IL DoR IL-4506 2017 free printable template

Show details

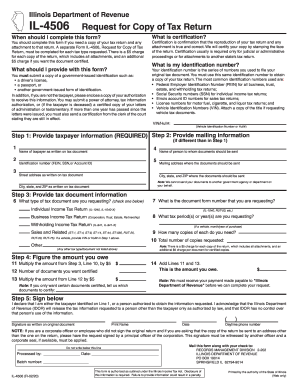

12 Multiply the number of documents you This is the amount you owe. want certified by 5 Note We must receive your payment made payable to Illinois Department of Revenue before we can complete your request. Illinois Department of Revenue IL-4506 Request for Copy of Tax Return What is my identification number When should I complete this form You should complete this form if you need a copy of your tax return and any attachment to that return. A separate Form IL-4506 Request for Copy of Tax...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL DoR IL-4506

Edit your IL DoR IL-4506 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL DoR IL-4506 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL DoR IL-4506 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IL DoR IL-4506. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR IL-4506 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL DoR IL-4506

How to fill out IL DoR IL-4506

01

Obtain the IL DoR IL-4506 form from the Illinois Department of Revenue website or from a local office.

02

Fill in your name, address, and Social Security number in the appropriate fields.

03

Provide the name and address of the entity that the form is being submitted to (if applicable).

04

Indicate the tax year(s) for which you need tax information.

05

Sign and date the form to certify that the information provided is true.

06

Submit the completed form to the Illinois Department of Revenue by mail or fax.

Who needs IL DoR IL-4506?

01

Individuals who need a copy of their tax return, transcripts, or tax information.

02

Taxpayers who are applying for loans or financial aid and require verification of tax information.

03

Anyone who needs to resolve issues with their tax accounts or discrepancies with the IRS.

Instructions and Help about IL DoR IL-4506

Fill

form

: Try Risk Free

People Also Ask about

What is IRS form 4506-T used for?

Taxpayers using a fiscal tax year must file Form 4506-T, Request for Transcript of Tax Return, to request a return transcript. Use Form 4506-T to request tax return transcripts, tax account information, W-2 information, 1099 information, verification of non-filing, and record of account. Customer File Number.

How to file IRS form 4506-T?

Please submit the form directly to the IRS at the address or fax number listed for your state of residence at the me your return was filed. The IRS will mail you a copy of the document you have requested. You will then submit all pages of that document to the Financial Aid & Scholarship Office for review.

Why am I getting a letter from the Illinois Department of Revenue?

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.

What is the IRS form 4506-T used for?

Taxpayers using a fiscal tax year must file Form 4506-T, Request for Transcript of Tax Return, to request a return transcript. Use Form 4506-T to request tax return transcripts, tax account information, W-2 information, 1099 information, verification of non-filing, and record of account. Customer File Number.

How long does it take to get a 4506 from the IRS?

Use Form 4506 to request a copy of your tax return. You can also designate (on line 5) a third party to receive the tax return. How long will it take? It may take up to 75 calendar days for us to process your request.

Do I need to file 4506?

If all borrower income is not validated through the DU validation service, the lender must obtain the completed and signed IRS Form 4506-C.

What does the signers need to complete on the 4506-T request for transcript of tax return document?

We require a signed, dated, and completed copy of IRS Form 4506-T (Request for Transcript of Tax Return) for each borrower. Borrowers who filed their tax returns jointly may send in one IRS Form 4506-T signed, dated, and completed by both of the joint filers. the last tax return. nine digits displayed.

How to fill out a 4506 form?

0:37 2:12 Learn How to Fill the Form 4506-T Request for Transcript of Tax Return YouTube Start of suggested clip End of suggested clip Six you must select the type of tax return which you are requesting. Such as a 1040. Return 1065.MoreSix you must select the type of tax return which you are requesting. Such as a 1040. Return 1065. Return or 1120. Return you must next select the type of transcript. You want to receive.

Can you submit form 4506 online?

Although the form can be completed online, you must print and sign the form, then submit to SBA. The IRS Form 4506-T must be completed and submitted with each SBA disaster loan application, even if you are not required to file a federal income tax return.

How do I write a check to the Illinois Department of Revenue?

Make your check payable to the Illinois Department of Revenue. Write your Social Security number, your spouse's Social Security number if filing jointly, and the tax year in the lower left-hand corner of your payment. Note: You may electronically pay your taxes no matter how you file.

How do I make a payment to the Illinois Department of Revenue?

Pay using: MyTax Illinois. If you have a MyTax Illinois account, click here and log in. Credit Card. Check or money order (follow the payment instructions on the form or voucher associated with your filing) ACH Credit - ACH credit is NOT the preferred payment option for most taxpayers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IL DoR IL-4506 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your IL DoR IL-4506 into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find IL DoR IL-4506?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the IL DoR IL-4506. Open it immediately and start altering it with sophisticated capabilities.

How do I make changes in IL DoR IL-4506?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your IL DoR IL-4506 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is IL DoR IL-4506?

IL DoR IL-4506 is a form used in Illinois for requesting a copy of a tax return or tax information from the Illinois Department of Revenue.

Who is required to file IL DoR IL-4506?

Individuals or entities who need to obtain a duplicate copy of their tax returns or tax documents from the Illinois Department of Revenue are required to file IL DoR IL-4506.

How to fill out IL DoR IL-4506?

To fill out IL DoR IL-4506, provide your name, address, Social Security number or taxpayer ID, the type of return needed, and the year of the tax return. Sign and date the form before submitting it.

What is the purpose of IL DoR IL-4506?

The purpose of IL DoR IL-4506 is to formally request a copy of a tax return or tax information for personal records, verification, or other purposes.

What information must be reported on IL DoR IL-4506?

IL DoR IL-4506 requires the reporting of personal identification information such as name, address, Social Security number or taxpayer ID, the specific tax return year, and the type of document requested.

Fill out your IL DoR IL-4506 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL DoR IL-4506 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.