CA RL-1 Summary 2016 free printable template

Show details

3 Jews. 2014 ... Forms and Publications Businesses RL Slips and Summaries ... RL2.GV, Guide to Filing the RL2 Slip: Retirement and Annuity Income, 201610 .... RLZ1.SV, Summary of Source Deductions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign CA RL-1 Summary

Edit your CA RL-1 Summary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA RL-1 Summary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA RL-1 Summary online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA RL-1 Summary. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA RL-1 Summary Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA RL-1 Summary

How to fill out CA RL-1 Summary

01

Obtain the CA RL-1 Summary form from the official tax website or office.

02

Fill in the correct tax year at the top of the form.

03

Enter your business identifier number (BIN) in the designated field.

04

Provide the total payment amounts for each type of income listed on the form.

05

Include any deductions or credits that apply to your situation.

06

Make sure to verify that your totals match the individual RL-1 slips issued to employees or clients.

07

Sign and date the form at the bottom.

Who needs CA RL-1 Summary?

01

Employers who issue RL-1 slips to their employees for income reporting.

02

Businesses that provide certain types of income to recipients in Quebec.

03

Tax preparers or accountants handling payroll for companies in Quebec.

Fill

form

: Try Risk Free

People Also Ask about

What is CNT tax in Quebec?

The contribution rate for these employers is 0.02% for 2022, 0.03% for 2023 and 0.05% for 2024. From 2025 onward, the rate will the same for all employers. For 2023, the portion of an employee's remuneration in excess of $91,000 is not subject to the contribution related to labour standards.

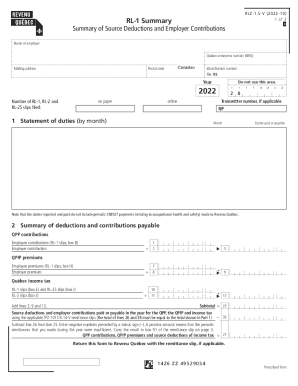

What is RL-1 summary?

Form RL-1 Summary is used by employers to report source withholdings on wages paid to employees. It is also used to calculate certain employer contributions. The remittance slip is provided for information purposes only, your data must be recopied on the form prescribed by the government.

What does RL-1 mean?

The RL-1 slip is used mainly for reporting salaries or wages, and any other remuneration that an employee receives. The RL-1 slip is also used for reporting amounts deducted at source from the above-mentioned types of remuneration.

How do I report RL-1?

Filing RL-1 slips with Revenu Québec If you are filing fewer than 51 RL-1 slips, you can send them to us: online using software authorized by Revenu Québec (in an XML file); online using the services in My Account for businesses; or. by mail, on paper (in which case, send us only copy 1 of each slip).

How do I submit a RL-1 summary?

You must file the RL-1 summary in the prescribed form.Filing methods the online services in My Account for businesses; software you purchased or developed; the fillable PDF version of the form (RLZ-1. S-V); the paper form (either the form we mail to you each year or the form you order in My Account for businesses).

How do I pay source deductions in Quebec?

To make the payments, use the remittance slip attached to the Remittance of Source Deductions and Employer Contributions (form TPZ-1015.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CA RL-1 Summary for eSignature?

When your CA RL-1 Summary is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find CA RL-1 Summary?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific CA RL-1 Summary and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an eSignature for the CA RL-1 Summary in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your CA RL-1 Summary right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is CA RL-1 Summary?

The CA RL-1 Summary is a tax form used in California to report various types of income for residents and non-residents. It summarizes income received from sources such as wages, pensions, and other taxable income.

Who is required to file CA RL-1 Summary?

Individuals and entities who have received income that is subject to California taxation are required to file the CA RL-1 Summary. This includes residents and non-residents with California source income.

How to fill out CA RL-1 Summary?

To fill out the CA RL-1 Summary, taxpayers need to gather all necessary financial information, including total income, tax withheld, and any deductions. The form requires entries in specific fields for accurate reporting according to California tax guidelines.

What is the purpose of CA RL-1 Summary?

The purpose of the CA RL-1 Summary is to provide the California Franchise Tax Board with a concise report of income earned by individuals and entities, ensuring proper taxation and compliance with state tax laws.

What information must be reported on CA RL-1 Summary?

The CA RL-1 Summary requires reporting of total income amounts, tax withheld, taxpayer identification information, and details of other relevant income sources subject to California state tax.

Fill out your CA RL-1 Summary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA RL-1 Summary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.