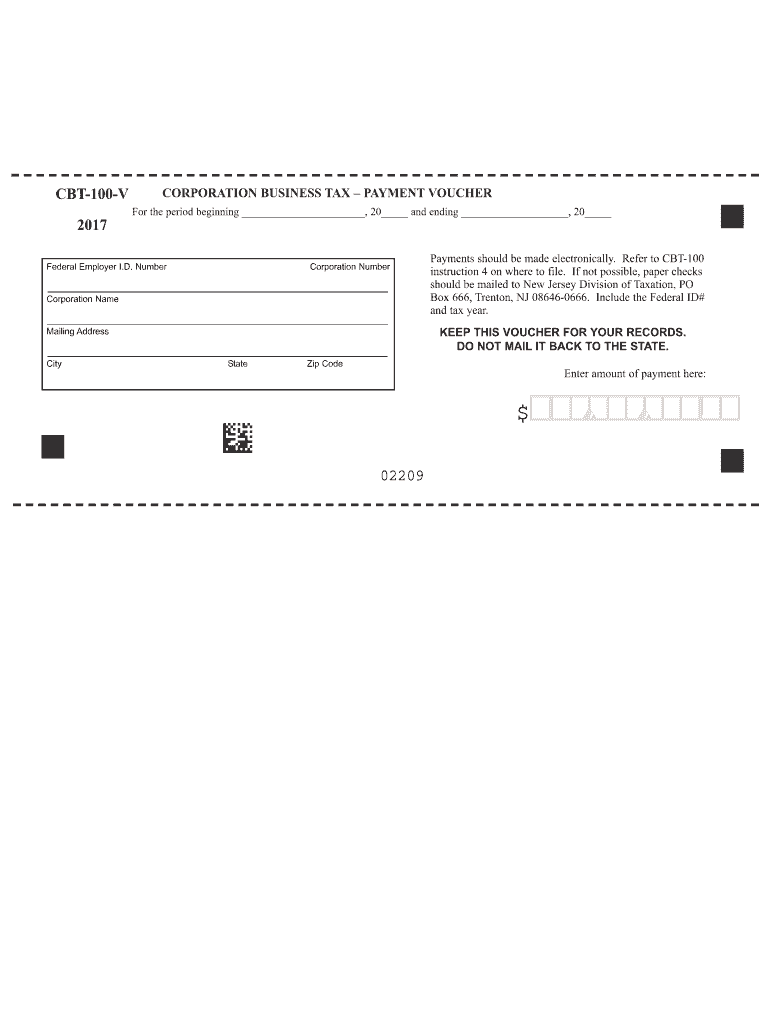

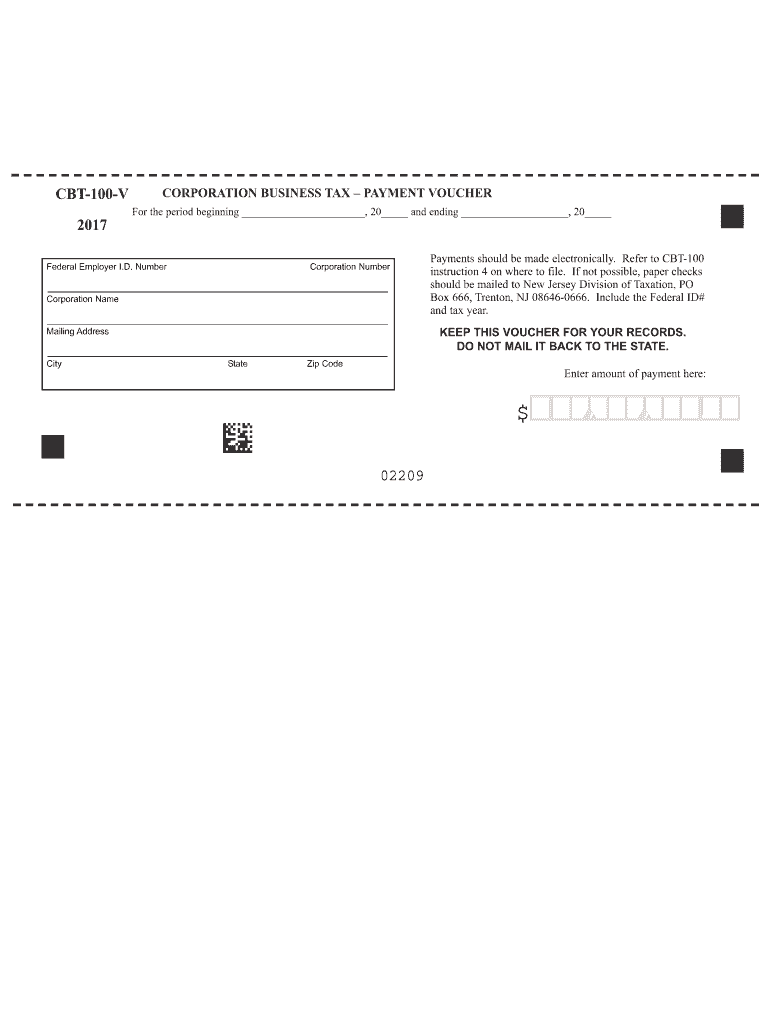

CBT100V CORPORATION BUSINESS TAX PAYMENT VOUCHER. For the period beginning. 20 and ending. 2017. Federal Employer I.D. Number.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ CBT-100-V

Edit your NJ CBT-100-V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ CBT-100-V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NJ CBT-100-V online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NJ CBT-100-V. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ CBT-100-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ CBT-100-V

How to fill out NJ CBT-100-V

01

Obtain the NJ CBT-100-V form from the New Jersey Division of Taxation website or your tax professional.

02

Enter your business name, address, and taxpayer identification number at the top of the form.

03

Fill in the tax period for which you are filing the form.

04

Calculate your total income and enter it in the specified section.

05

Deduct any applicable business expenses and enter the result as your net income.

06

Utilize the appropriate tax rate to calculate your tax liability based on your net income.

07

Review all entries to ensure accuracy.

08

Sign and date the form before submission.

09

Submit the completed form either electronically or via mail to the New Jersey Division of Taxation.

Who needs NJ CBT-100-V?

01

Any business entity that has registered with the State of New Jersey and is required to pay the corporation business tax.

02

Businesses with a net income that exceeds the minimum threshold set by the state.

03

Corporations and S corporations operating in New Jersey that are subject to state tax requirements.

Instructions and Help about NJ CBT-100-V

Fill

form

: Try Risk Free

People Also Ask about

What is NJ CBT form?

Corporation Business Tax (CBT)- Extensions You must include a tentative tax payment with your application for extension. If 90% of the tax liability is not paid by the original due date of the return, your request for an extension will be denied and we will impose penalties and interest for late filing and payment.

How do I file a CBT-100 in NJ?

Visit the Division's website or check with your soft- ware provider to see if they support any or all of these filings. To file and pay the annual report electronically, visit the Division of Revenue and Enterprise Services website. A new, simplified, standardized return is being created that will replace Form CBT-100.

Who must file NJ CBT-100?

Any officer or director of any corporation who shall distribute or cause to be distributed any assets in dissolution or liquidation to the stockholders without having first paid all corporation franchise taxes, fees, penalties and interest imposed on said corporation, in ance with N.J.S.A.

What is CBT tax in New Jersey?

In general, all Corporation Business Tax (CBT) returns and payments, whether self-prepared or prepared by a tax professional, must be submitted electronically.

What is NJ CBT 100v?

Form CBT-100-V is a New Jersey Corporate Income Tax form. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the SSN/EIN of the taxpayer who sent it.

Who must file CBT 100?

All taxpayers and tax preparers must file Corporation Business Tax returns and make payments electronically. This mandate includes all returns, estimated payments, extensions, and vouchers. Visit the Division's website or check with your soft- ware provider to see if they support any or all of these filings.

Who files CBT-100S?

CORPORATIONS REQUIRED TO FILE THIS RETURN: (b) Foreign corporations that meet the filing requirements and whose income is immune from tax pursuant to Public Law 86- 272, 15 U.S.C. § 381 et seq., must obtain and complete Schedule N, Nexus - Immune Activity Declaration, and remit the minimum tax with the CBT-100S.

Who is required to file NJ CBT?

Every partnership that has income or loss derived from sources in the State of New Jersey, or has any type of New Jersey resident partner, must file Form NJ-1065. Form NJ- CBT-1065 must be filed when the entity is required to calculate a tax on its nonresident partner(s).

How do I pay my CBT tax in NJ?

You may make a payment by EFT, e-check, or credit card through our online Corporation Business Tax Online Filing and Payments Service. (Combined Filers must submit payments using the Unitary ID number assigned to the Managerial Member.)

Who must file NJ CBT 100?

Any officer or director of any corporation who shall distribute or cause to be distributed any assets in dissolution or liquidation to the stockholders without having first paid all corporation franchise taxes, fees, penalties and interest imposed on said corporation, in ance with N.J.S.A.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NJ CBT-100-V online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your NJ CBT-100-V and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit NJ CBT-100-V straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing NJ CBT-100-V, you need to install and log in to the app.

How do I complete NJ CBT-100-V on an Android device?

Complete NJ CBT-100-V and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is NJ CBT-100-V?

NJ CBT-100-V is a payment voucher used for corporate business tax in New Jersey.

Who is required to file NJ CBT-100-V?

Businesses that are required to pay the New Jersey Corporate Business Tax and are filing NJ CBT-100 must submit NJ CBT-100-V along with their payments.

How to fill out NJ CBT-100-V?

To fill out NJ CBT-100-V, provide your business name, address, federal identification number, and the amount of tax payment being submitted.

What is the purpose of NJ CBT-100-V?

The purpose of NJ CBT-100-V is to facilitate the timely payment of corporate business taxes to the state of New Jersey.

What information must be reported on NJ CBT-100-V?

The NJ CBT-100-V must report the business's name, address, federal identification number, tax period, and the payment amount.

Fill out your NJ CBT-100-V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ CBT-100-V is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.