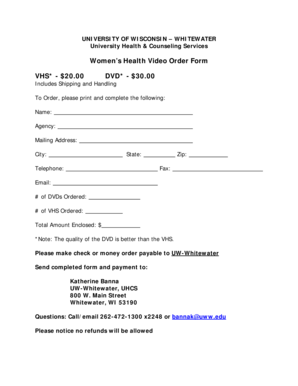

CT DRS CT-706 NT EXT 2011 free printable template

Show details

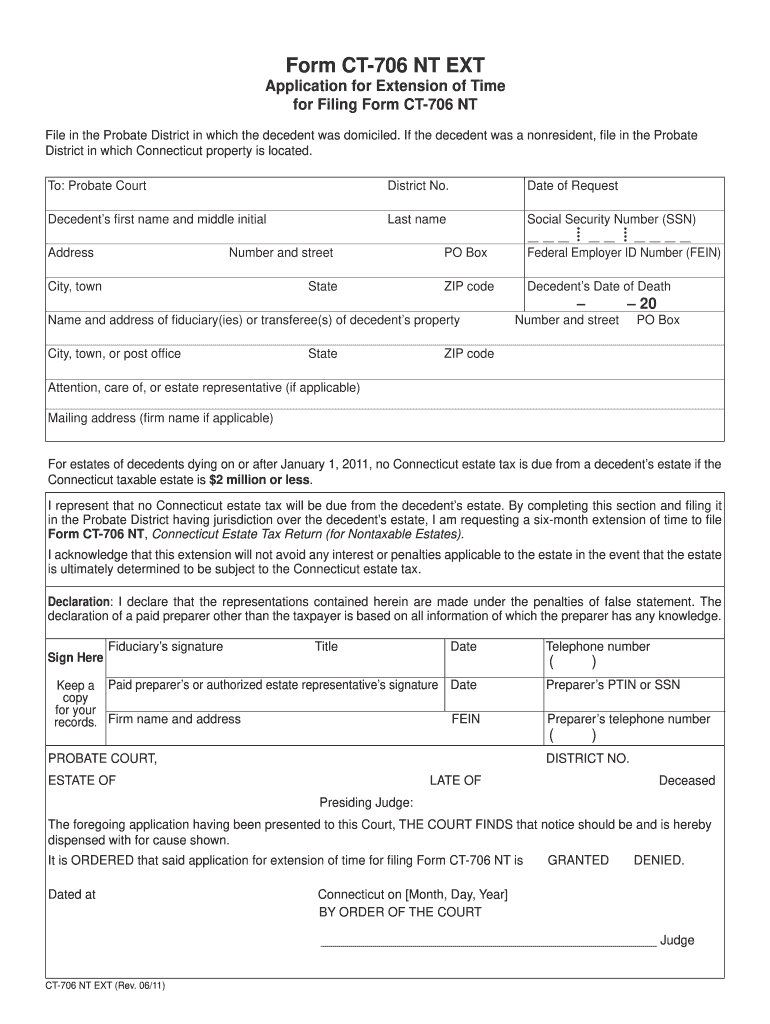

Failure to File Form CT-706 NT EXT When to File If a Form CT-706 NT EXT is not led on or before the original due date of the Form CT-706 NT the costs that would otherwise have been due under subsection b of Conn. Gen. Stat. Connecticut on Month Day Year BY ORDER OF THE COURT Judge CT-706 NT EXT Rev. 06/11 Instructions Complete this form in blue or black ink only. CT-706 NT EXT Back Rev. 06/11 be submitted. Complete the name and address of decedent decedent s social security number or the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-706 NT EXT

Edit your CT DRS CT-706 NT EXT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-706 NT EXT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT DRS CT-706 NT EXT online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CT DRS CT-706 NT EXT. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-706 NT EXT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS CT-706 NT EXT

How to fill out CT DRS CT-706 NT EXT

01

Start by downloading the CT DRS CT-706 NT EXT form from the Connecticut Department of Revenue Services website.

02

Fill in the taxpayer information section, including the taxpayer's name, address, and Social Security number.

03

Provide information regarding the property, including the property address and the type of property.

04

Indicate the reason for the exemption by checking the appropriate box, and provide any required documentation to support your claim.

05

Complete the financial information section, detailing any income or adjustments as requested on the form.

06

Review all the filled sections for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the completed form by mailing it to the appropriate address provided on the form or submit it electronically if applicable.

Who needs CT DRS CT-706 NT EXT?

01

Individuals or entities that own property in Connecticut and are seeking exemption from state property taxes due to specific qualifications.

02

Taxpayers who meet the criteria outlined by the Connecticut Department of Revenue Services for the exemptions available under CT-706 NT EXT.

Fill

form

: Try Risk Free

People Also Ask about

What is the extension of time to file Form 706?

Automatic extension. An executor may apply for an automatic 6-month extension of time to file Form 706, 706-A, 706-NA, or 706-QDT. Unless you are an executor who is out of the country (see below), the automatic extension of time to file is 6 months from the original due date of the applicable return.

Is there an extension of time to file CT-706 NT?

If a Form CT-706 NT EXT is filed and an extension is granted, interest will begin to accrue 30 days after the extended due date of Form CT-706 NT. Fill in the district of the Probate Court to which the form is to be submitted. Complete the name and address of decedent. Complete the fiduciary's name and address.

How do I file an extension for a 706?

Use Form 4768 to: Apply for an automatic 6-month extension of time to file Form 706, Form 706-A, Form 706-NA, or Form 706-QDT. Apply for a discretionary (additional) extension of time to file Form 706 (Part II of Form 4768).

What is CT-706 NT?

Form CT-706 NT, Connecticut Estate Tax Return (for Nontaxable Estates), is required to be filed by the executor or administrator of a decedent's estate where the amount of the decedent's Connecticut taxable estate is less than or equal to the Connecticut estate tax exemption amount.

Who must file a CT-706?

The executor or administrator of the decedent's estate must sign and file Form CT‑706 NT. If there is no executor or administrator, then each person in actual or constructive possession of any property of the decedent must file Form CT‑706 NT. If there is more than one fiduciary, all must sign the return.

What is the gift tax exemption amount for 2011?

The annual gift exclusion remains $13,000 in 2011 and 2012. See Annual exclusion, later, for more information. The basic exclusion amount for gifts made and estates of decedents who died in calendar year 2011 is $5,000,000, and $5,120,000 for gifts made and estates of decedents who die in 2012.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CT DRS CT-706 NT EXT?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the CT DRS CT-706 NT EXT in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I sign the CT DRS CT-706 NT EXT electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your CT DRS CT-706 NT EXT in seconds.

How can I fill out CT DRS CT-706 NT EXT on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your CT DRS CT-706 NT EXT from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is CT DRS CT-706 NT EXT?

CT DRS CT-706 NT EXT is an extension form for the Connecticut estate tax return, specifically for those estates that are not required to file a full estate tax return for the state of Connecticut.

Who is required to file CT DRS CT-706 NT EXT?

The form CT DRS CT-706 NT EXT is required to be filed by executors or administrators of estates that qualify for an extension of time to file the estate tax return in Connecticut.

How to fill out CT DRS CT-706 NT EXT?

To fill out CT DRS CT-706 NT EXT, you need to provide details such as the decedent's name, date of death, estimated value of the estate, and any other required information as specified in the form instructions.

What is the purpose of CT DRS CT-706 NT EXT?

The purpose of CT DRS CT-706 NT EXT is to grant an extension of time to file the Connecticut estate tax return, ensuring that the estate can settle matters without incurring late fees or penalties.

What information must be reported on CT DRS CT-706 NT EXT?

Information that must be reported on CT DRS CT-706 NT EXT includes the decedent's name, date of death, estimated gross estate value, and any other relevant financial details needed for the extension application.

Fill out your CT DRS CT-706 NT EXT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-706 NT EXT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.