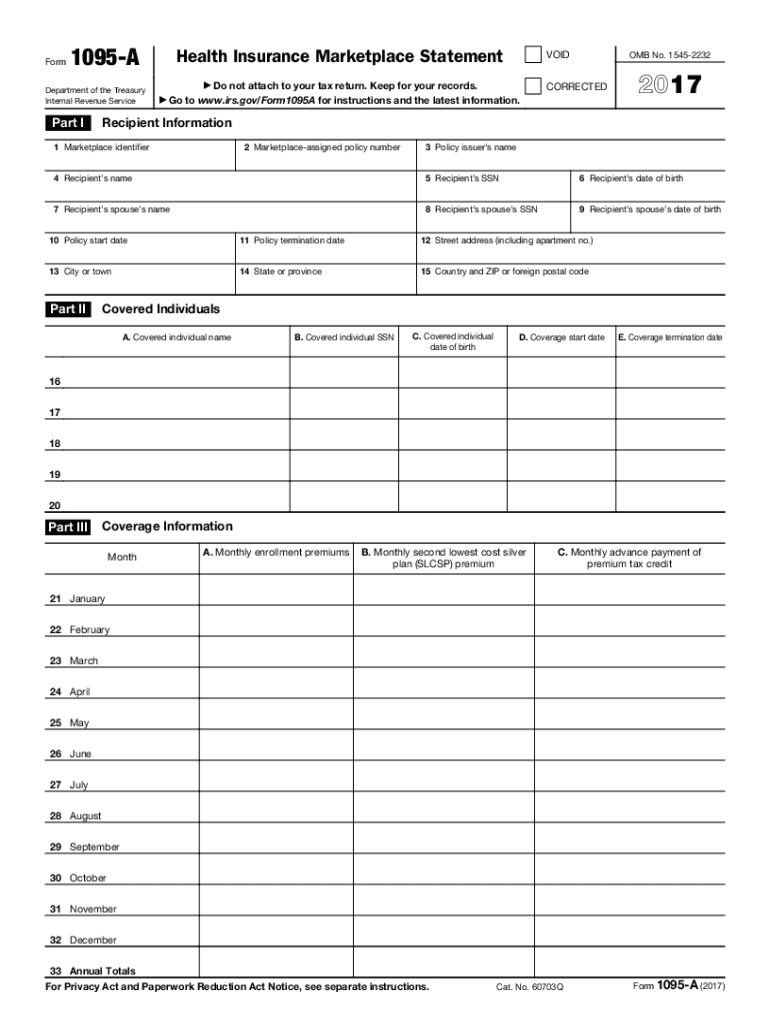

Who needs a form 1095-A?

Form 1095-A, this form provides important tax information about the cost of health insurance and the federal subsidy that you may have received in 2016. This subsidy, known as the Premium Tax Credit (PTC), makes the cost of healthcare coverage cheaper for individuals who purchased plans through the health insurance marketplaces. Unlike most tax credits, the government pays the PTC in advance each month directly to insurers.

What is form 1095-A for?

Form 1095-A provides a report of these advance payments to the taxpayer. If you receive a 1095-A, you need to use it to complete your tax return and another new IRS form, Form 8962.

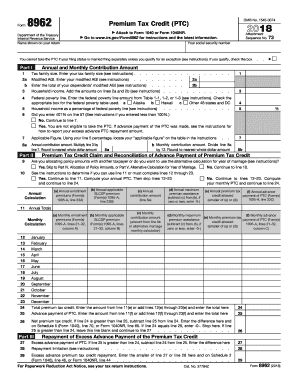

Is it accompanied by other forms?

Form 8962 reconciles the monthly Premium Tax Credit payments reported on 1095-A with your actual annual income and family size. With that information, you can determine if the subsidy payments paid to the insurer throughout the year were too high or too low. If they were too high, the IRS will take the difference from your tax refund. Conversely, if the payments weren’t enough, the marketplaces will pay out the remaining credits to you.

When is form 1095-A due?

There is no due date for filing the Form 1095-A. It is an annual return used by taxpayers to fill out Form 8962, which in turn is due April 17, 2017.

How do I fill out a form 1095-A?

The Form 1095-A is completed by health insurance providers who offer coverage through the Health Insurance Marketplace. There are three sections to the form; Part I, Recipient Information, Part II, Covered Individuals, and Part III, Coverage Information. For the taxpayer, the Form 1095-A is for informational purposes only. It does not have to be filed with your tax return. However, information from the Form 1095-A is needed to complete the Form 8962 (Premium tax Credit).

Where do I send it?

Form 1095-A is not to be filed with IRS. Health Insurance Marketplaces fill it out for each individual that they provide health coverage to, which is why they must send it directly to the insurance holder.