CA RL-1 Summary 2018 free printable template

Show details

Navigation pointers

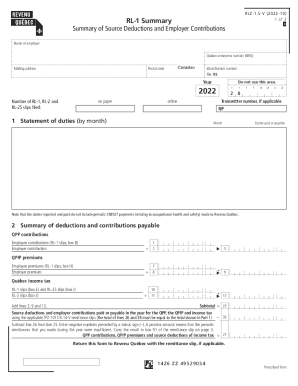

Notice1Summary of Source Deductions

and Employer Contributions LZ1.SV (201810)

1 of 4RLE4S U M M A RY

Eraser information see page 3 of this form.

Name of employer

Quebec enterprise

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign CA RL-1 Summary

Edit your CA RL-1 Summary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA RL-1 Summary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA RL-1 Summary online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA RL-1 Summary. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA RL-1 Summary Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA RL-1 Summary

How to fill out CA RL-1 Summary

01

Gather all relevant T4 slips for the tax year.

02

Complete the identification section, including your business number and name.

03

Enter the total amounts from your slips in the appropriate fields.

04

Ensure that you include all required declarations and signatures.

05

Double-check all entries for accuracy before submission.

Who needs CA RL-1 Summary?

01

Employers who have issued T4 slips to their employees.

02

Businesses that need to report income and deductions to the Canada Revenue Agency (CRA).

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a T4 and a RL-1 information slip?

A federal T4 slip will be automatically generated for every employee, however a RL-1 slip will only be displayed if the province of employment is Quebec. Data entered for the federal T4 slip will be used to calculate the Quebec RL-1 amounts.

What is RL-1 form?

The RL-1 slip must be filed by any employer or payer that paid amounts such as salaries, wages, gratuities, tips, fees, scholarships or commissions. The information on the RL-1 slip is used by individuals to complete the personal income tax return (TP-1-V).

What is RL-1 in English?

You'll receive a Relevé 1: Employment and other income (RL-1) from each Québec-based employer you worked for during the year. This slip shows your income as well as any amounts deducted from it, including income tax, QPP contributions, and union dues.

What is Quebec T4?

The T4 is essentially an aggregation of amounts paid and deducted during the year and include and deductions including. Employment income includes bonuses, vacation pay, tips and taxable benefits like car allowances provided to employees that cover personal use.

What is RL-1?

The RL-1 slip must be filed by any employer or payer that paid amounts such as salaries, wages, gratuities, tips, fees, scholarships or commissions. The information on the RL-1 slip is used by individuals to complete the personal income tax return (TP-1-V).

What is T4 r1?

The T4 (Statement of Remuneration Paid) slips and Relevé-1 (RL-1) slips are used to report all income you paid to your employees over the previous calendar year to the Canada Revenue Agency (CRA) and Revenu Québec respectively, including salaries, wages, taxable benefits (company contributions), commissions, and any

Where can I find my RL-1?

Where do I claim this? Under the QUICK ENTRY tab, click the QUICK SLIP icon. You will find yourself here: Type RL-1 or relevé 1 in the search field and either click the highlighted selection or press Enter to continue. When you arrive at the page for your RL-1, enter your information into the tax software.

How do I report rl1?

To file, you can use: the online services in My Account for businesses; software authorized by Revenu Québec for filing RL-1 slips; software you have developed for filing RL-1 slips that meets our requirements; the PDF RL-1 slip (in French only) that can be completed onscreen; or. the paper RL-1 slip that we provide.

What is the difference between T4 and RL-1?

A federal T4 slip will be automatically generated for every employee, however a RL-1 slip will only be displayed if the province of employment is Quebec. Data entered for the federal T4 slip will be used to calculate the Quebec RL-1 amounts.

What is a RL slip in Quebec?

RL slips are official receipts that you receive annually. They are used to determine the amount of your income and the deductions and tax credits you can claim for a taxation year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in CA RL-1 Summary?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your CA RL-1 Summary and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit CA RL-1 Summary in Chrome?

CA RL-1 Summary can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the CA RL-1 Summary in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your CA RL-1 Summary and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is CA RL-1 Summary?

The CA RL-1 Summary is a tax form used in California to report income and other information related to various types of payments made to residents and non-residents, including wages, dividends, and pensions.

Who is required to file CA RL-1 Summary?

Employers and payers who make payments subject to California income tax withholding and are required to report the income to the state are obligated to file the CA RL-1 Summary.

How to fill out CA RL-1 Summary?

To fill out the CA RL-1 Summary, you need to include details such as the payer's identification information, the amount of income or payments made, withholding amounts, and the recipient's information. It's important to follow the specific instructions provided by the California Franchise Tax Board.

What is the purpose of CA RL-1 Summary?

The purpose of the CA RL-1 Summary is to provide the California Franchise Tax Board with a comprehensive summary of all reportable income and withholding, ensuring that proper taxes are collected and reported.

What information must be reported on CA RL-1 Summary?

The CA RL-1 Summary must report information such as the payer's name and identification number, recipient's details, types and amounts of income paid, the total amount withheld, and any other pertinent tax information.

Fill out your CA RL-1 Summary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA RL-1 Summary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.