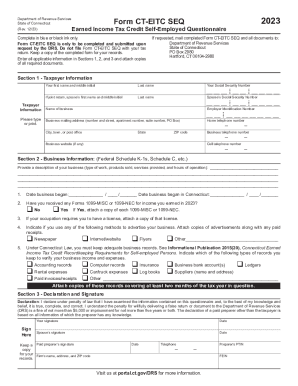

CT DRS CT-EITC SEQ 2016 free printable template

Show details

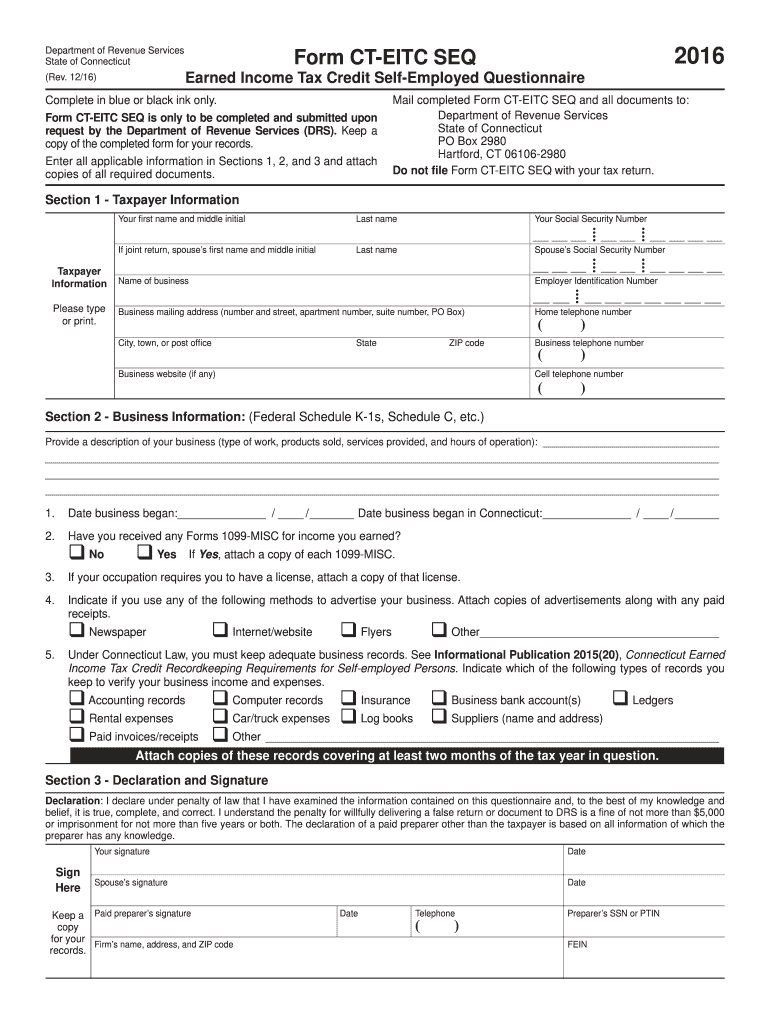

Mail completed Form CT-EITC SEQ and all documents to PO Box 2980 Hartford CT 06106-2980 Do not le Form CT-EITC SEQ with your tax return. Section 1 - Taxpayer Information Your rst name and middle initial Last name Taxpayer Information Name of business Please type or print. Business mailing address number and street apartment number suite number PO Box Your Social Security Number Spouse s Social Security Number Employer Identi cation Number Home telephone number If joint return spouse s rst...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-EITC SEQ

Edit your CT DRS CT-EITC SEQ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-EITC SEQ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT DRS CT-EITC SEQ online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CT DRS CT-EITC SEQ. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-EITC SEQ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS CT-EITC SEQ

How to fill out CT DRS CT-EITC SEQ

01

Gather necessary documents such as your federal tax return, W-2 forms, and any other income statements.

02

Obtain the CT DRS CT-EITC SEQ form from the Connecticut Department of Revenue Services website or local offices.

03

Begin filling out the form with your personal information, including your name, Social Security number, and address.

04

Indicate your filing status (single, married, etc.) on the form.

05

Report your total earned income as indicated on your tax return.

06

Calculate the Earned Income Tax Credit (EITC) based on the guidelines provided in the instructions.

07

Fill in any additional information required, such as the number of qualifying children, if applicable.

08

Review your completed form for accuracy and ensure all required information is provided.

09

Sign and date the form before submitting it to the appropriate tax authority.

Who needs CT DRS CT-EITC SEQ?

01

Individuals and families residing in Connecticut who have earned income and meet specific income thresholds.

02

Taxpayers who want to claim the state Earned Income Tax Credit (EITC).

03

Residents with qualifying children who wish to maximize their tax credits.

Instructions and Help about CT DRS CT-EITC SEQ

Fill

form

: Try Risk Free

People Also Ask about

When can I expect my child tax rebate in CT?

State officials said Thursday that 2022 Connecticut Child Tax Rebate checks are going out and families should begin receiving them over the next several days. Gov. Ned Lamont held a news conference Thursday morning with Department of Revenue Services Commissioner Mark Boughton.

Can you track a rebate check?

Is there any way to track your payment? There isn't a tracking tool. The tax board does provide dates for when they expect to send out each round of payments, which give you a sense of when you'll receive a direct deposit or debit card. They expect 90% direct deposits to be issued in October 2022.

Is CT getting a rebate check?

Ned Lamont announced Thursday. Around 45,000 Connecticut residents will receive an average rebate of $540. The rebate amount is based on an income scale and the rent and utility payments made in the year before applying for a rebate.

Will we receive the Child Tax Credit in 2022?

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Determining your eligibility for the credit begins with understanding which children qualify and what other criteria you need to be mindful of.

How do I track my CT rebate?

TELEPHONE: Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 (Connecticut calls outside the Greater Hartford calling area only) or 860-297-5962 (from anywhere).

What is my CT EITC?

The Connecticut Earned Income Tax Credit (or CT EITC) is a refundable state income tax credit for low to moderate income working individuals and families. The state credit mirrors the federal Earned Income Tax Credit.

Where do I find the CT EITC state ID?

The employer should list that state ID on the W-2 as well as their EIN. If they did not, you will need to call their payroll department and get that number from them.

Is the IRS giving out extra money 2022?

Refunds may be smaller in 2023. Taxpayers will not receive an additional stimulus payment with a 2023 tax refund because there were no Economic Impact Payments for 2022. In addition, taxpayers who don't itemize and take the standard deduction, won't be able to deduct their charitable contributions.

How much earned income credit will I receive?

Basic Qualifying Rules Have worked and earned income under $57,414. Have investment income below $10,000 in the tax year 2021. Have a valid Social Security number by the due date of your 2021 return (including extensions) Be a U.S. citizen or a resident alien all year.

How do I check my EITC status?

Simply enter your Social Security Number, filing status, and the exact refund amount. You can check the status within 24 hours after IRS has received your e-filed tax return, or 4 weeks after mailing in your paper return. This information is updated once every 24 hours, usually overnight.

How much is the Earned Income Tax Credit for 2022?

Maximum Credit Amounts No qualifying children: $560. 1 qualifying child: $3,733. 2 qualifying children: $6,164. 3 or more qualifying children: $6,935.

Is CT sending relief checks?

Gov. Ned Lamont's administration mailed out nearly 248,000 checks to low-income households this past weekend — the second time in the past two months a state tax cut delivered tens of millions of dollars to Connecticut families.

Are we getting Child Tax Credit in july 2022?

Expanded Child Tax Credit available only through the end of 2022 - CBS Los Angeles.

How do I check my child tax credit payments?

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal. For stimulus payments 1 and 2 check Where's My Refund.

How much is the CT EITC?

Eligible earned income amounts # of childrenMax Federal EITCMax State EITC @ 30.5% of Federal3 or more$6,728$2,0522$5,980$1,8241$3,618$1,103None$1502$458

How much is the CT earned income credit?

In 2021, the credit is worth up to $6,728. The credit amount rises with earned income until it reaches a maximum amount, then gradually phases out. Families with more children are eligible for higher credit amounts. You cannot get the EITC if you have investment income of more than $10,000 in 2021.

How will I receive my EITC?

If you claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), you can expect to get your refund March 1 if: You file your return online. You choose to get your refund by direct deposit. We found no issues with your return.

How much is the child tax credit in CT?

You may be eligible for a child tax rebate of up to a maximum of $750 ($250 per child up to three children).

How much EITC do I qualify for?

Who qualifies for the earned income tax credit Number of childrenMinimum AGI to earn the creditCredit sizeZeroSingle: $9,820 Heads of household: $9,820 Married: $9,820$1,502OneSingle: $10,640 Heads of household: $10,640 Married: $10,640$3,618TwoSingle: $14,950 Heads of household: $14,950 Married: $14,950$5,9802 more rows • Mar 24, 2022

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CT DRS CT-EITC SEQ in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your CT DRS CT-EITC SEQ and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send CT DRS CT-EITC SEQ for eSignature?

Once you are ready to share your CT DRS CT-EITC SEQ, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find CT DRS CT-EITC SEQ?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific CT DRS CT-EITC SEQ and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

What is CT DRS CT-EITC SEQ?

CT DRS CT-EITC SEQ is a form used in Connecticut to facilitate the reporting and claiming of the Earned Income Tax Credit (EITC) by eligible individuals and families.

Who is required to file CT DRS CT-EITC SEQ?

Individuals or families in Connecticut who qualify for the Earned Income Tax Credit and wish to claim it on their tax returns are required to file the CT DRS CT-EITC SEQ.

How to fill out CT DRS CT-EITC SEQ?

To fill out the CT DRS CT-EITC SEQ, taxpayers should gather their income information, complete the form with personal details, and provide necessary calculations related to their earned income and family size.

What is the purpose of CT DRS CT-EITC SEQ?

The purpose of the CT DRS CT-EITC SEQ is to ensure accurate reporting of information required to claim the Earned Income Tax Credit, which helps low-income individuals and families by reducing their tax liability.

What information must be reported on CT DRS CT-EITC SEQ?

The information that must be reported on the CT DRS CT-EITC SEQ includes personal identification details, income earned, tax filing status, and the number of qualified dependents.

Fill out your CT DRS CT-EITC SEQ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-EITC SEQ is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.