Retirement Calculator With Pension

What is retirement calculator with pension?

A retirement calculator with pension is a useful tool that helps individuals estimate their retirement savings and plan for their financial future. It takes into account various factors such as current age, annual income, expected retirement age, and desired retirement income. By inputting these details, the calculator provides an estimate of how much money one may need to save and invest each year to achieve their retirement goals.

What are the types of retirement calculator with pension?

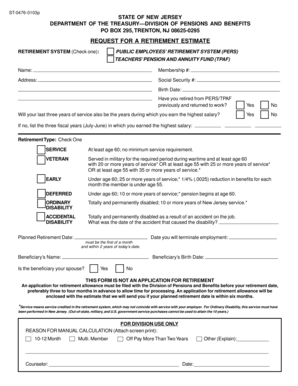

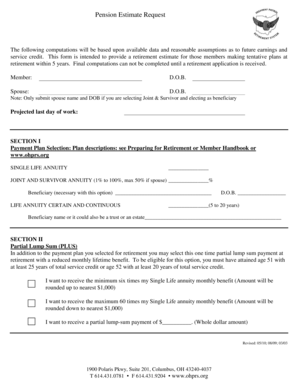

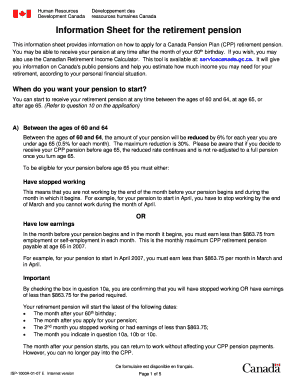

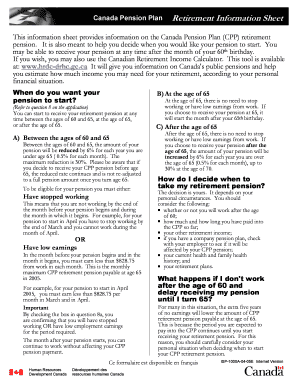

There are several types of retirement calculators with pension available to assist individuals in planning their retirement. Some common types include: 1. Traditional Pension Calculators: These calculators focus on estimating the retirement income based on the pension scheme offered by an employer. 2. Personal Retirement Calculators: These calculators allow individuals to estimate their retirement income based on their personal savings, investments, and pension plans. 3. Social Security Retirement Calculators: These calculators help individuals understand their future Social Security benefits and how they can contribute to their retirement income. 4. Comprehensive Retirement Planners: These calculators offer a holistic approach by considering multiple factors like investments, savings, pensions, and social security to create a comprehensive retirement plan.

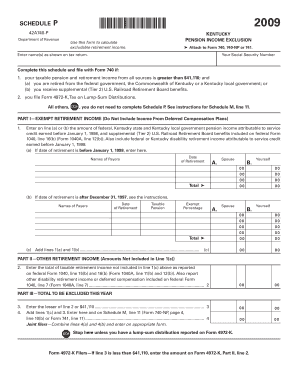

How to complete retirement calculator with pension

Completing a retirement calculator with pension is a straightforward process. Follow these simple steps to get accurate results: 1. Gather necessary information: Collect details such as your current age, annual income, retirement age, expected retirement income, and any existing pension plans or savings. 2. Choose a retirement calculator: Select the type of retirement calculator that suits your needs. Decide whether you want to focus on your employer's pension scheme, personal savings, social security benefits, or a comprehensive retirement plan. 3. Input the required information: Fill in the necessary fields with the collected information. Be as accurate as possible to get precise calculations. 4. Review and analyze the results: Once you submit the required details, the retirement calculator will generate estimates and projections based on the provided information. Review the results carefully and analyze how different factors contribute to your retirement savings. 5. Adjust and plan accordingly: If the results are not aligned with your desired retirement income, consider adjusting the inputs to see how different scenarios impact your savings. Use the insights gained from the calculator to create a realistic retirement plan.

pdfFiller is an excellent online platform that empowers users to create, edit, and share documents easily. With unlimited fillable templates and powerful editing tools, pdfFiller caters to all your document needs. Whether you're using retirement calculators or any other document-related tasks, pdfFiller is the go-to PDF editor that simplifies your work and helps you get things done efficiently.