AU NAT 3093 2021-2025 free printable template

Show details

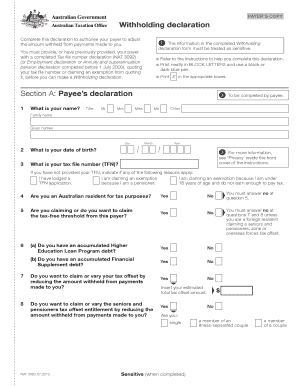

The information in the completed Withholding declaration form must be treated as sensitive. Once you have completed signed and dated the declaration file the declaration form. Do not send the declaration to us. PAYER S COPY Withholding declaration Complete this declaration to authorise your payer to adjust the amount withheld from payments made to you. Are you single NAT 3093-06. 2021 Answer no here if you are a foreign resident or working holiday maker except if you are a foreign resident in...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nat 3093 form

Edit your taxation withholding declaration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your withholding declaration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing withholding declaration form download online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nat 3093 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU NAT 3093 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out withholding declaration form pdf

How to fill out AU NAT 3093

01

Obtain the AU NAT 3093 form from the official website or a designated office.

02

Carefully read the instructions provided with the form.

03

Fill out your personal details in the designated sections, including name, address, and contact information.

04

Provide any necessary identification or reference numbers as required.

05

Complete the sections that relate to your specific situation or application type.

06

Review the form for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the completed form through the prescribed method, whether online or via postal mail.

Who needs AU NAT 3093?

01

Individuals applying for certain visas or citizenship in Australia.

02

People seeking to access specific government services.

03

Anyone required to provide evidence of their immigration status or entitlement.

Fill

australia withholding form

: Try Risk Free

People Also Ask about nat 3093 printable

Should I fill out a withholding form?

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes.

What is the meaning of withholding statement?

A payroll withholding statement is notification from an employer to an employee or tax office detailing the taxes that have been withheld from an employee's pay. The term is most commonly associated with the W-2 form that summarizes withholdings from an individual employee during the year.

Do I claim 0 or 1 on my w4?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

How should I fill out my withholding?

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. Step 2: Indicate Multiple Jobs or a Working Spouse. Step 3: Add Dependents. Step 4: Add Other Adjustments. Step 5: Sign and Date Form W-4.

How do I stop withholding tax?

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

What is withholding declaration?

A withholding declaration authorises your payer to adjust the amount of tax withheld from your payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send australia withholding declaration to be eSigned by others?

To distribute your nat 3093 withholding, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an eSignature for the australia taxation declaration in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your au taxation declaration right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete nat3093 withholding on an Android device?

Use the pdfFiller mobile app and complete your nat3093 declaration form and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is AU NAT 3093?

AU NAT 3093 is a form used in Australia for reporting an individual's non-lodgment advice to the Australian Taxation Office (ATO).

Who is required to file AU NAT 3093?

Individuals who do not need to lodge a tax return for a given financial year due to their income being below the tax threshold or for other reasons are required to file AU NAT 3093.

How to fill out AU NAT 3093?

To fill out AU NAT 3093, individuals need to provide their personal details, including name, address, and TFN, along with the reason for not lodging a tax return.

What is the purpose of AU NAT 3093?

The purpose of AU NAT 3093 is to inform the ATO that an individual has no requirement to submit a tax return and to ensure their tax records are updated accordingly.

What information must be reported on AU NAT 3093?

The information that must be reported includes the individual's personal details, tax file number (TFN), and the specific reason for not lodging a tax return for that year.

Fill out your withholding declaration form 2021-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

nat3093 Withholding Declaration is not the form you're looking for?Search for another form here.

Keywords relevant to form application online online

Related to word to pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.