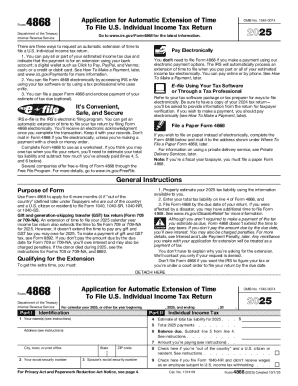

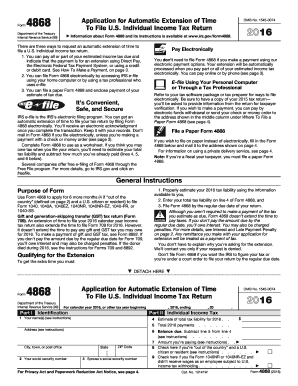

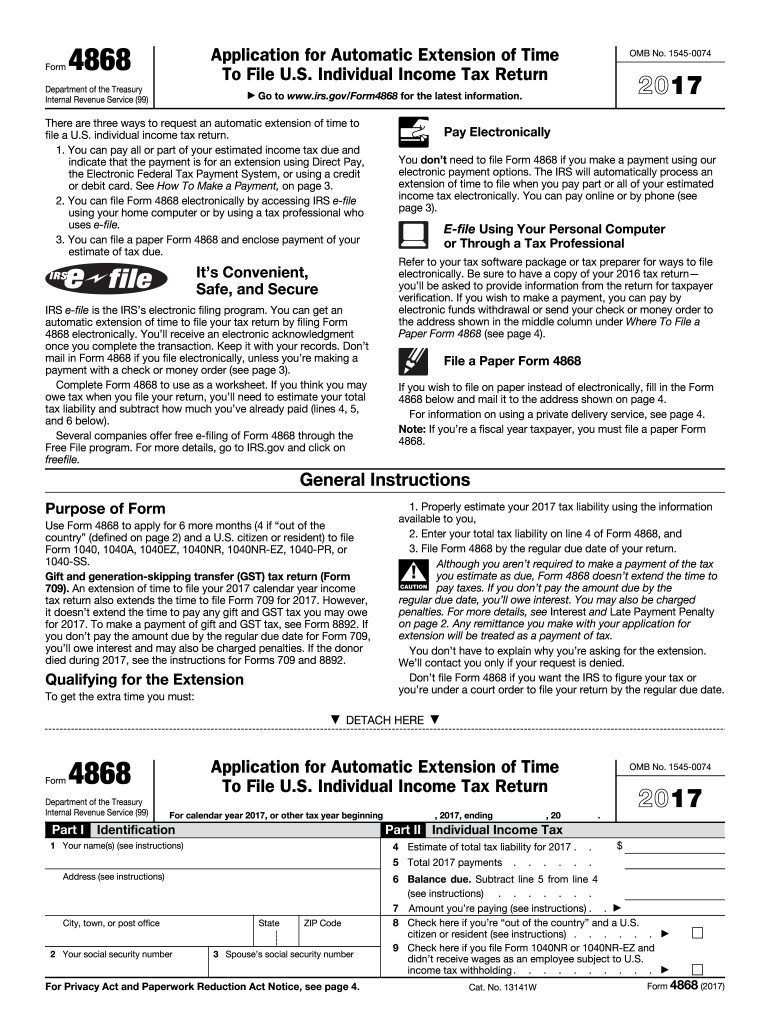

IRS 4868 2017 free printable template

Instructions and Help about IRS 4868

How to edit IRS 4868

How to fill out IRS 4868

About IRS 4 previous version

What is IRS 4868?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

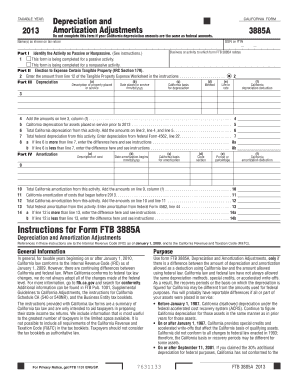

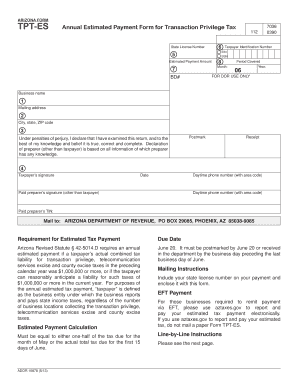

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 4868

What should I do if I realize I've made a mistake on my IRS 4868 form?

If you discover an error after filing your IRS 4868, you can submit an amended form or follow the IRS guidance for correcting mistakes. It's important to address errors promptly to avoid potential issues with your filing status or penalties.

How can I track the status of my IRS 4868 submission?

To verify the receipt and processing of your IRS 4868, you should use the IRS online tracking tools or contact the IRS directly. Keep an eye on common e-file rejection codes, as these can inform you if any issues arose during submission.

Are there any special considerations for nonresidents filing an IRS 4868?

Nonresidents must check previous guidance when filing IRS 4868, as there may be specific rules regarding PIN requirements and additional documentation. Ensuring that you meet all necessary criteria will help facilitate a smoother filing process.

What common errors should I watch for when submitting my IRS 4868?

Common errors when filing IRS 4868 include incorrect amounts or personal information discrepancies. Review your entries carefully to mitigate mistakes, and consider consulting tax software that helps identify potential pitfalls.

What technical requirements should I consider for e-filing my IRS 4868?

When e-filing your IRS 4868, ensure your software is compatible with the IRS systems and meets technical specifications. It’s advisable to keep your web browser updated and check system requirements to avoid processing issues during submission.

See what our users say