Get the free cpp overpayment form

Show details

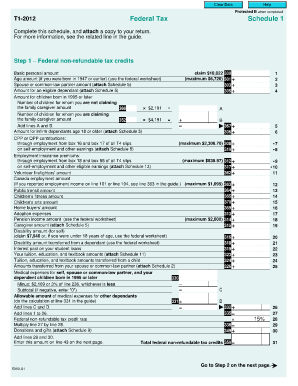

70 Required contribution multiply line 3 by 4. 95. Canada Pension Plan overpayment Line 4 minus line 5 if negative enter 0 Basic CPP/QPP exemption Earnings subject to contribution line 1 minus line 2 if negative enter 0 If the amount from line 6 is positive enter it on line 448 of your return. If negative you may be able to make additional CPP Enter the amount from line 4 or 5 whichever is less on line 308 of Schedule 1 and if it applies on line 5824 of Form 428. Employee Overpayment of 2012...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your cpp overpayment form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cpp overpayment form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cpp overpayment online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cpp overpayment form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cpp overpayment?

CPP Overpayment is an excess amount of Canada Pension Plan (CPP) contributions that have been deducted from an individual's earnings.

Who is required to file cpp overpayment?

Individuals who have made excess CPP contributions and wish to claim a refund or adjust their contribution amounts are required to file CPP overpayment.

How to fill out cpp overpayment?

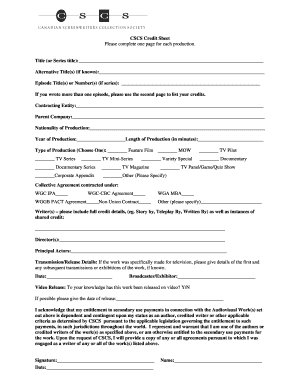

To fill out CPP overpayment, an individual needs to complete the appropriate form provided by the Canada Revenue Agency (CRA), providing their personal information, details of the overpayment, and any supporting documentation.

What is the purpose of cpp overpayment?

The purpose of CPP overpayment is to allow individuals to correct any excess contributions made to the Canada Pension Plan and claim a refund or adjust future contribution amounts.

What information must be reported on cpp overpayment?

The CPP overpayment form typically requires individuals to report their personal information, including their name, Social Insurance Number (SIN), contact details, and the amount of the overpayment.

When is the deadline to file cpp overpayment in 2023?

The deadline to file CPP overpayment in 2023 is typically April 30th, but it's always best to consult the Canada Revenue Agency's official website or seek advice from a tax professional for the most accurate and up-to-date information.

What is the penalty for late filing of cpp overpayment?

The penalty for the late filing of CPP overpayment can vary depending on the circumstances. It's advisable to contact the Canada Revenue Agency or consult a tax professional for specific penalty details.

How can I get cpp overpayment?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the cpp overpayment form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an eSignature for the cpp overpayment in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your cpp overpayment form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out cpp overpayment using my mobile device?

Use the pdfFiller mobile app to complete and sign cpp overpayment form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your cpp overpayment form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.