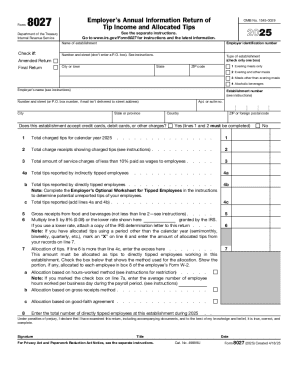

IRS 8027 2017 free printable template

Instructions and Help about IRS 8027

How to edit IRS 8027

How to fill out IRS 8027

About IRS 8 previous version

What is IRS 8027?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8027

How can I correct mistakes on form 8027 2017 after filing?

To correct mistakes on form 8027 2017 after it has been filed, you need to submit an amended form. Ensure that you clearly mark the form as 'Amended' and provide the correct information. Check for any potential discrepancies from your original submission to avoid further issues with the IRS.

What should I do if my e-filed form 8027 2017 is rejected?

If your e-filed form 8027 2017 is rejected, you will receive a notification detailing the reason for rejection. Review the rejection codes carefully, correct the errors in your submission, and resubmit the form. Make sure to double-check all entered information for accuracy to prevent repeated rejections.

Are electronic signatures accepted for filing form 8027 2017?

Yes, electronic signatures are generally accepted for form 8027 2017, as long as they comply with IRS regulations. It's crucial to stay updated on your specific e-filing software’s requirements to ensure that your e-signed documents are valid and meet the necessary standards.

What information should I prepare if I receive an audit notice related to form 8027 2017?

If you receive an audit notice concerning form 8027 2017, gather all relevant documentation such as the original form, proof of submissions, and any communication with the IRS. Prepare to explain discrepancies and keep organized records to support your claims during the audit process.

See what our users say