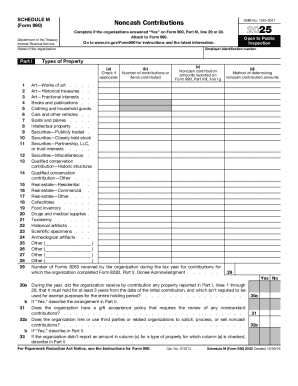

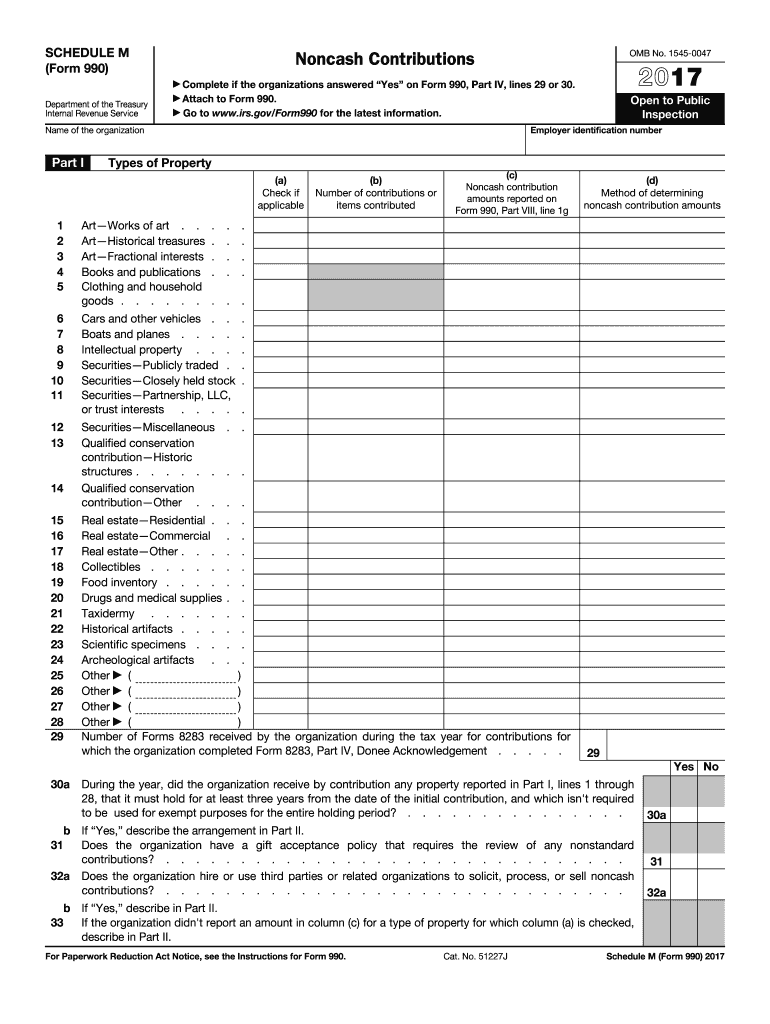

IRS 990 - Schedule M 2017 free printable template

Instructions and Help about IRS 990 - Schedule M

How to edit IRS 990 - Schedule M

How to fill out IRS 990 - Schedule M

About IRS 990 - Schedule M 2017 previous version

What is IRS 990 - Schedule M?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 990 - Schedule M

What should I do if I need to correct a mistake on my previously filed 2017 m form?

If you discover a mistake after filing your 2017 m form, you can submit an amended form to correct the errors. It's crucial to clearly indicate that the new submission is a correction and refer to your original form. Ensure all amendments are well documented to avoid further discrepancies.

How can I track the status of my 2017 m form after submission?

To verify the receipt and processing of your 2017 m form, you can use the online tracking tools provided by the IRS or your e-filing software. Keep an eye out for any common e-file rejection codes and address them promptly to ensure successful processing.

Are e-signatures acceptable for submitting the 2017 m form?

Yes, e-signatures are generally accepted for submitting the 2017 m form, aligning with IRS standards. Make sure to follow their guidelines for e-signature usage to ensure that your submission is valid and to maintain compliance with privacy and data security regulations.

What should I do if I receive an audit notice after filing my 2017 m form?

If you receive a notice or audit after filing your 2017 m form, respond promptly by gathering the required documentation to support your filing. It's advisable to thoroughly review your form and the notice details, and consider consulting a tax professional for guidance on how to proceed effectively.

What are some common errors to avoid when filing the 2017 m form?

Common errors include incorrect taxpayer identification numbers, mismatched names, and failure to report all relevant income. Double-check your information, pay close attention to any specific instructions, and consider using tax software to reduce the risk of mistakes when filing your 2017 m form.