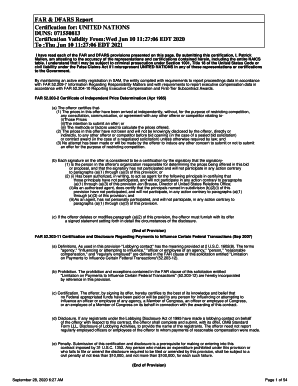

CT DRS CT-706 NT EXT 2017 free printable template

Show details

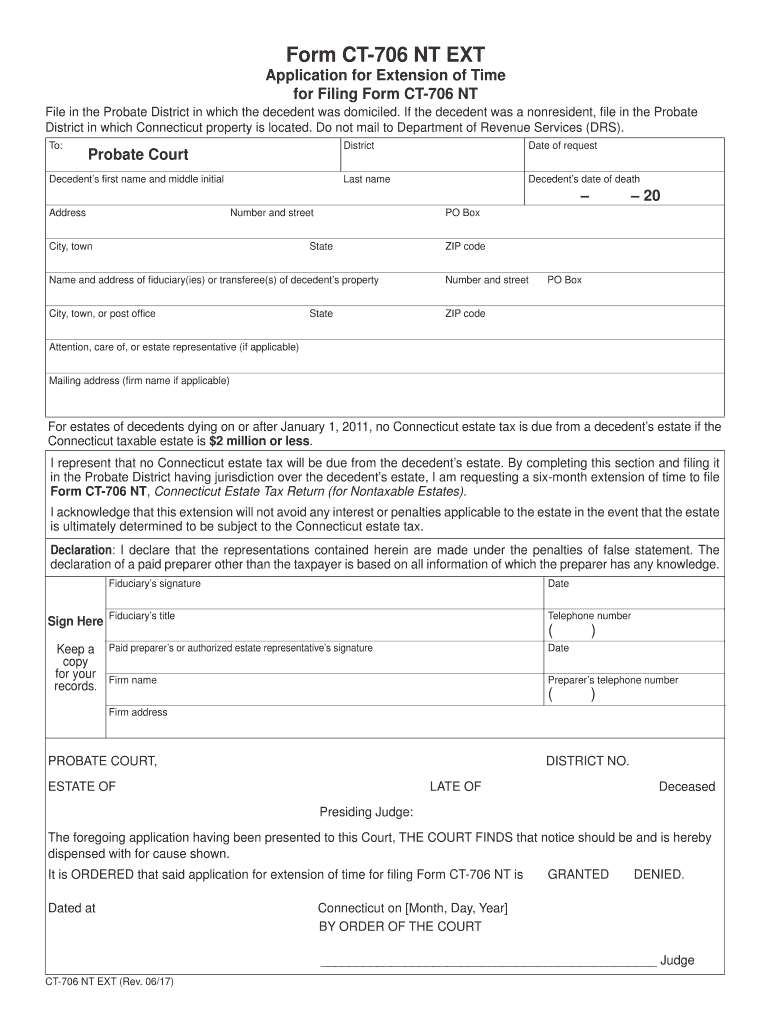

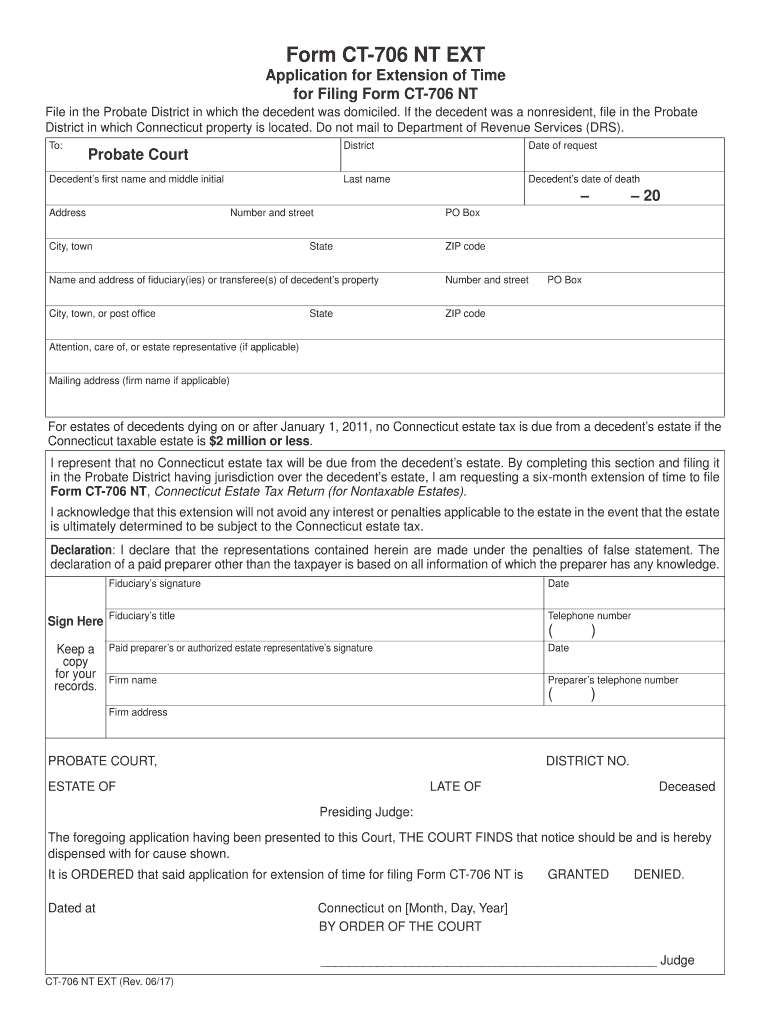

Form CT706 NT EXT

Application for Extension of Time

for Filing Form CT706 NT

File in the Probate District in which the decedent was domiciled. If the decedent was a nonresident, file in the Probate

District

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-706 NT EXT

Edit your CT DRS CT-706 NT EXT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-706 NT EXT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT DRS CT-706 NT EXT online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CT DRS CT-706 NT EXT. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-706 NT EXT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS CT-706 NT EXT

How to fill out CT DRS CT-706 NT EXT

01

Gather all necessary information regarding the decedent's estate.

02

Obtain the CT DRS CT-706 NT EXT form from the Connecticut Department of Revenue Services website.

03

Fill in the decedent's full name, date of death, and Social Security number in the designated sections.

04

Provide the details of the estate including assets, liabilities, and any other relevant financial information.

05

Calculate the total value of the estate, ensuring accuracy in all figures stated.

06

Complete the appropriate sections regarding deductions and exemptions applicable to the estate.

07

Review the completed form thoroughly for any errors or missing information.

08

Sign and date the form at the designated area.

09

Submit the form along with any required documentation to the Connecticut Department of Revenue Services by the deadline.

Who needs CT DRS CT-706 NT EXT?

01

Individuals who are the executors or administrators of an estate in Connecticut.

02

Those responsible for filing estate tax returns for decedents who passed away in Connecticut.

03

Beneficiaries who may need to verify estate tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is the average cost of probate in CT?

The cost of probate in Connecticut largely depends on the following factors: How large the estate is - previous law maxed capped fees at $12,500, but in 2015 that cap was removed; now estates exceeding a $2M value will pay a flat rate (currently $5615) plus an additional ½ percent of the gross estate value over $2M.

Does an estate have to go through probate in CT?

Not all estates need to go through full probate. For instance, in Connecticut, if the decedent's solely-owned assets include no real property and are valued at less than $40,000 – which is the state's “small estates limit” – then the estate can be settled without full probate, under a much shorter and easier process.

Do you have to go through probate in CT?

Do All Connecticut Estates Have to Go Through Probate? Not all estates must go through the formal probate process in Connecticut. If an estate is worth less than $40,000, an affidavit from the court is all that is necessary to transfer the ownership to the heirs.

What is the average fee for an executor of an estate in CT?

Executor Compensation in Connecticut Most people in Connecticut will classify reasonable as between 3% and 5% of the total estate value and fiduciary fees of under 4% are generally considered reasonable by Connecticut probate judges.

Is probate mandatory in CT?

Do All Connecticut Estates Have to Go Through Probate? Not all estates must go through the formal probate process in Connecticut. If an estate is worth less than $40,000, an affidavit from the court is all that is necessary to transfer the ownership to the heirs.

What are the steps of probate in CT?

Here's a walk-through of the Connecticut probate process: Application for administration or probate of Will. Certificate for Land Records. Inventory of solely-owned assets. Pay expenses and claims. File estate tax returns. Final accounting and proposed distribution.

How much is a probate lawyer in CT?

Probate lawyers in Connecticut cost between $300-$800 dollars per hour on average.

Who must file probate in CT?

At present, only estates valued at $2,000,000 or higher have Connecticut estate tax exposure. Those estates must file the Connecticut return with the Department of Revenue Services. Estates valued at less than $2,000,000 need only file the return with the probate court.

What is the threshold for probate in CT?

In the state of Connecticut, the minimum value of the deceased's assets is $40,000. When accessing the total value of the estate, you may only include the assets and property that must go through probate—and exclude and assets or property that was jointly owned or held in trust.

How much does an estate have to be worth to go to probate in Connecticut?

How much does an estate have to be worth to go to probate in Connecticut? In the state of Connecticut, the minimum value of the deceased's assets is $40,000.

How long does it take to go through probate in Connecticut?

The entire process can be completed within 30 days, instead of six months or longer as is normally required for the regular probate process. Further, the expedited process only requires the filing of one piece of paper (plus a tax return) instead of up to ten or more documents required in a regular probate process.

What assets are subject to probate in Connecticut?

Only three types of assets get probated: Personal possessions, business interests and assets in the decedent's name (which does not include assets in trusts or owned in the name of a business);

How does probate work in CT?

The Probate Courts ensure that any debt owed by the deceased person, funeral expenses and taxes are paid before the remaining assets are distributed. Often a family member or friend is responsible for settling the affairs of the estate.

Can probate be avoided in CT?

Create a Living Trust A living trust is one of the most common ways probate can be avoided in Connecticut. This is established when the assets of the trust's creator (known as the settlor) are put into a trust and then the settlor legally gives up their ownership of those assets.

Do you have to file probate in Connecticut?

Do All Connecticut Estates Have to Go Through Probate? Not all estates must go through the formal probate process in Connecticut. If an estate is worth less than $40,000, an affidavit from the court is all that is necessary to transfer the ownership to the heirs.

Do I need a lawyer for probate in CT?

Do I need an attorney for a probate case? Individuals involved in probate cases have the option of hiring an attorney but are not generally required to be represented by an attorney. Probate Court forms are designed to be user-friendly, and court staff may offer limited assistance in completing required forms.

Who Must File probate in CT?

At present, only estates valued at $2,000,000 or higher have Connecticut estate tax exposure. Those estates must file the Connecticut return with the Department of Revenue Services. Estates valued at less than $2,000,000 need only file the return with the probate court.

Who decides if probate is needed?

Probate. If you are named in someone's will as an executor, you may have to apply for probate. This is a legal document which gives you the authority to share out the estate of the person who has died ing to the instructions in the will. You do not always need probate to be able to deal with the estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CT DRS CT-706 NT EXT from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your CT DRS CT-706 NT EXT into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send CT DRS CT-706 NT EXT to be eSigned by others?

When you're ready to share your CT DRS CT-706 NT EXT, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an eSignature for the CT DRS CT-706 NT EXT in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your CT DRS CT-706 NT EXT directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is CT DRS CT-706 NT EXT?

CT DRS CT-706 NT EXT is an extension form used for filing the Connecticut estate tax return for estates that are not taxable and require additional time to file.

Who is required to file CT DRS CT-706 NT EXT?

Executors or administrators of estates that are not subject to Connecticut estate tax but need more time to submit the estate tax return must file CT DRS CT-706 NT EXT.

How to fill out CT DRS CT-706 NT EXT?

To fill out CT DRS CT-706 NT EXT, provide details such as the estate's name, address, federal estate tax identification number, and the reason for the extension, then sign and date the form.

What is the purpose of CT DRS CT-706 NT EXT?

The purpose of CT DRS CT-706 NT EXT is to grant an extension of time to file the Connecticut estate tax return for non-taxable estates.

What information must be reported on CT DRS CT-706 NT EXT?

Information that must be reported includes the name of the decedent, their date of death, the estate's executor or administrator contact information, and the requested extension period.

Fill out your CT DRS CT-706 NT EXT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-706 NT EXT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.