IL DoR IL-4506 2020 free printable template

Show details

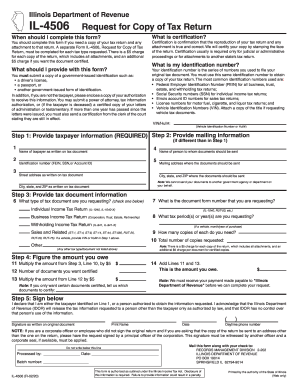

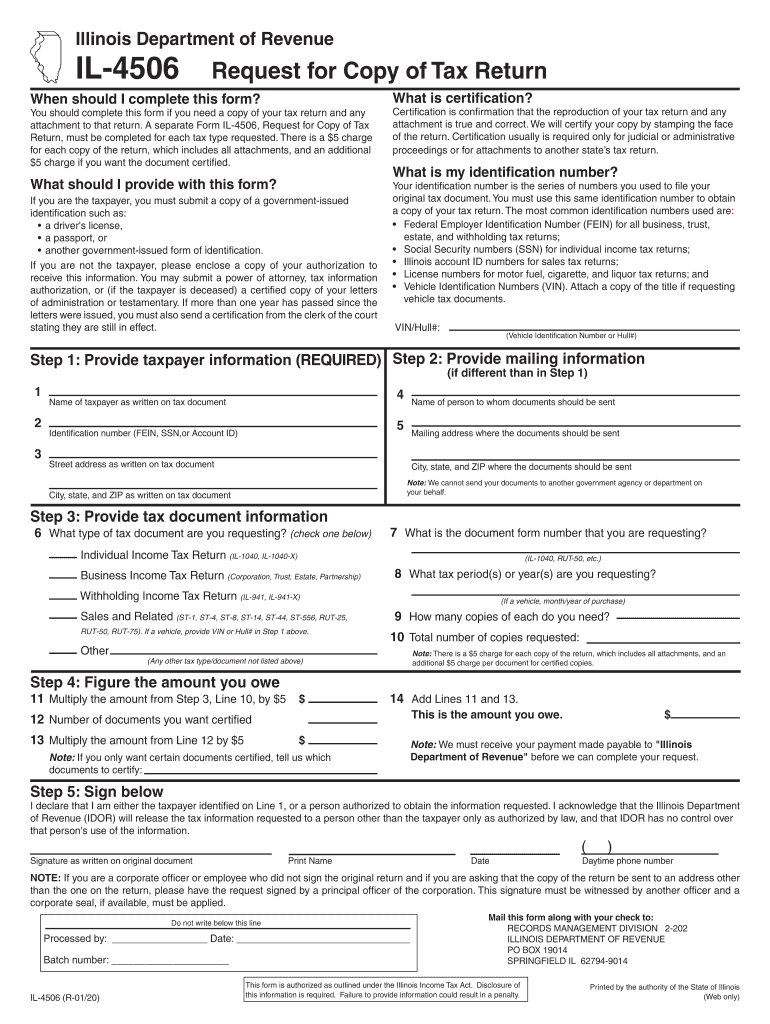

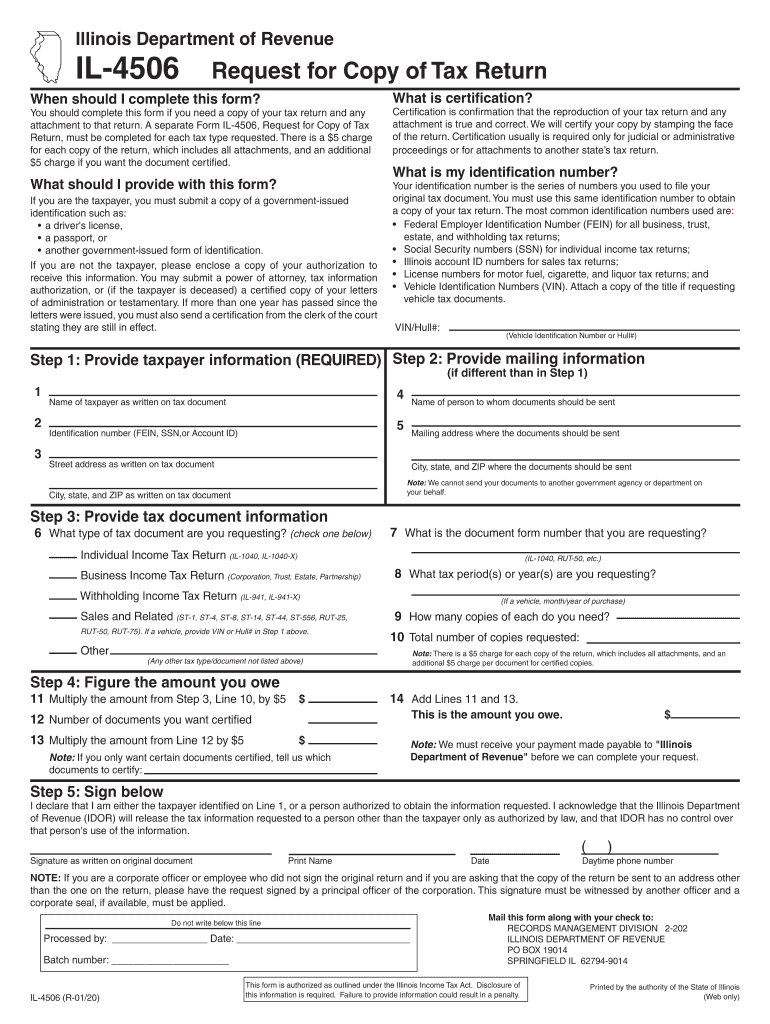

12 Multiply the number of documents you This is the amount you owe. want certified by 5 Note We must receive your payment made payable to Illinois Department of Revenue before we can complete your request. Illinois Department of Revenue IL-4506 Request for Copy of Tax Return What is my identification number When should I complete this form You should complete this form if you need a copy of your tax return and any attachment to that return. A separate Form IL-4506 Request for Copy of Tax...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL DoR IL-4506

Edit your IL DoR IL-4506 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL DoR IL-4506 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL DoR IL-4506 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IL DoR IL-4506. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR IL-4506 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL DoR IL-4506

How to fill out IL DoR IL-4506

01

Obtain the IL DoR IL-4506 form from the Illinois Department of Revenue website.

02

Fill in your name and address in the appropriate fields at the top of the form.

03

Provide your Social Security Number (SSN) or Employer Identification Number (EIN) as required.

04

Indicate the type of tax information you are requesting on the form.

05

Specify the tax years for which you need the information.

06

If applicable, provide the name and address of the person or organization you authorize to receive the information.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form to the Illinois Department of Revenue via mail or fax.

Who needs IL DoR IL-4506?

01

Individuals or businesses needing copies of their tax returns or tax information for specific tax years.

02

Taxpayers who are applying for loans or financial aid that require proof of income or tax filings.

03

Anyone undergoing an audit or needing to verify their tax history.

Instructions and Help about IL DoR IL-4506

Fill

form

: Try Risk Free

People Also Ask about

How much is a 4506 form?

You should complete Form 4506 and mail it to the address listed in the instructions, along with a $43 fee for each tax return requested.

Does the Illinois Department of Revenue use a collection agency?

We contract with collection agencies to help us collect the amount of tax, penalty, and interest that you owe. If we send your account to one of these agencies, you will become responsible for collection agency fees in addition to the tax, penalty, and interest that you already owe.

How do I get my Illinois state tax transcript?

If you do not have your confirmation code, call our Taxpayer Assistance at 1-800-732-8866 or (217) 782-3336. You may also obtain a copy by completing and submitting Form IL-4506, Request for Copy of Tax Return.

How do I know if I owe the state of Illinois money?

You can view the amounts of estimated payments you have made by visiting our IL-1040-ES Payment Inquiry application. You will be required to enter your primary Social Security number and the first four letters of your last name.

Can I get copies of my tax returns online?

Online. People can use Get Transcript Online to view, print or download a copy of all transcript types. They must verify their identity using the Secure Access process.

How can I get my tax transcript online immediately?

Taxpayers may also obtain a tax transcript online from the IRS. Use Get Transcript Online to immediately view the AGI. Taxpayers must pass the Secure Access identity verification process. Use Get Transcript by Mail or call 800-908-9946.

What does the Illinois Department of Revenue do?

Our Mission To serve Illinois' taxpayers by administering Illinois tax laws and collecting tax revenues in a fair, consistent, and efficient manner and by providing accurate and reliable funding and information in a timely manner.

How long does it take to process 4506?

Form 4506-T is free, and transcripts generally arrive in about three weeks. When you file the Form 4506-T, you'll receive a printout of most of the line items on your tax return (rather than a copy of the actual return). This document is called a tax return transcript.

How long does IRS take to process 4506?

Use Form 4506 to request a copy of your tax return. You can also designate (on line 5) a third party to receive the tax return. How long will it take? It may take up to 75 calendar days for us to process your request.

Why would the Department of Taxation send me a letter?

Typically, it's about a specific issue with a taxpayer's federal tax return or tax account. A notice may tell them about changes to their account or ask for more information. It could also tell them they need to make a payment.

Why am I getting a letter from Illinois Department of Revenue?

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in IL DoR IL-4506?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your IL DoR IL-4506 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an eSignature for the IL DoR IL-4506 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your IL DoR IL-4506 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete IL DoR IL-4506 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your IL DoR IL-4506 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is IL DoR IL-4506?

IL DoR IL-4506 is a form used in Illinois for requesting a copy of a tax return or related tax information from the Illinois Department of Revenue.

Who is required to file IL DoR IL-4506?

Individuals or entities who need to obtain their own tax return information, such as taxpayers or their authorized representatives, are required to file IL DoR IL-4506.

How to fill out IL DoR IL-4506?

To fill out IL DoR IL-4506, you need to provide personal information such as your name, address, Social Security number, the tax year for which you are requesting information, and the type of return you need.

What is the purpose of IL DoR IL-4506?

The purpose of IL DoR IL-4506 is to allow taxpayers to formally request copies of their tax returns or related information from the Illinois Department of Revenue.

What information must be reported on IL DoR IL-4506?

The information reported on IL DoR IL-4506 includes the taxpayer's name, address, Social Security number, the specific tax year requested, and the type of tax return being requested.

Fill out your IL DoR IL-4506 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL DoR IL-4506 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.