IRS 8621 2012 free printable template

Show details

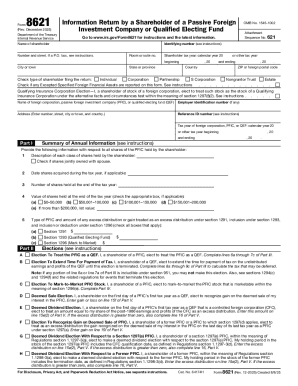

Form8621(Rev. December 2012)

Department of the Treasury

Internal Revenue Service

Name of shareholderInformation Return by a Shareholder of a Passive Foreign

Investment Company or Qualified Electing

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8621

Edit your IRS 8621 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8621 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 8621 online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS 8621. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8621 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8621

How to fill out IRS 8621

01

Obtain Form 8621 from the IRS website or your tax software.

02

Fill out your identifying information at the top of the form.

03

Indicate the tax year for which the form is being filed.

04

Complete Schedule A to report your ownership interest in the foreign passive investment entity (FPI).

05

Fill out Schedule B if you are making a mark-to-market election.

06

Report any gains or losses on your share of the FPI on Schedule C.

07

Provide any additional information required for your specific situation in the designated sections.

08

Review the completed form for accuracy.

09

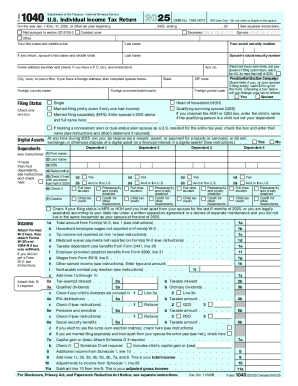

Attach Form 8621 to your tax return (Form 1040) when submitting.

Who needs IRS 8621?

01

U.S. persons who own shares in a foreign passive investment entity (FPI).

02

Individuals with ownership in a foreign corporation classified as a PFIC (Passive Foreign Investment Company).

03

Taxpayers who have made elections related to the taxation of their share in a FPI.

Fill

form

: Try Risk Free

People Also Ask about

What are examples of PFIC?

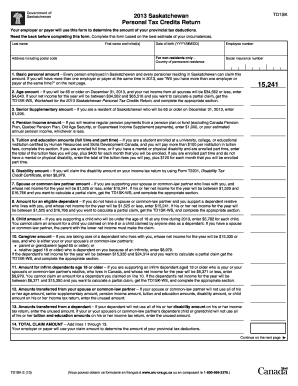

Examples of securities that are classified as PFICs are Canadian mutual funds, Canadian pooled funds, Canadian Exchange Traded Funds (ETFs) and many Canadian income trusts or real estate investment trusts (REITs).

Who needs PFIC reporting?

PFICs and Tax Strategies U.S. investors who own shares of a PFIC must file IRS Form 8621. This form is used to report actual distributions and gains, along with income and increases in QEF elections. The tax form 8621 is a lengthy, complicated form that the IRS itself estimates may take more than 40 hours to fill out.

What qualifies as a PFIC?

The IRS defines a passive foreign investment company (PFIC) as a non-U.S. entity that either earns 75% or more of its gross income from non-business operational activities (the income test); or, if it least 50% of its assets are held for generating passive income (the asset test).

Who needs to file PFIC?

A U.S. person that is a direct or indirect shareholder of a passive foreign investment company (PFIC) files Form 8621 if they: Receive certain direct or indirect distributions from a PFIC. Recognize a gain on a direct or indirect disposition of PFIC stock.

Is there a threshold for filing form 8621?

Threshold for Reporting PFIC The person who is single or married filing separate has to file form 8621 in any year that their total number of PFICs exceed $25,000.

What is the purpose of IRS form 8621?

A U.S. person can attach the Form 8621 to an amended return for the tax year of the U.S. person to which the election relates if the U.S. person can demonstrate that the reason for not filing the form with its original return was due to reasonable cause.

Is there a penalty for not filing form 8621?

There is actually no penalty for not filing this form when you are supposed to. However, the statute of limitations for assessing penalties is suspended until you do file the form, if required. That means your entire return remains subject to audit until three years after you file the required Form 8621.

How do you determine if an investment is a PFIC?

Under the income test, a foreign corporation is a PFIC if 75% or more of its gross income is passive income. Under the asset test, a foreign corporation is a PFIC if 50% or more of the average value of its assets consists of assets that would produce passive income.

What is form 8621 for?

More In Forms and Instructions A U.S. person that is a direct or indirect shareholder of a passive foreign investment company (PFIC) files Form 8621 if they: Receive certain direct or indirect distributions from a PFIC. Recognize a gain on a direct or indirect disposition of PFIC stock.

Are ETFs considered PFICs?

Most PFICs are simply “pooled investments” incorporated outside of the United States. These include foreign mutual funds, exchange-traded funds (ETFs), closed-end funds, hedge funds, insurance products and investments held in some non-U.S. pension plans.

Is there a penalty for not filing 8621?

Penalties for failure to file Form 8621 could include a $10,000 penalty (under Form 8938), and suspension of the statute of limitations with respect to the U.S. shareholder's entire tax return until Form 8621 is filed.

Do I have to file 8621 every year?

Most US citizens who are shareholders in a PFIC are required to file Form 8621 every year. Using Form 8621, shareholders can report certain types of PFIC income.

Do I need to file form 8621 every year?

If you are a direct or indirect shareholder of a PFIC, you are required to file IRS Form 8621 for each year that you: Recognize gain on a direct or indirect disposition of PFIC stock, or. Receive certain direct or indirect distributions from a PFIC, or. Make an election reportable on Form 8621.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 8621 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your IRS 8621 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send IRS 8621 for eSignature?

When you're ready to share your IRS 8621, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete IRS 8621 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your IRS 8621. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is IRS 8621?

IRS Form 8621 is used to report a taxpayer's interests in a Passive Foreign Investment Company (PFIC) and to make certain elections related to the taxation of income from such investments.

Who is required to file IRS 8621?

Taxpayers who have an investment in a PFIC are required to file IRS Form 8621, including U.S. citizens, residents, and certain entities that hold shares in a PFIC.

How to fill out IRS 8621?

To fill out IRS Form 8621, taxpayers must provide information about their PFIC investment, including the income received, distributions, and any elections made. The form must be filed along with the taxpayer's annual federal income tax return.

What is the purpose of IRS 8621?

The purpose of IRS Form 8621 is to ensure that U.S. taxpayers report their foreign investments correctly, comply with U.S. tax laws regarding PFICs, and to elect special tax treatment where applicable.

What information must be reported on IRS 8621?

IRS Form 8621 requires reporting of information such as the name and address of the PFIC, share ownership details, income and loss calculations, distributions received, and any elections regarding the taxation of the PFIC's income.

Fill out your IRS 8621 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8621 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.