CA RL-1 Summary 2022-2026 free printable template

Show details

Navigation pointers

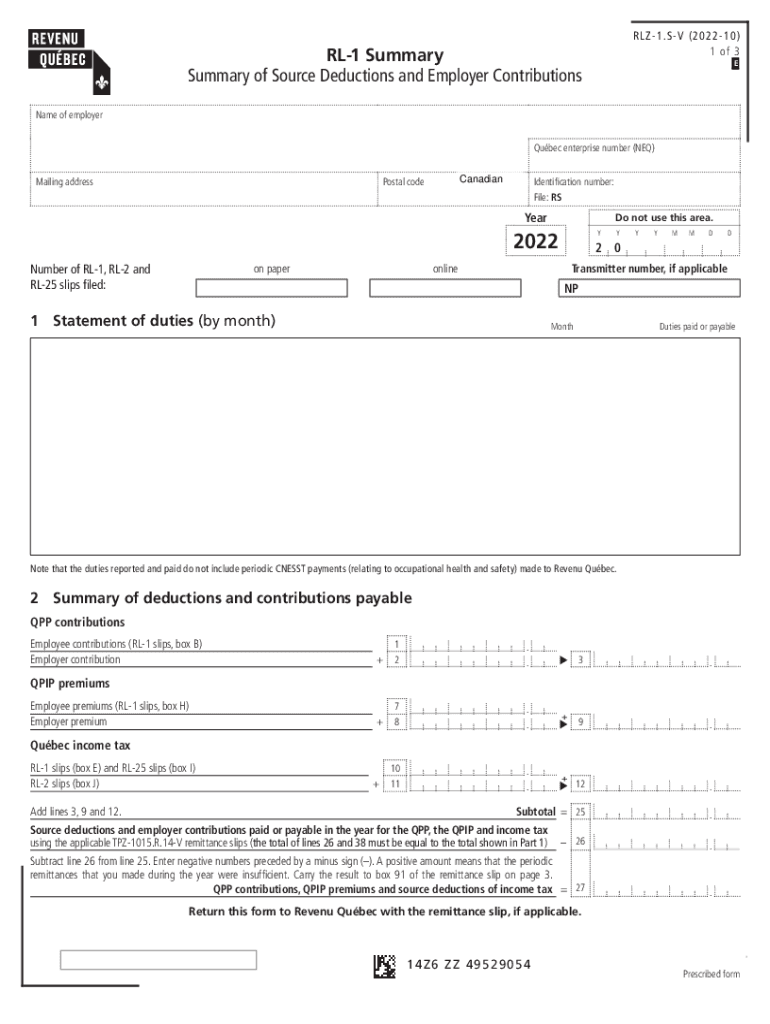

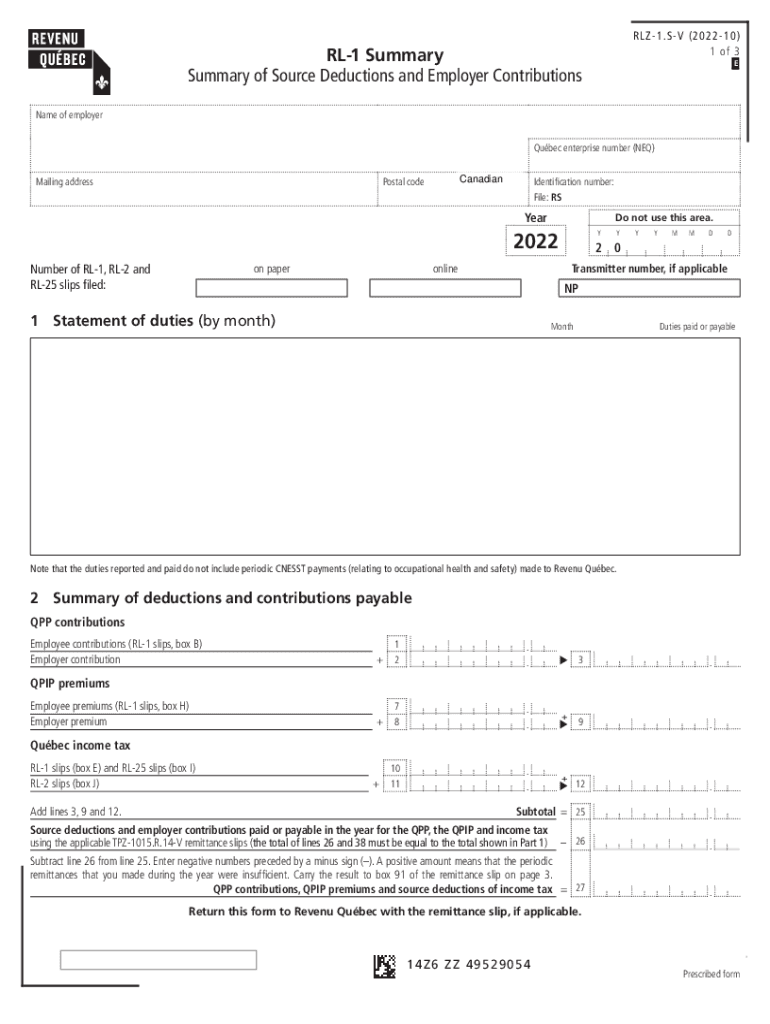

R LZ1.SV (202210)

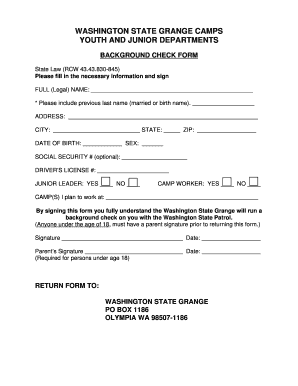

1 of 3NoticeRL1 Summary of Source Deductions and Employer ContributionsE4EraseFor information see page 3 of this form.

Name of employer

Quebec enterprise number

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rl 1 summary form fillable

Edit your rl 1 summary fillable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rl 1 quebec form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rl 1 summary quebec online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rl 1 summary form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA RL-1 Summary Form Versions

Version

Form Popularity

Fillable & printabley

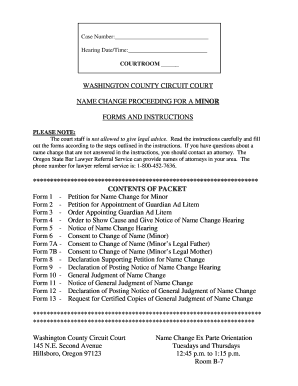

How to fill out rl1 rlz1sv pdffiller form

How to fill out CA RL-1 Summary

01

Gather all necessary tax documents related to employment and income.

02

Obtain the CA RL-1 Summary form from the official tax agency website or your employer.

03

Fill out the personal information section, including your name, address, and social insurance number.

04

Provide details regarding the income earned, including the amounts for various categories like wages, bonuses, and taxable benefits.

05

Ensure you include any deductions or credits that may apply to reduce taxable income.

06

Review the form for accuracy, ensuring all figures match your tax documents.

07

Sign and date the form before submitting it to the appropriate tax authorities.

Who needs CA RL-1 Summary?

01

Individuals who are employed and need to report employment income.

02

Employers who need to provide a summary of employee income to the provincial tax agency.

03

Freelancers or contractors who need to report income earned from multiple sources.

Fill

ca rl 1 summary form

: Try Risk Free

People Also Ask about rl1 summary online

What is the difference between a T4 and a RL-1 information slip?

A federal T4 slip will be automatically generated for every employee, however a RL-1 slip will only be displayed if the province of employment is Quebec. Data entered for the federal T4 slip will be used to calculate the Quebec RL-1 amounts.

What is RL-1 form?

The RL-1 slip must be filed by any employer or payer that paid amounts such as salaries, wages, gratuities, tips, fees, scholarships or commissions. The information on the RL-1 slip is used by individuals to complete the personal income tax return (TP-1-V).

What is RL-1 in English?

You'll receive a Relevé 1: Employment and other income (RL-1) from each Québec-based employer you worked for during the year. This slip shows your income as well as any amounts deducted from it, including income tax, QPP contributions, and union dues.

What is Quebec T4?

The T4 is essentially an aggregation of amounts paid and deducted during the year and include and deductions including. Employment income includes bonuses, vacation pay, tips and taxable benefits like car allowances provided to employees that cover personal use.

What is RL-1?

The RL-1 slip must be filed by any employer or payer that paid amounts such as salaries, wages, gratuities, tips, fees, scholarships or commissions. The information on the RL-1 slip is used by individuals to complete the personal income tax return (TP-1-V).

What is T4 r1?

The T4 (Statement of Remuneration Paid) slips and Relevé-1 (RL-1) slips are used to report all income you paid to your employees over the previous calendar year to the Canada Revenue Agency (CRA) and Revenu Québec respectively, including salaries, wages, taxable benefits (company contributions), commissions, and any

Where can I find my RL-1?

Where do I claim this? Under the QUICK ENTRY tab, click the QUICK SLIP icon. You will find yourself here: Type RL-1 or relevé 1 in the search field and either click the highlighted selection or press Enter to continue. When you arrive at the page for your RL-1, enter your information into the tax software.

How do I report rl1?

To file, you can use: the online services in My Account for businesses; software authorized by Revenu Québec for filing RL-1 slips; software you have developed for filing RL-1 slips that meets our requirements; the PDF RL-1 slip (in French only) that can be completed onscreen; or. the paper RL-1 slip that we provide.

What is the difference between T4 and RL-1?

A federal T4 slip will be automatically generated for every employee, however a RL-1 slip will only be displayed if the province of employment is Quebec. Data entered for the federal T4 slip will be used to calculate the Quebec RL-1 amounts.

What is a RL slip in Quebec?

RL slips are official receipts that you receive annually. They are used to determine the amount of your income and the deductions and tax credits you can claim for a taxation year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my rlz 1s v in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign releve 1 summary and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit rl1 summary in Chrome?

rlz 1 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit rlz 1 s straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing what is rl1.

What is CA RL-1 Summary?

The CA RL-1 Summary is a form used in California to report information regarding source income that is not subject to withholding tax, primarily for recipients of interest and dividends.

Who is required to file CA RL-1 Summary?

Individuals or entities that make payments of $600 or more in interest, dividends, or other reportable income to California residents are required to file the CA RL-1 Summary.

How to fill out CA RL-1 Summary?

To fill out the CA RL-1 Summary, gather the necessary payment information, including the recipient's details and the total amount paid. Follow the form's instructions to list each payer's information, the total payments made, and any applicable tax information.

What is the purpose of CA RL-1 Summary?

The purpose of the CA RL-1 Summary is to report non-wage income to the state of California, ensuring compliance with tax laws and aiding the state in tracking income for tax assessment purposes.

What information must be reported on CA RL-1 Summary?

The CA RL-1 Summary must report the name, address, and taxpayer identification number of the payee, the type of income received, the total amount paid, and any taxes withheld related to those payments.

Fill out your CA RL-1 Summary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

rl1 Summary Fillable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.