NJ DoT CBT-200-T 2014 free printable template

Show details

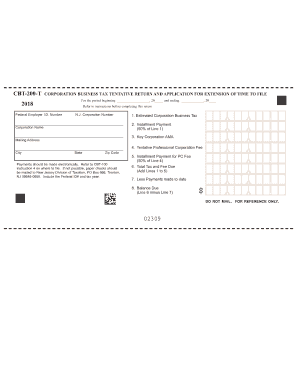

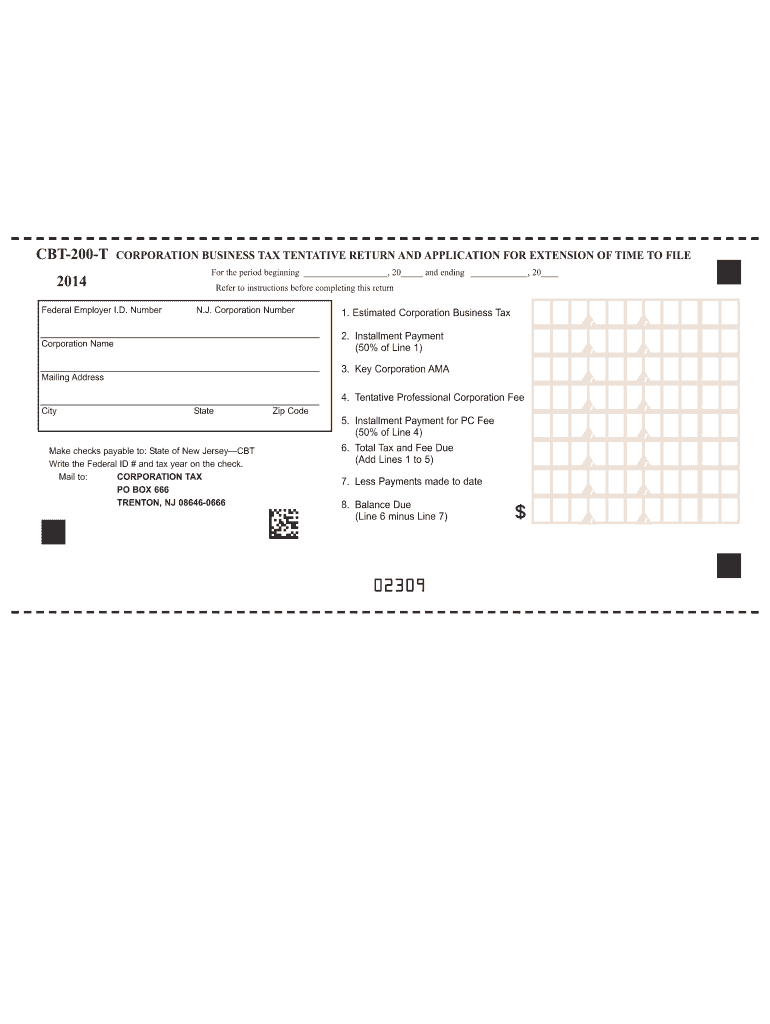

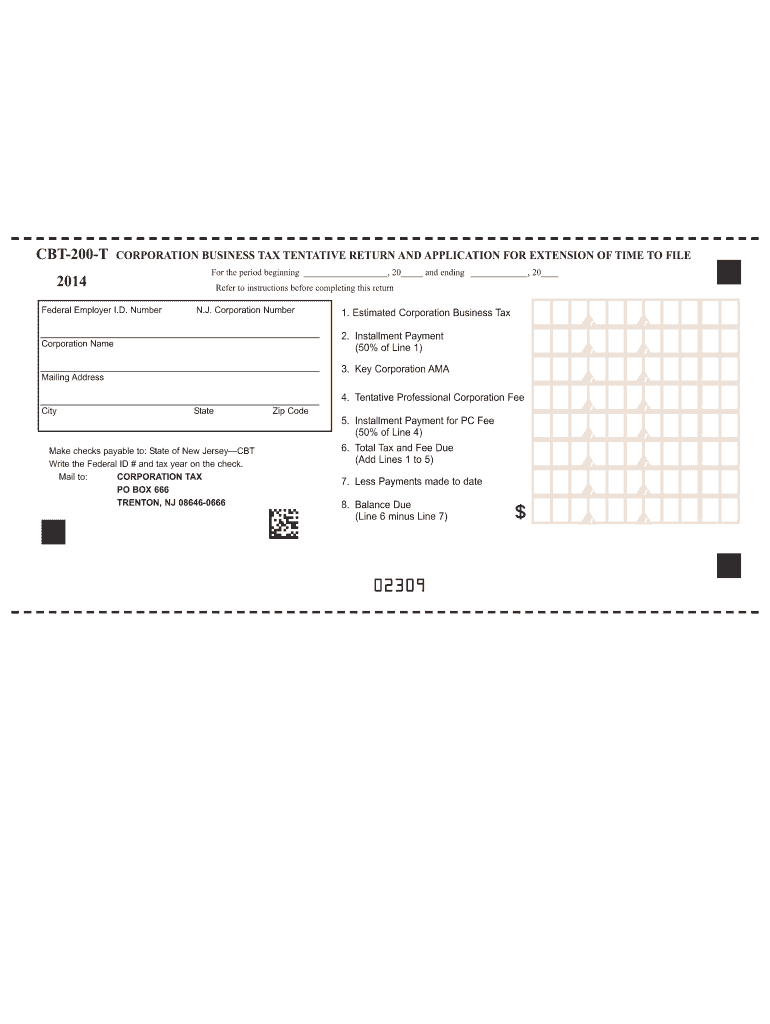

CBT 200-T CORPORATION BUSINESS TAX TENTATIVE RETURN AND APPLICATION FOR EXTENSION OF TIME To FILE. 201 For the period beginning 20 ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ DoT CBT-200-T

Edit your NJ DoT CBT-200-T form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ DoT CBT-200-T form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NJ DoT CBT-200-T online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NJ DoT CBT-200-T. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT CBT-200-T Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ DoT CBT-200-T

How to fill out NJ DoT CBT-200-T

01

Obtain the NJ DoT CBT-200-T form from the New Jersey Department of Transportation website or local office.

02

Fill in your personal information at the top of the form, including your full name, address, and contact number.

03

Provide details of the vehicle(s) involved, such as make, model, and license plate number.

04

Indicate the reason for filling out the form, ensuring it matches the specific criteria outlined by the NJ DoT.

05

Complete any additional sections as required, such as accident details or registration information.

06

Review all filled-out sections for accuracy and completeness.

07

Submit the form as instructed, either through mail or online submission, along with any required fees or documentation.

Who needs NJ DoT CBT-200-T?

01

Individuals who are applying for a special permit or registration related to transportation in New Jersey.

02

Drivers involved in vehicle accidents that require reporting to the New Jersey Department of Transportation.

03

Businesses that need to register commercial vehicles within New Jersey.

Fill

form

: Try Risk Free

People Also Ask about

Can you print tax forms front and back?

Print Tax Return Double-Sided Forms with Caution While each form can be double-sided, different forms cannot share the same page – so for example, each page of a Form 1040 can be double-sided. But part of the Form 1040 cannot share a page with a Form 7004.

Do I have to file a NJ-1040NR?

If you moved into or out of New Jersey and had New Jersey source income while you were a nonresident of NJ, file a nonresident return (NJ-1040NR) to report your New Jersey source income.

Is NJ processing paper tax returns?

Processing of paper tax returns typically takes a minimum of 12 weeks. We process most returns through our automated system. However, staff members do look at some returns manually to see whether the taxpayer filed income, deductions, and credits correctly.

Do non residents need to file a tax return?

Nonresident aliens must file and pay any tax due using Form 1040NR, U.S. Nonresident Alien Income Tax Return.

Does NJ have a state tax form?

Complete Form NJ-630, include a Check or Money Order, and mail both to the address on Form NJ-630. Even if you filed an extension, you will still need to file your NJ tax return either via eFile or by paper by Oct.

Where can I get NJ state tax forms?

Income Tax Returns Phone – Call our automated phone line at 1-800-323-4400 (within NJ, NY, PA, DE and MD) or 609-826-4400 (from anywhere). In Person – Visit the Regional Information Center nearest to you to pick up a copy of the forms and instructions.

How does NJ tax non residents?

As a nonresident, you must calculate your tax on income from all sources as if you were a resident, and then prorate your tax based on your New Jersey source income. For more information on completing the nonresident return, see instructions for Form NJ-1040NR.

Where is my NJ CBT refund?

Where Is my Refund? By phone: 1-800-323-4400 or 609-826-4400 (anywhere) for our automated refund system.

Can you paper file NJ corporate tax return?

Returns must be filed electronically.

Can I submit my corporation tax return myself?

You can file your company's corporate tax return yourself or get an accountant to prepare and file it for you.

Do I need to file a NJ nonresident tax return?

A nonresident serviceperson who has income from New Jersey sources such as a civilian job in off-duty hours, income or gain from property located in New Jersey or income from a business, trade or profession carried on in this State must file a New Jersey nonresident return, Form NJ-1040NR.

Who must file a NJ corporate tax return?

Every corporation which incorporates, qualifies or otherwise acquires a taxable status in New Jersey must file a Corporation Business Tax return, Form CBT-100.

What is CBT tax in New Jersey?

For taxpayers with Entire Net Income of $50,000 or less, the tax rate is 6.5% (. 065) on adjusted net income or such portion thereof as may be allocable to New Jersey.C Corporation - MINIMUM TAX: Gross Receipts:Tax:$100,000 or more but less than $250,000$750$250,000 or more but less than $500,000$1,0003 more rows • Feb 25, 2020

Who is subject to NJ CBT?

Every partnership that has income or loss derived from sources in the State of New Jersey, or has any type of New Jersey resident partner, must file Form NJ-1065. Form NJ-CBT-1065 must be filed when the entity is re- quired to calculate a tax on its nonresident partner(s).

What is CBT tax in NJ?

The tax rate is 9.00% (. 09) of entire net income that is subject to federal income taxation or such portion thereof as may be allocable to New Jersey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NJ DoT CBT-200-T online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your NJ DoT CBT-200-T and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for the NJ DoT CBT-200-T in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your NJ DoT CBT-200-T.

Can I create an electronic signature for signing my NJ DoT CBT-200-T in Gmail?

Create your eSignature using pdfFiller and then eSign your NJ DoT CBT-200-T immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is NJ DoT CBT-200-T?

NJ DoT CBT-200-T is a tax form used by corporations in New Jersey to report their business income and calculate the corporate business tax.

Who is required to file NJ DoT CBT-200-T?

Corporations operating or doing business in New Jersey are required to file NJ DoT CBT-200-T.

How to fill out NJ DoT CBT-200-T?

To fill out NJ DoT CBT-200-T, corporations must provide their income details, deductions, applicable tax credits, and complete other required sections as outlined in the instructions for the form.

What is the purpose of NJ DoT CBT-200-T?

The purpose of NJ DoT CBT-200-T is to ensure that corporations accurately report their income and pay their corporate business taxes to the state of New Jersey.

What information must be reported on NJ DoT CBT-200-T?

The information that must be reported includes total income, deductions, credits, tax liability, and other relevant financial data pertaining to the corporation's business activities in New Jersey.

Fill out your NJ DoT CBT-200-T online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ DoT CBT-200-T is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.