NJ DoT CBT-200-T 2017 free printable template

Show details

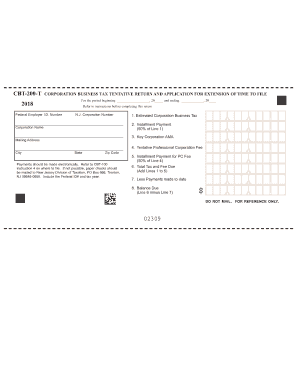

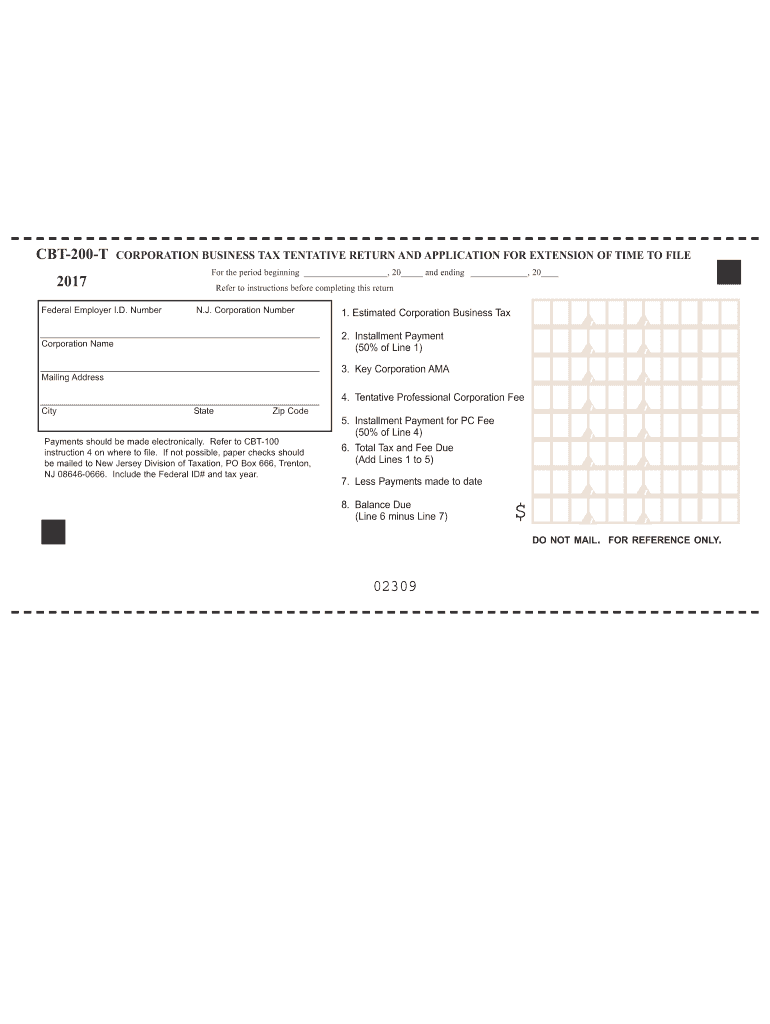

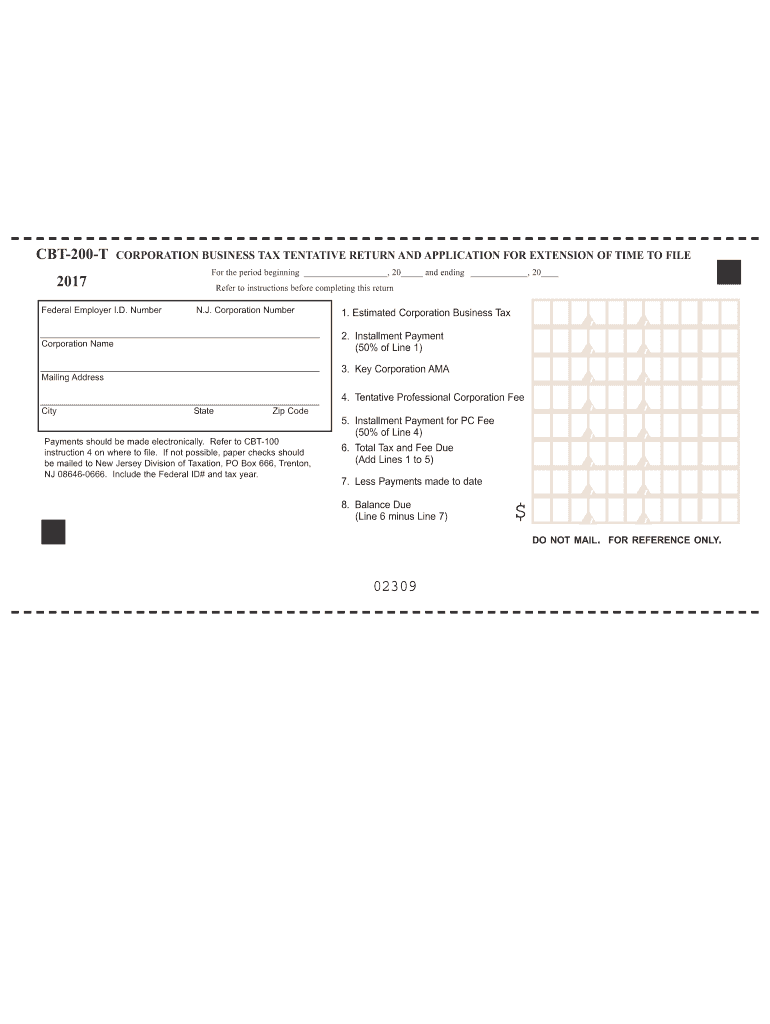

CBT200TCORPORATION BUSINESS TAX TENTATIVE RETURN AND APPLICATION FOR EXTENSION OF TIME TO FILE 2017 Federal Employer I.D. Number the period beginning, 20 and ending, 20 Refer to instructions before

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ DoT CBT-200-T

Edit your NJ DoT CBT-200-T form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ DoT CBT-200-T form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NJ DoT CBT-200-T online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NJ DoT CBT-200-T. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT CBT-200-T Form Versions

Version

Form Popularity

Fillable & printabley

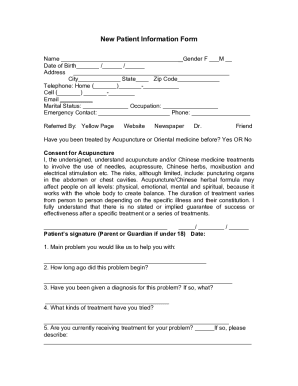

How to fill out NJ DoT CBT-200-T

How to fill out NJ DoT CBT-200-T

01

Gather necessary information: Ensure you have your personal details, vehicle information, and any required documentation ready.

02

Download the NJ DoT CBT-200-T form from the official New Jersey Department of Transportation website.

03

Fill out the form: Start by entering your name, address, and contact information in the designated fields.

04

Provide vehicle information: Include the make, model, year, and VIN of your vehicle as requested.

05

Answer all relevant questions: Respond accurately to any questions regarding your driving history and insurance.

06

Review your information: Double-check all entries to ensure that there are no mistakes or omissions.

07

Submit the form: Follow the submission instructions, which may include mailing the form to a specific address or submitting it online.

Who needs NJ DoT CBT-200-T?

01

The NJ DoT CBT-200-T form is required for drivers seeking to obtain or renew their Commercial Driver's License (CDL).

02

Commercial drivers who are applying for specialized endorsements, such as for transporting hazardous materials or driving larger vehicles, also need to fill out this form.

03

Individuals who have recently moved to New Jersey and need to register their vehicles or fulfill state-specific requirements may also need this form.

Fill

form

: Try Risk Free

People Also Ask about

Can you print tax forms front and back?

Print Tax Return Double-Sided Forms with Caution While each form can be double-sided, different forms cannot share the same page – so for example, each page of a Form 1040 can be double-sided. But part of the Form 1040 cannot share a page with a Form 7004.

Do I have to file a NJ-1040NR?

If you moved into or out of New Jersey and had New Jersey source income while you were a nonresident of NJ, file a nonresident return (NJ-1040NR) to report your New Jersey source income.

Is NJ processing paper tax returns?

Processing of paper tax returns typically takes a minimum of 12 weeks. We process most returns through our automated system. However, staff members do look at some returns manually to see whether the taxpayer filed income, deductions, and credits correctly.

Do non residents need to file a tax return?

Nonresident aliens must file and pay any tax due using Form 1040NR, U.S. Nonresident Alien Income Tax Return.

Does NJ have a state tax form?

Complete Form NJ-630, include a Check or Money Order, and mail both to the address on Form NJ-630. Even if you filed an extension, you will still need to file your NJ tax return either via eFile or by paper by Oct.

Where can I get NJ state tax forms?

Income Tax Returns Phone – Call our automated phone line at 1-800-323-4400 (within NJ, NY, PA, DE and MD) or 609-826-4400 (from anywhere). In Person – Visit the Regional Information Center nearest to you to pick up a copy of the forms and instructions.

How does NJ tax non residents?

As a nonresident, you must calculate your tax on income from all sources as if you were a resident, and then prorate your tax based on your New Jersey source income. For more information on completing the nonresident return, see instructions for Form NJ-1040NR.

Where is my NJ CBT refund?

Where Is my Refund? By phone: 1-800-323-4400 or 609-826-4400 (anywhere) for our automated refund system.

Can you paper file NJ corporate tax return?

Returns must be filed electronically.

Can I submit my corporation tax return myself?

You can file your company's corporate tax return yourself or get an accountant to prepare and file it for you.

Do I need to file a NJ nonresident tax return?

A nonresident serviceperson who has income from New Jersey sources such as a civilian job in off-duty hours, income or gain from property located in New Jersey or income from a business, trade or profession carried on in this State must file a New Jersey nonresident return, Form NJ-1040NR.

Who must file a NJ corporate tax return?

Every corporation which incorporates, qualifies or otherwise acquires a taxable status in New Jersey must file a Corporation Business Tax return, Form CBT-100.

What is CBT tax in New Jersey?

For taxpayers with Entire Net Income of $50,000 or less, the tax rate is 6.5% (. 065) on adjusted net income or such portion thereof as may be allocable to New Jersey.C Corporation - MINIMUM TAX: Gross Receipts:Tax:$100,000 or more but less than $250,000$750$250,000 or more but less than $500,000$1,0003 more rows • Feb 25, 2020

Who is subject to NJ CBT?

Every partnership that has income or loss derived from sources in the State of New Jersey, or has any type of New Jersey resident partner, must file Form NJ-1065. Form NJ-CBT-1065 must be filed when the entity is re- quired to calculate a tax on its nonresident partner(s).

What is CBT tax in NJ?

The tax rate is 9.00% (. 09) of entire net income that is subject to federal income taxation or such portion thereof as may be allocable to New Jersey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the NJ DoT CBT-200-T in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your NJ DoT CBT-200-T.

Can I create an electronic signature for signing my NJ DoT CBT-200-T in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your NJ DoT CBT-200-T directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit NJ DoT CBT-200-T on an iOS device?

You certainly can. You can quickly edit, distribute, and sign NJ DoT CBT-200-T on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is NJ DoT CBT-200-T?

NJ DoT CBT-200-T is a tax form used by corporations in New Jersey to report their business income and calculate the corporation business tax owed to the state.

Who is required to file NJ DoT CBT-200-T?

Corporations and certain business entities operating in New Jersey are required to file NJ DoT CBT-200-T if they have gross receipts or taxable income that falls within the state's jurisdiction.

How to fill out NJ DoT CBT-200-T?

To fill out NJ DoT CBT-200-T, businesses must provide their entity information, report total income and expenses, calculate taxable income, and determine the tax owed based on the state's tax rates, following the instructions provided with the form.

What is the purpose of NJ DoT CBT-200-T?

The purpose of NJ DoT CBT-200-T is to ensure that businesses report their income accurately and pay the correct amount of corporation business tax to New Jersey.

What information must be reported on NJ DoT CBT-200-T?

NJ DoT CBT-200-T requires businesses to report information such as gross receipts, expenses, taxable income, and specific deductions or credits applicable under New Jersey tax law.

Fill out your NJ DoT CBT-200-T online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ DoT CBT-200-T is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.