ZA SARS IT77C 2013 free printable template

Show details

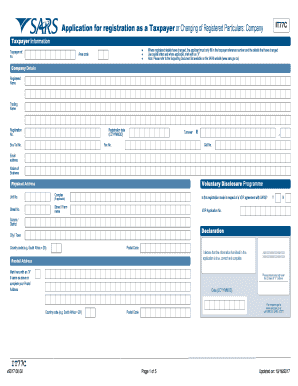

Application for registration as a Taxpayer or Changing of Registered Particulars: Company IT77C Taxpayer Information TPINF01 Taxpayer ref. No. Area code Where registered details have changed, the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ZA SARS IT77C

Edit your ZA SARS IT77C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ZA SARS IT77C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ZA SARS IT77C online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ZA SARS IT77C. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ZA SARS IT77C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ZA SARS IT77C

How to fill out ZA SARS IT77C

01

Gather your personal information including your ID number and tax reference number.

02

Download the IT77C form from the SARS website or obtain a physical copy from a SARS branch.

03

Carefully read the instructions provided on the form to understand the requirements.

04

Fill in your personal details in the designated sections, ensuring accuracy.

05

Indicate your reason for submission in the appropriate section.

06

Provide any supporting documentation as required by the form instructions.

07

Review the completed form for any errors or omissions.

08

Submit the form electronically via SARS eFiling or deliver it in person to a SARS office.

Who needs ZA SARS IT77C?

01

Individuals who are applying for a tax directive, or need to amend their personal tax registration information.

02

Taxpayers who qualify for certain tax benefits or need to declare specific income adjustments.

03

Those who have undergone a change in circumstances that requires updating their tax details.

Fill

form

: Try Risk Free

People Also Ask about

How do I find my SARS tax number?

You can get it on eFiling if you are registered as an eFiler. All you need to do is log on and check your number. You can also request your notice of registration via the MobiApp if you are a registered eFiler.

What is SARS approved proof of address?

Proof of residential address for the newly appointed members. Certified copy of a valid identity document, driving licence or passport, temporary identity document, asylum seekers certificate, permit of all three fiduciary responsible office bearers (as contained in Exemption of Income Tax (EI) application).

Is my tax reference number my tax number?

Your income tax reference number is a unique 10-digit number issued by SARS to a taxpayer on registration. If you are registered, you can find your tax number on your: Notice of registration from SARS (only available at a SARS Branch and not via the SARS Contact Centre)

How do I register as a taxpayer in South Africa?

call the SARS Contact Centre on 0800 00 7277 and select option 0 (zero). A SARS official will book the appointment on your behalf.

What documents do I need to activate representative SARS?

To confirm a Registered Representative A copy of your valid identity document or drivers licence or passport or temporary identity document or asylum seekers certificate/permit, together with the original identification (for those visiting a SARS office). A copy of your proof of residential address.

What is an it77 form?

Application for registration as a Taxpayer or Changing of Registered Particulars: Company. IT77C. Taxpayer Information. Company Details.

How do I get a tax number for a trust in South Africa?

Income Tax – Registration for Trusts can now be done in the following ways: Online on this website via the Send us an Online Query system, where you can submit the request, the Trust supporting documents as well as the IT77TR – Application for registration of a Trust form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ZA SARS IT77C online?

Easy online ZA SARS IT77C completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make changes in ZA SARS IT77C?

The editing procedure is simple with pdfFiller. Open your ZA SARS IT77C in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete ZA SARS IT77C on an Android device?

Use the pdfFiller Android app to finish your ZA SARS IT77C and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is ZA SARS IT77C?

ZA SARS IT77C is a tax form used in South Africa for the submission of income tax returns by individuals who are required to disclose their income and calculate their tax liability.

Who is required to file ZA SARS IT77C?

Individuals who earn income in South Africa, including self-employed individuals and those with other sources of income, are required to file the ZA SARS IT77C.

How to fill out ZA SARS IT77C?

To fill out ZA SARS IT77C, applicants must provide personal details, income information, allowable deductions, and any other relevant financial data, and ensure all sections are completed accurately before submitting to the South African Revenue Service (SARS).

What is the purpose of ZA SARS IT77C?

The purpose of ZA SARS IT77C is to facilitate the declaration of income and expense by taxpayers, ensuring compliance with South African tax laws and helping the South African Revenue Service to assess tax liabilities.

What information must be reported on ZA SARS IT77C?

The information that must be reported on ZA SARS IT77C includes personal identification details, income earned from various sources, deductions, tax credits, and any other relevant financial information.

Fill out your ZA SARS IT77C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ZA SARS it77c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.