NJ DoT CBT-200-T 2018-2026 free printable template

Show details

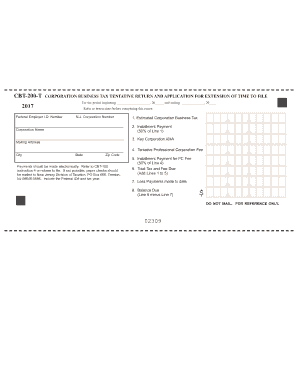

CBT200TCORPORATION BUSINESS TAX TENTATIVE RETURN AND APPLICATION FOR EXTENSION OF TIME TO FILE 2018 Federal Employer I.D. Number the period beginning, 20 and ending, 20 Refer to instructions before

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ DoT CBT-200-T

Edit your NJ DoT CBT-200-T form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ DoT CBT-200-T form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NJ DoT CBT-200-T online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NJ DoT CBT-200-T. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT CBT-200-T Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ DoT CBT-200-T

How to fill out NJ DoT CBT-200-T

01

Obtain the NJ DoT CBT-200-T form from the New Jersey Department of Transportation website or local office.

02

Read the instructions carefully to understand the required information.

03

Fill out the personal identification section with your name, address, and contact information.

04

Provide any relevant vehicle information including make, model, year, and VIN.

05

Complete the section related to your driving history and any previous violations or accidents.

06

Review the form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form to the designated office or department, either in person or via mail if applicable.

Who needs NJ DoT CBT-200-T?

01

Anyone applying for a Commercial Driver's License (CDL) in New Jersey.

02

Individuals seeking to renew their driving privileges or addresses related to commercial driving.

03

Drivers who have had violations and need to provide a comprehensive driving record.

Fill

form

: Try Risk Free

People Also Ask about

Can you print tax forms front and back?

Print Tax Return Double-Sided Forms with Caution While each form can be double-sided, different forms cannot share the same page – so for example, each page of a Form 1040 can be double-sided. But part of the Form 1040 cannot share a page with a Form 7004.

Do I have to file a NJ-1040NR?

If you moved into or out of New Jersey and had New Jersey source income while you were a nonresident of NJ, file a nonresident return (NJ-1040NR) to report your New Jersey source income.

Is NJ processing paper tax returns?

Processing of paper tax returns typically takes a minimum of 12 weeks. We process most returns through our automated system. However, staff members do look at some returns manually to see whether the taxpayer filed income, deductions, and credits correctly.

Do non residents need to file a tax return?

Nonresident aliens must file and pay any tax due using Form 1040NR, U.S. Nonresident Alien Income Tax Return.

Does NJ have a state tax form?

Complete Form NJ-630, include a Check or Money Order, and mail both to the address on Form NJ-630. Even if you filed an extension, you will still need to file your NJ tax return either via eFile or by paper by Oct.

Where can I get NJ state tax forms?

Income Tax Returns Phone – Call our automated phone line at 1-800-323-4400 (within NJ, NY, PA, DE and MD) or 609-826-4400 (from anywhere). In Person – Visit the Regional Information Center nearest to you to pick up a copy of the forms and instructions.

How does NJ tax non residents?

As a nonresident, you must calculate your tax on income from all sources as if you were a resident, and then prorate your tax based on your New Jersey source income. For more information on completing the nonresident return, see instructions for Form NJ-1040NR.

Where is my NJ CBT refund?

Where Is my Refund? By phone: 1-800-323-4400 or 609-826-4400 (anywhere) for our automated refund system.

Can you paper file NJ corporate tax return?

Returns must be filed electronically.

Can I submit my corporation tax return myself?

You can file your company's corporate tax return yourself or get an accountant to prepare and file it for you.

Do I need to file a NJ nonresident tax return?

A nonresident serviceperson who has income from New Jersey sources such as a civilian job in off-duty hours, income or gain from property located in New Jersey or income from a business, trade or profession carried on in this State must file a New Jersey nonresident return, Form NJ-1040NR.

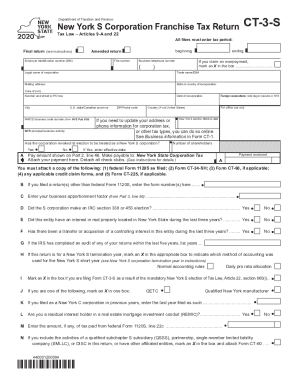

Who must file a NJ corporate tax return?

Every corporation which incorporates, qualifies or otherwise acquires a taxable status in New Jersey must file a Corporation Business Tax return, Form CBT-100.

What is CBT tax in New Jersey?

For taxpayers with Entire Net Income of $50,000 or less, the tax rate is 6.5% (. 065) on adjusted net income or such portion thereof as may be allocable to New Jersey.C Corporation - MINIMUM TAX: Gross Receipts:Tax:$100,000 or more but less than $250,000$750$250,000 or more but less than $500,000$1,0003 more rows • Feb 25, 2020

Who is subject to NJ CBT?

Every partnership that has income or loss derived from sources in the State of New Jersey, or has any type of New Jersey resident partner, must file Form NJ-1065. Form NJ-CBT-1065 must be filed when the entity is re- quired to calculate a tax on its nonresident partner(s).

What is CBT tax in NJ?

The tax rate is 9.00% (. 09) of entire net income that is subject to federal income taxation or such portion thereof as may be allocable to New Jersey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in NJ DoT CBT-200-T?

With pdfFiller, the editing process is straightforward. Open your NJ DoT CBT-200-T in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit NJ DoT CBT-200-T straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing NJ DoT CBT-200-T right away.

How do I fill out NJ DoT CBT-200-T using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign NJ DoT CBT-200-T and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is NJ DoT CBT-200-T?

NJ DoT CBT-200-T is a tax form used for the Corporation Business Tax in New Jersey, specifically for corporations that have a change in their business status or tax liability.

Who is required to file NJ DoT CBT-200-T?

Corporations that have undergone significant changes, such as mergers, acquisitions, or any substantial alterations in their business structures or activities, are required to file NJ DoT CBT-200-T.

How to fill out NJ DoT CBT-200-T?

To fill out NJ DoT CBT-200-T, corporations must provide relevant financial information, including income, expenses, and details regarding their business operations, along with any additional required schedules.

What is the purpose of NJ DoT CBT-200-T?

The purpose of NJ DoT CBT-200-T is to report and assess the corporate business taxes owed by corporations in New Jersey, particularly in relation to any changes in their operational status.

What information must be reported on NJ DoT CBT-200-T?

Information that must be reported on NJ DoT CBT-200-T includes the company's name, address, business activities, financial statements, tax credits, and the details of any changes affecting tax liability.

Fill out your NJ DoT CBT-200-T online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ DoT CBT-200-T is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.