IRS 941-V 2017 free printable template

Show details

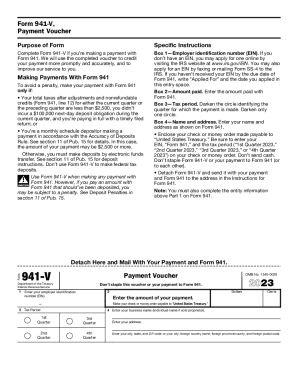

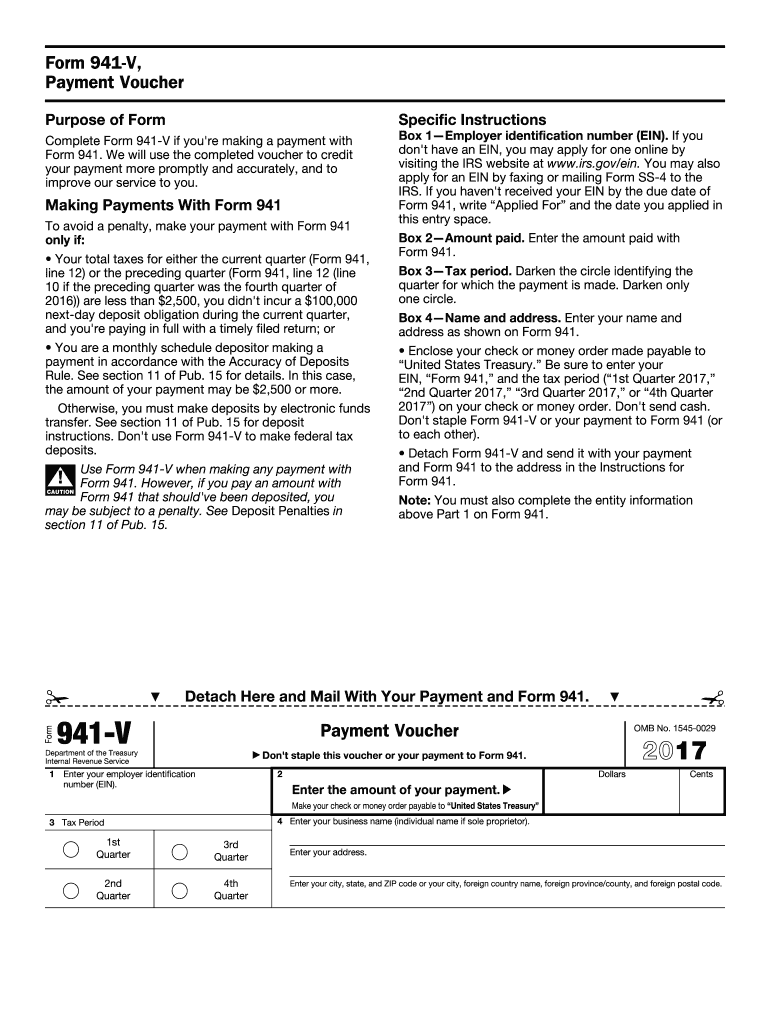

Don t use Form 941-V to make federal tax deposits. Use Form 941-V when making any payment with Form 941. Form 941-V Payment Voucher Specific Instructions Complete Form 941-V if you re making a payment with Form 941. 941-V Department of the Treasury Internal Revenue Service Box 1 Employer identification number EIN. Don t send cash. Don t staple Form 941-V or your payment to Form 941 or to each other. Detach Form 941-V and send it with your payment and Form 941 to the address in the Instructions...for Note You must also complete the entity information above Part 1 on Form 941. We will use the completed voucher to credit your payment more promptly and accurately and to improve our service to you. Making Payments With Form 941 To avoid a penalty make your payment with Form 941 only if Your total taxes for either the current quarter Form 941 line 12 or the preceding quarter Form 941 line 12 line 10 if the preceding quarter was the fourth quarter of 2016 are less than 2 500 you didn t incur a...100 000 next-day deposit obligation during the current quarter and you re paying in full with a timely filed return or You are a monthly schedule depositor making a payment in accordance with the Accuracy of Deposits Rule. See section 11 of Pub. 15 for details. In this case the amount of your payment may be 2 500 or more. Otherwise you must make deposits by electronic funds transfer. See section 11 of Pub. 15 for deposit instructions. However if you pay an amount with CAUTION Form 941 that...should ve been deposited you may be subject to a penalty. See Deposit Penalties in section 11 of Pub. 15. Form Detach Here and Mail With Your Payment and Form 941. If you don t have an EIN you may apply for one online by visiting the IRS website at www*irs*gov/ein* You may also apply for an EIN by faxing or mailing Form SS-4 to the IRS* If you haven t received your EIN by the due date of Form 941 write Applied For and the date you applied in this entry space. Box 2 Amount paid* Enter the amount...paid with Box 3 Tax period. Darken the circle identifying the quarter for which the payment is made. Darken only one circle. Box 4 Name and address. Enter your name and address as shown on Form 941. Enclose your check or money order made payable to United States Treasury. Be sure to enter your EIN Form 941 and the tax period 1st Quarter 2017 2nd Quarter 2017 3rd Quarter 2017 or 4th Quarter 2017 on your check or money order. Don t OMB No* 1545-0029 staple this voucher or your payment to...Form 941. Enter your employer identification number EIN. Purpose of Form Dollars Cents Enter the amount of your payment. Make your check or money order payable to United States Treasury 4 Enter your business name individual name if sole proprietor. 3 Tax Period 1st Quarter 3rd 2nd 4th Enter your address. Enter your city state and ZIP code or your city foreign country name foreign province/county and foreign postal code. Form 941 Rev* 1-2017 Privacy Act and Paperwork Reduction Act Notice. We ask...for the information on Form 941 to carry out the figure and collect the right amount of tax.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 941-V

How to edit IRS 941-V

How to fill out IRS 941-V

Instructions and Help about IRS 941-V

How to edit IRS 941-V

Editing the IRS 941-V form can be necessary if you discover errors after submission. Use a tool like pdfFiller to easily make adjustments, ensuring data accuracy before filing. Be certain to check that all modifications comply with IRS requirements to avoid further complications.

How to fill out IRS 941-V

To fill out the IRS 941-V, begin by collecting the necessary information, including your Employer Identification Number (EIN) and payment amounts. Follow the form instructions carefully to ensure all fields are complete. It may be beneficial to enter values into a template provided by a reliable online service like pdfFiller for an orderly submission.

About IRS 941-V 2017 previous version

What is IRS 941-V?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 941-V 2017 previous version

What is IRS 941-V?

IRS 941-V is a payment voucher used by employers to submit payments for their quarterly payroll tax filings. This form is particularly relevant for employers who owe taxes related to their 941 form filings. The voucher helps to ensure that payments are properly credited to the employer’s account.

What is the purpose of this form?

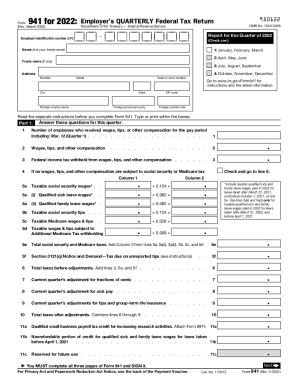

The primary purpose of the IRS 941-V is to facilitate the payment processes for taxes owed in connection with the IRS Form 941, which reports employee wages, tips, and other compensation along with federal income tax withheld and FICA taxes. The use of this voucher ensures that the submitted payments are correctly matched with the appropriate tax returns.

Who needs the form?

Employers who are required to file Form 941 must use IRS 941-V when making direct payments to the IRS regarding their quarterly payroll taxes. This includes any business that pays wages subject to federal withholding or employment taxes. Understanding the need for this form is essential to maintaining compliance with payroll tax obligations.

When am I exempt from filling out this form?

Employers are typically exempt from filing IRS 941-V when they have no tax liability for the quarter, which means they are not submitting any payments. Additionally, certain small businesses can qualify for exceptions based on their total payroll tax liability, limiting their submission obligations.

Components of the form

The IRS 941-V form includes fields for the employer’s name, address, and Employer Identification Number (EIN), as well as the payment amount. It also provides a space to indicate the tax period associated with the payment. Proper completion of these components is crucial for proper processing by the IRS.

Due date

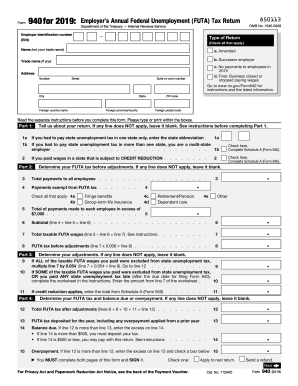

The IRS 941-V must be submitted alongside the associated Form 941 by the designated quarterly due dates, typically by the last day of the month following the end of each quarter. This ensures timely payments and compliance with federal tax regulations.

What payments and purchases are reported?

This form is used to report payments related to the employer's withheld income taxes, Social Security taxes, and Medicare taxes owed for employees. Accurate reporting of these figures is essential to avoid penalties and ensure compliance with federal tax laws.

How many copies of the form should I complete?

Employers should complete one copy of the IRS 941-V for each payment made alongside their Form 941 submission. Keeping a copy for their records is recommended for future reference and clarity in case of audits or inquiries from the IRS.

What are the penalties for not issuing the form?

Failure to submit the IRS 941-V when required may result in penalties, including fines and interest on overdue taxes. The IRS may also assess additional penalties for late payments that can increase the total amount owed, making timely submission vital.

What information do you need when you file the form?

When filing IRS 941-V, you need to provide your business details, including the EIN, the amount being paid, and the tax period related to the payment. This information is necessary for accurate processing and to ensure proper credit to your account.

Is the form accompanied by other forms?

IRS 941-V should be submitted alongside Form 941, which reports quarterly payroll taxes. These forms are interconnected; thus, it is important to submit them together to maintain compliance and clarity in reporting.

Where do I send the form?

The completed IRS 941-V should be submitted according to the instructions provided by the IRS, which vary based on the payment method and the employer’s location. Typically, payments are mailed to specific IRS addresses designated for tax payments, which are outlined on the IRS website or instruction booklet.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

helped my son with his Eagle Scout

perfect

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.