IRS 4835 2017 free printable template

Show details

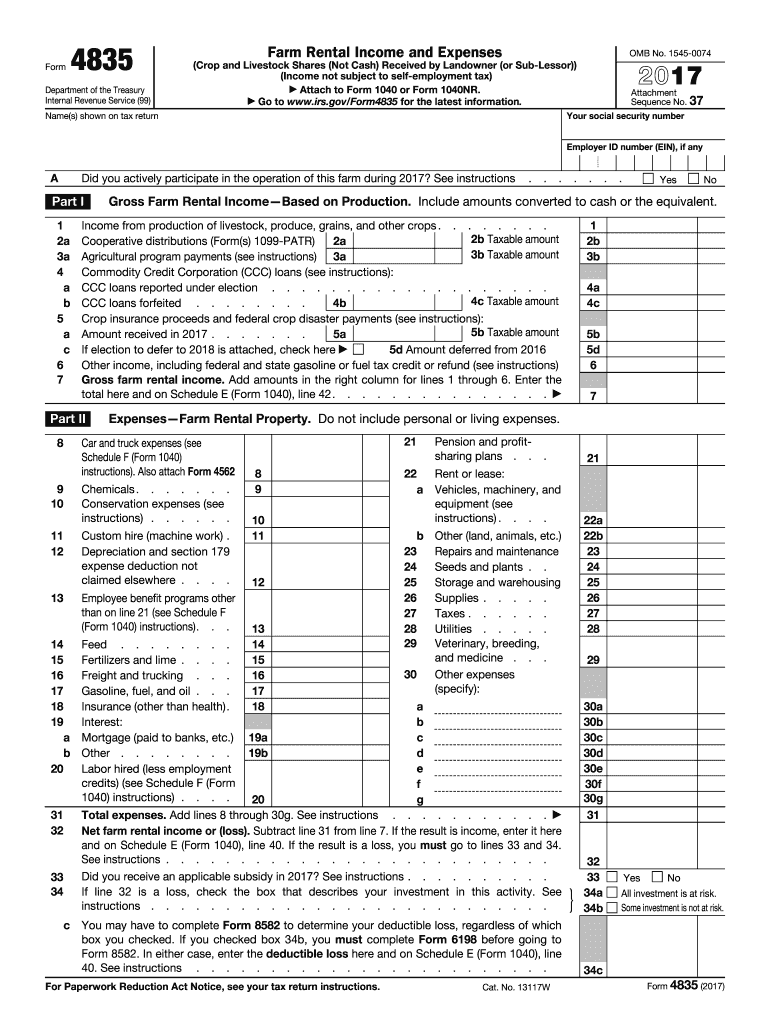

Note You may need to include information from Form 4835 on Form 8582 even if you have a net profit. For the latest information about developments related to Form 4835 and its instructions such as legislation enacted after they were published go Purpose of Form If you were the landowner or sub-lessor and did not materially participate for self-employment tax purposes in the operation or management of the farm use Form 4835 to report farm rental income based on crops or livestock produced by the...tenant. For more information see the Instructions for Form 8582. Line 33. If you received an applicable subsidy and checked Yes on line 33 your farm rental losses may be reduced or eliminated if your Form 4835 activity is a trade or business. Some investment is not at risk. 34c Form 4835 2017 Page 2 General Instructions Section references are to the Internal Revenue Code unless otherwise noted. Future developments. These rules could affect how much interest you are allowed to deduct on Form...4835. See the instructions for Line 22a. If you rented or leased vehicles machinery or rental cost. Qualified joint ventures. If you and your spouse each owned and operated farm rental business and you filed a joint return for the tax year you can make an election to be taxed as a qualified joint venture instead of a partnership. This election in most cases will not increase the total tax owed on the joint return but it does give each of you credit for social security earnings on which...retirement benefits are based and for Medicare coverage without filing a partnership return. If you and your spouse make the election and you didn t materially participate for self-employment tax purposes in the operation or management of the farm but maintained the farm as a rental business you each can file a separate Form 4835 to report your share of farm rental income based on crops or livestock produced by the tenant. If you and your spouse did materially participate for self-employment tax...purposes in the operation or management of the farm you each must file a separate Schedule F Form 1040. For an explanation of C Form 1040 Profit or Loss From Business Sole Proprietorship line G. For more information on qualified joint ventures go to IRS.gov and enter qualified joint venture in the search box. Do not use Form 4835 if you were a/an Tenant instead use Schedule F Form 1040 to report farm income and expenses Landowner or sub-lessor and materially participated in expenses pasture or...farmland based on a flat charge instead report as income on Schedule E Form 1040 Part I Estate or trust with rental income and expenses from Form 1040 Part I or Partnership or S corporation with rental income and expenses from crop and livestock shares instead report on Form 8825. Form Department of the Treasury Internal Revenue Service 99 Farm Rental Income and Expenses OMB No* 1545-0074 Crop and Livestock Shares Not Cash Received by Landowner or Sub-Lessor Income not subject to...self-employment tax Attach to Form 1040 or Form 1040NR* Go to www*irs*gov/Form4835 for the latest information* Attachment Sequence No* 37 Your social security number Name s shown on tax return Employer ID number EIN if any A Did you actively participate in the operation of this farm during 2017 See instructions Part I 2a 3a a b c.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 4835

How to edit IRS 4835

How to fill out IRS 4835

Instructions and Help about IRS 4835

How to edit IRS 4835

To edit IRS 4835, you may use a PDF editor that enables form modifications like pdfFiller. Start by uploading the form to the platform, where you can make necessary changes directly to the text fields. Ensure all information is accurate before saving the updated version, as discrepancies can lead to filing delays or issues with the IRS.

How to fill out IRS 4835

Filling out IRS 4835 requires detailed information about farming or fishing activities conducted as a partnership or as a sole proprietor. First, gather all relevant records regarding income and expenses. The form must be completed in sections, starting with identifying information like the taxpayer's name and Social Security number, followed by details of raised crops or livestock sales, and any deductions applicable.

About IRS 4 previous version

What is IRS 4835?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 4 previous version

What is IRS 4835?

IRS 4835, also known as the "Farm Rental Income and Expenses," is a tax form used to report income and expenses related to farm rental activities as a non-farmer. This form is applicable primarily when someone engages in renting out land for farming or provides services associated with agricultural work. The form allows for proper reporting to ensure compliance with federal tax obligations.

What is the purpose of this form?

The purpose of IRS 4835 is to help individuals and entities report income derived from agricultural rental agreements and related expenses accurately. By using this form, taxpayers can identify deductions directly linked to their farming activities, such as payments for operating expenses, depreciation of property, and necessary repairs, which can help in lowering tax liabilities.

Who needs the form?

Taxpayers who rent land or property for farming must file IRS 4835. This includes individuals who receive income from crop or livestock rentals but do not actively farm the land themselves. It's essential for those wanting to claim expenses associated with their land rental income during tax filing season.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 4835 if you do not earn income through farm rental activities, or if your income is below the reporting threshold set by the IRS. Additionally, if you actively participate in farming and file other related forms, you would typically report your income and expenses differently.

Components of the form

IRS 4835 includes several key sections that must be completed. The first part contains the taxpayer’s identifying information, followed by tables where income from rental activities and related expenses are listed. Deductions related to property depreciation, operating costs, and repairs are covered comprehensively within the form to facilitate correct reporting.

What are the penalties for not issuing the form?

Failing to file IRS 4835, when required, can result in penalties imposed by the IRS. A taxpayer may face fines for incorrect or late submissions, which may increase depending on the duration of the delay or the severity of the discrepancies found in tax reporting. It's crucial to file correctly to avoid escalated penalties.

What information do you need when you file the form?

When filing IRS 4835, you will need various pieces of information including, but not limited to, your Social Security number, income from renting land for farming, detailed expenses incurred, and documentation supporting claims for any deductions. Keeping accurate records will streamline the filing process and help substantiate your claims if the IRS conducts an audit.

Is the form accompanied by other forms?

IRS 4835 may need to be filed alongside other relevant forms, such as Schedule E (Supplemental Income and Loss) if the income is reported under multiple property categories. Ensure all necessary accompanying documentation is included to provide a clear picture of your financial situation concerning rental activities.

Where do I send the form?

The completed IRS 4835 should be mailed to the address specified in the filing instructions of the form. This is generally determined by whether you are enclosing a payment or filing for a refund. Double-check the latest IRS guidelines for any recent changes to mailing instructions related to tax year-specific forms.

See what our users say