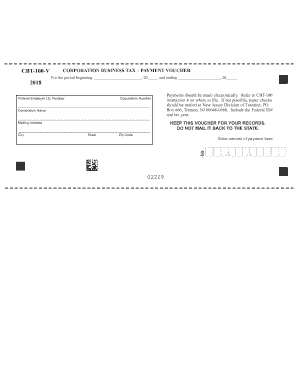

NJ CBT-100-V 2015 free printable template

Get, Create, Make and Sign NJ CBT-100-V

Editing NJ CBT-100-V online

Uncompromising security for your PDF editing and eSignature needs

NJ CBT-100-V Form Versions

How to fill out NJ CBT-100-V

How to fill out NJ CBT-100-V

Who needs NJ CBT-100-V?

Instructions and Help about NJ CBT-100-V

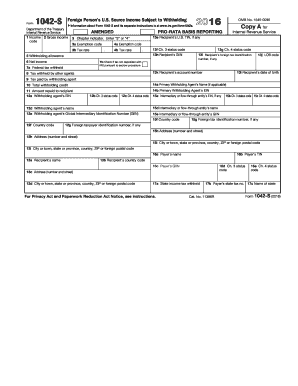

Hey what's up guys this is josh with job business solutions so earlier this week we posted an article about the benefits of being in LLC taxes and S corporation and when the requirements we put in there to become an S corporation is you have to file form 2553, so we're going to show you today how to fill that out as always I do recommend that you use a CPA to do this you don't want to do something wrong and haven't screwed up your entire business entity but if you're going to try and do it yourself here's how it works so go down to part 1 here and the election information name, so this would be the name of your business so in this case I'll do my business job Business Solutions then over on a here you're going to put your employer identification number, so I'm just going to make one up and if you don't already have an employer identification number which if you're an LLC you may not it's not required, but it is required for an S corporation so if you don't have one, yet you would have to obtain that, and maybe we'll do a video on how to do that, but it's pretty simple you can google how to get an EIN and the IRS is website has a pretty straightforward on how to do that alright so be here they don't want to know when it became incorporated when you become this business my case it was a 101 2013 the state of incorporation where it's located Colorado the address of the business so let's just say one one one somewhere street city or town Centennial Colorado eight zero one five okay, so this is all just your basic business information name address player identification number when you incorporated and the state that it's incorporated okay so if you changed your address after applying for an EIN you'll have to check either whether you change your name or your address okay, so you do that there election is to be effective for the tax year beginning okay, so this is the year you want it to become an escort for me if I wanted to become one in 2013 I would say oh 101 2013 if I wanted it for 2014 I'll just do a one-on-one 2014 all right the selected tax year for most of you guys this is going to be the calendar year a fiscal year just means you have a different year-end and a calendar year, so maybe it's at the end of September for 99 percent of you it's just going to be the calendar year if more than 100 shareholders are listed for item J check this box okay so a small business what we're talking about here you're not going to have more than 100 shareholders, so you can ignore G the name and title of the officer or legal representative with the IRS may call for more information so if you're the only person in your business which is likely if you're watching this you're just going to put your name and title here, so I'll just put Josh Barely owner and your phone number alright if this S corporation election is being filed with form 1120s I declare that I had reasonable calls for not filing form 2553 timely and if this selection is made by an entity...

People Also Ask about

What is NJ CBT form?

How do I file a CBT-100 in NJ?

Who must file NJ CBT-100?

What is CBT tax in New Jersey?

What is NJ CBT 100v?

Who must file CBT 100?

Who files CBT-100S?

Who is required to file NJ CBT?

How do I pay my CBT tax in NJ?

Who must file NJ CBT 100?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in NJ CBT-100-V?

How do I make edits in NJ CBT-100-V without leaving Chrome?

Can I sign the NJ CBT-100-V electronically in Chrome?

What is NJ CBT-100-V?

Who is required to file NJ CBT-100-V?

How to fill out NJ CBT-100-V?

What is the purpose of NJ CBT-100-V?

What information must be reported on NJ CBT-100-V?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.