IL DoR IL-4506 2010 free printable template

Show details

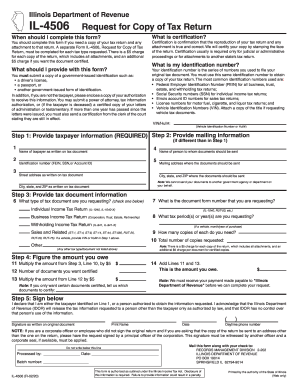

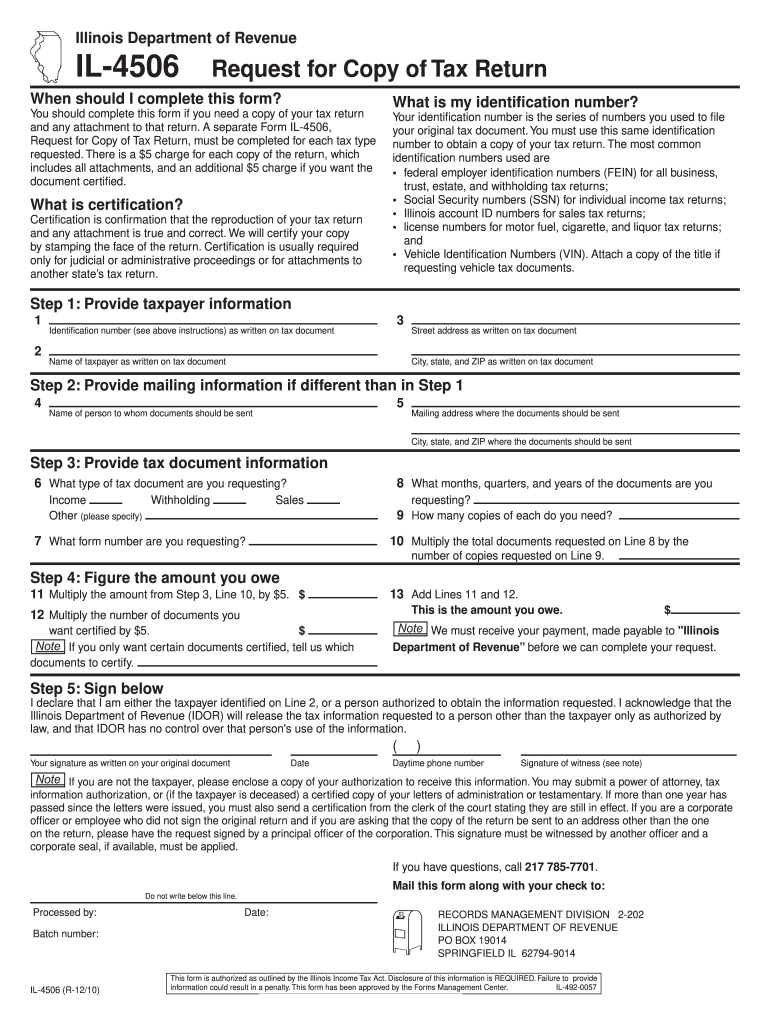

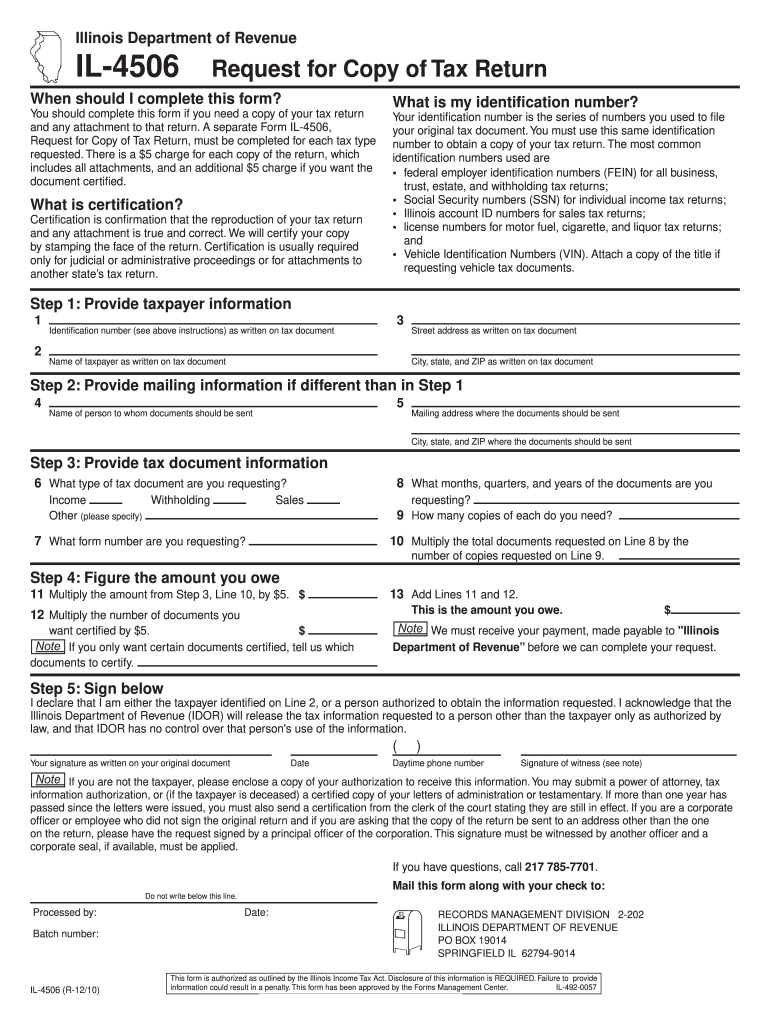

Mail this form along with your check to Do not write below this line. Processed by RECORDS MANAGEMENT DIVISION 2-202 ILLINOIS DEPARTMENT OF REVENUE PO BOX 19014 SPRINGFIELD IL 62794-9014 Batch number IL-4506 R-12/10 This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide information could result in a penalty. Illinois Department of Revenue IL-4506 Request for Copy of Tax Return When should I complete this form You...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL DoR IL-4506

Edit your IL DoR IL-4506 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL DoR IL-4506 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL DoR IL-4506 online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IL DoR IL-4506. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR IL-4506 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL DoR IL-4506

How to fill out IL DoR IL-4506

01

Obtain the IL DoR IL-4506 form either online or from your local Department of Revenue office.

02

Fill in your name, address, and taxpayer identification information in the designated fields.

03

Specify the type of tax return you are requesting the information for.

04

Indicate the tax year or years for which you need a copy of your tax return.

05

Provide your signature along with the date to authenticate the request.

06

Submit the form according to the instructions, either by mail or online, as per the options available.

Who needs IL DoR IL-4506?

01

Individuals who need to request a copy of their Illinois tax return for personal records or to provide information for loan applications.

02

Businesses or tax professionals who require copies of tax returns for clients or for their own records.

03

Anyone who is undergoing an audit or needs verification of past tax filings.

Instructions and Help about IL DoR IL-4506

Fill

form

: Try Risk Free

People Also Ask about

How much is a 4506 form?

You should complete Form 4506 and mail it to the address listed in the instructions, along with a $43 fee for each tax return requested.

Does the Illinois Department of Revenue use a collection agency?

We contract with collection agencies to help us collect the amount of tax, penalty, and interest that you owe. If we send your account to one of these agencies, you will become responsible for collection agency fees in addition to the tax, penalty, and interest that you already owe.

How do I get my Illinois state tax transcript?

If you do not have your confirmation code, call our Taxpayer Assistance at 1-800-732-8866 or (217) 782-3336. You may also obtain a copy by completing and submitting Form IL-4506, Request for Copy of Tax Return.

How do I know if I owe the state of Illinois money?

You can view the amounts of estimated payments you have made by visiting our IL-1040-ES Payment Inquiry application. You will be required to enter your primary Social Security number and the first four letters of your last name.

Can I get copies of my tax returns online?

Online. People can use Get Transcript Online to view, print or download a copy of all transcript types. They must verify their identity using the Secure Access process.

How can I get my tax transcript online immediately?

Taxpayers may also obtain a tax transcript online from the IRS. Use Get Transcript Online to immediately view the AGI. Taxpayers must pass the Secure Access identity verification process. Use Get Transcript by Mail or call 800-908-9946.

What does the Illinois Department of Revenue do?

Our Mission To serve Illinois' taxpayers by administering Illinois tax laws and collecting tax revenues in a fair, consistent, and efficient manner and by providing accurate and reliable funding and information in a timely manner.

How long does it take to process 4506?

Form 4506-T is free, and transcripts generally arrive in about three weeks. When you file the Form 4506-T, you'll receive a printout of most of the line items on your tax return (rather than a copy of the actual return). This document is called a tax return transcript.

How long does IRS take to process 4506?

Use Form 4506 to request a copy of your tax return. You can also designate (on line 5) a third party to receive the tax return. How long will it take? It may take up to 75 calendar days for us to process your request.

Why would the Department of Taxation send me a letter?

Typically, it's about a specific issue with a taxpayer's federal tax return or tax account. A notice may tell them about changes to their account or ask for more information. It could also tell them they need to make a payment.

Why am I getting a letter from Illinois Department of Revenue?

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute IL DoR IL-4506 online?

pdfFiller has made filling out and eSigning IL DoR IL-4506 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I sign the IL DoR IL-4506 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I fill out IL DoR IL-4506 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your IL DoR IL-4506. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IL DoR IL-4506?

IL DoR IL-4506 is a form used in Illinois to request a copy of a tax return or a transcript of a tax return from the Illinois Department of Revenue.

Who is required to file IL DoR IL-4506?

Any individual or entity that needs to obtain a copy of their tax return or transcript for their personal or business records may file IL DoR IL-4506.

How to fill out IL DoR IL-4506?

To fill out IL DoR IL-4506, provide accurate identification details including your name, address, tax identification number, and specify the tax year for which you are requesting the return or transcript.

What is the purpose of IL DoR IL-4506?

The purpose of IL DoR IL-4506 is to facilitate the retrieval of tax documents, aiding individuals or entities in accessing their historical tax information for various needs such as loan applications or audits.

What information must be reported on IL DoR IL-4506?

Information required on IL DoR IL-4506 includes the taxpayer's name, address, Social Security Number or Employer Identification Number, the specific tax documents being requested, and the tax year relevant to the request.

Fill out your IL DoR IL-4506 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL DoR IL-4506 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.