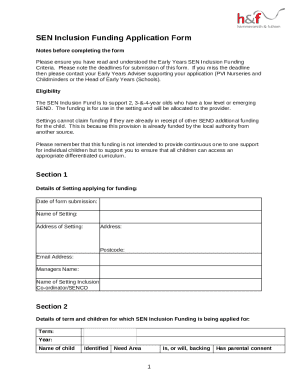

CT DRS CT-706 NT EXT 2022 free printable template

Show details

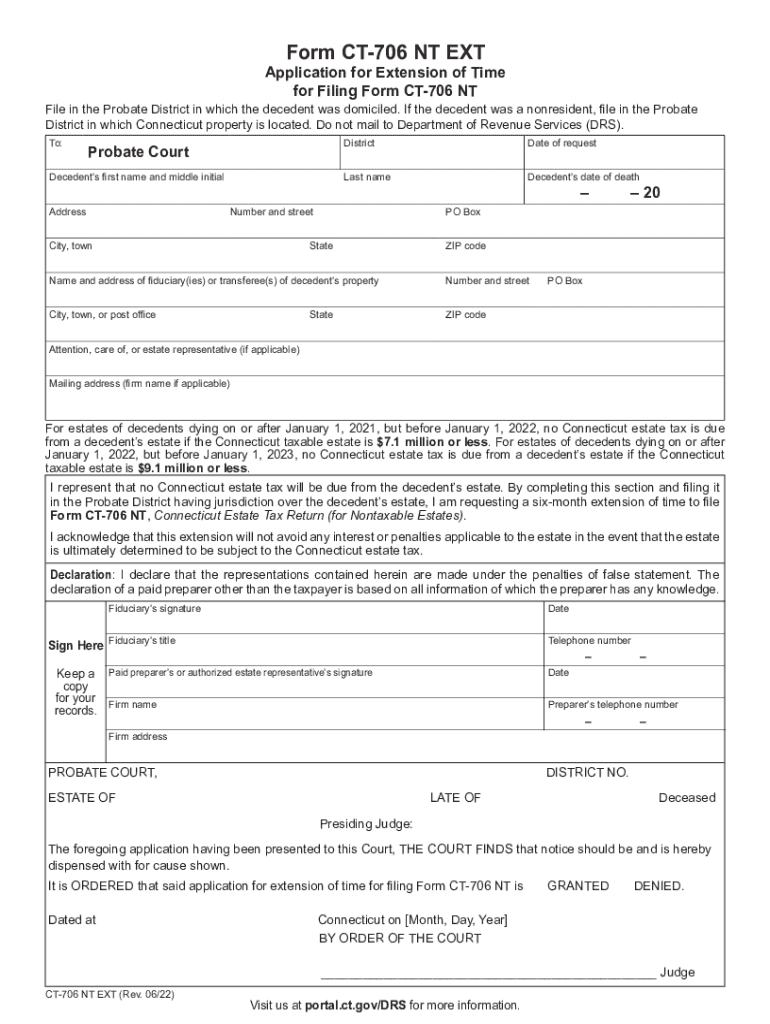

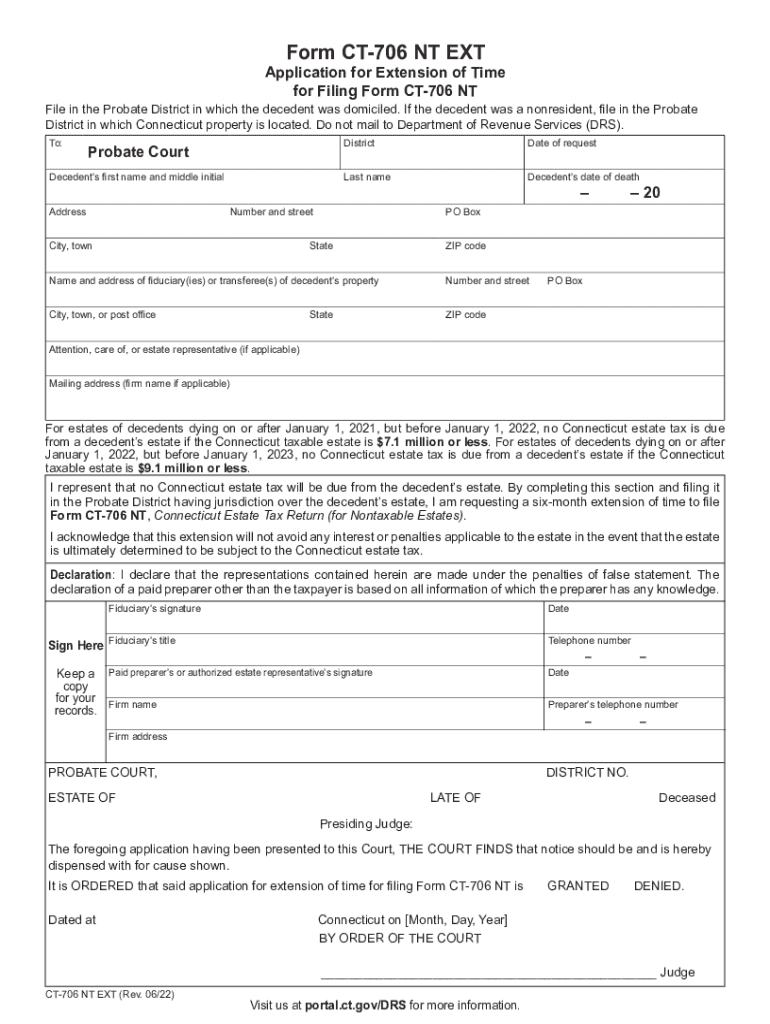

The granting of an extension of time for filing Form CT 706 NT by the Probate Court will not avoid any interest or penalties applicable to the estate tax in the event that Failure to File Form CT-706 NT EXT If a Form CT-706 NT EXT is not filed on or before the original due date of the Form CT-706 NT the fees that would otherwise have been due under Conn. Gen. Stat. Connecticut on Month Day Year BY ORDER OF THE COURT Judge CT-706 NT EXT Rev. 06/22 Visit us at portal.ct. Completing Form CT-706...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-706 NT EXT

Edit your CT DRS CT-706 NT EXT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-706 NT EXT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT DRS CT-706 NT EXT online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CT DRS CT-706 NT EXT. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-706 NT EXT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS CT-706 NT EXT

How to fill out CT DRS CT-706 NT EXT

01

Obtain the CT DRS CT-706 NT EXT form from the Connecticut Department of Revenue Services website.

02

Fill out the taxpayer identification information at the top of the form, including your name, address, and social security number or employer identification number.

03

Indicate the tax period for which you are requesting an extension.

04

Calculate the estimated tax liability for the period.

05

Write the amount of any payment included with the form, if applicable.

06

Sign and date the form.

07

Submit the completed form to the address indicated in the instructions, either by mail or electronically, before the due date.

Who needs CT DRS CT-706 NT EXT?

01

Individuals or businesses in Connecticut who are unable to file their income tax return by the original due date but require an extension.

02

Taxpayers who expect to owe taxes and want to avoid penalties by filing for an extension rather than a late return.

Fill

form

: Try Risk Free

People Also Ask about

What is the average cost of probate in CT?

The cost of probate in Connecticut largely depends on the following factors: How large the estate is - previous law maxed capped fees at $12,500, but in 2015 that cap was removed; now estates exceeding a $2M value will pay a flat rate (currently $5615) plus an additional ½ percent of the gross estate value over $2M.

Does an estate have to go through probate in CT?

Not all estates need to go through full probate. For instance, in Connecticut, if the decedent's solely-owned assets include no real property and are valued at less than $40,000 – which is the state's “small estates limit” – then the estate can be settled without full probate, under a much shorter and easier process.

Do you have to go through probate in CT?

Do All Connecticut Estates Have to Go Through Probate? Not all estates must go through the formal probate process in Connecticut. If an estate is worth less than $40,000, an affidavit from the court is all that is necessary to transfer the ownership to the heirs.

What is the average fee for an executor of an estate in CT?

Executor Compensation in Connecticut Most people in Connecticut will classify reasonable as between 3% and 5% of the total estate value and fiduciary fees of under 4% are generally considered reasonable by Connecticut probate judges.

Is probate mandatory in CT?

Do All Connecticut Estates Have to Go Through Probate? Not all estates must go through the formal probate process in Connecticut. If an estate is worth less than $40,000, an affidavit from the court is all that is necessary to transfer the ownership to the heirs.

What are the steps of probate in CT?

Here's a walk-through of the Connecticut probate process: Application for administration or probate of Will. Certificate for Land Records. Inventory of solely-owned assets. Pay expenses and claims. File estate tax returns. Final accounting and proposed distribution.

How much is a probate lawyer in CT?

Probate lawyers in Connecticut cost between $300-$800 dollars per hour on average.

Who must file probate in CT?

At present, only estates valued at $2,000,000 or higher have Connecticut estate tax exposure. Those estates must file the Connecticut return with the Department of Revenue Services. Estates valued at less than $2,000,000 need only file the return with the probate court.

What is the threshold for probate in CT?

In the state of Connecticut, the minimum value of the deceased's assets is $40,000. When accessing the total value of the estate, you may only include the assets and property that must go through probate—and exclude and assets or property that was jointly owned or held in trust.

How much does an estate have to be worth to go to probate in Connecticut?

How much does an estate have to be worth to go to probate in Connecticut? In the state of Connecticut, the minimum value of the deceased's assets is $40,000.

How long does it take to go through probate in Connecticut?

The entire process can be completed within 30 days, instead of six months or longer as is normally required for the regular probate process. Further, the expedited process only requires the filing of one piece of paper (plus a tax return) instead of up to ten or more documents required in a regular probate process.

What assets are subject to probate in Connecticut?

Only three types of assets get probated: Personal possessions, business interests and assets in the decedent's name (which does not include assets in trusts or owned in the name of a business);

How does probate work in CT?

The Probate Courts ensure that any debt owed by the deceased person, funeral expenses and taxes are paid before the remaining assets are distributed. Often a family member or friend is responsible for settling the affairs of the estate.

Can probate be avoided in CT?

Create a Living Trust A living trust is one of the most common ways probate can be avoided in Connecticut. This is established when the assets of the trust's creator (known as the settlor) are put into a trust and then the settlor legally gives up their ownership of those assets.

Do you have to file probate in Connecticut?

Do All Connecticut Estates Have to Go Through Probate? Not all estates must go through the formal probate process in Connecticut. If an estate is worth less than $40,000, an affidavit from the court is all that is necessary to transfer the ownership to the heirs.

Do I need a lawyer for probate in CT?

Do I need an attorney for a probate case? Individuals involved in probate cases have the option of hiring an attorney but are not generally required to be represented by an attorney. Probate Court forms are designed to be user-friendly, and court staff may offer limited assistance in completing required forms.

Who Must File probate in CT?

At present, only estates valued at $2,000,000 or higher have Connecticut estate tax exposure. Those estates must file the Connecticut return with the Department of Revenue Services. Estates valued at less than $2,000,000 need only file the return with the probate court.

Who decides if probate is needed?

Probate. If you are named in someone's will as an executor, you may have to apply for probate. This is a legal document which gives you the authority to share out the estate of the person who has died ing to the instructions in the will. You do not always need probate to be able to deal with the estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in CT DRS CT-706 NT EXT?

The editing procedure is simple with pdfFiller. Open your CT DRS CT-706 NT EXT in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit CT DRS CT-706 NT EXT in Chrome?

CT DRS CT-706 NT EXT can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I fill out CT DRS CT-706 NT EXT on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your CT DRS CT-706 NT EXT, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is CT DRS CT-706 NT EXT?

CT DRS CT-706 NT EXT is a form used in Connecticut for filing an extension for the filing of a Connecticut estate tax return for estates that are not subject to tax.

Who is required to file CT DRS CT-706 NT EXT?

The executor or administrator of an estate that is not subject to Connecticut estate tax is required to file CT DRS CT-706 NT EXT if they need additional time to file the complete estate tax return.

How to fill out CT DRS CT-706 NT EXT?

To fill out CT DRS CT-706 NT EXT, you must provide the decedent's name, date of death, the name of the executor or administrator, and indicate the reason for the extension request. Follow the form instructions carefully.

What is the purpose of CT DRS CT-706 NT EXT?

The purpose of CT DRS CT-706 NT EXT is to request an extension of time to file the Connecticut estate tax return for estates that are not subject to the estate tax, allowing for additional time to gather necessary documentation.

What information must be reported on CT DRS CT-706 NT EXT?

The information that must be reported on CT DRS CT-706 NT EXT includes the decedent's name, their date of death, the contact information of the executor or administrator, and the reason for requesting the extension.

Fill out your CT DRS CT-706 NT EXT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-706 NT EXT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.