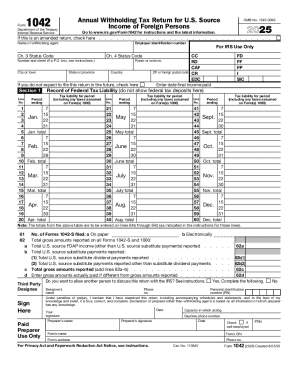

IRS 1042 2017 free printable template

Instructions and Help about IRS 1042

How to edit IRS 1042

How to fill out IRS 1042

About IRS previous version

What is IRS 1042?

Who needs the form?

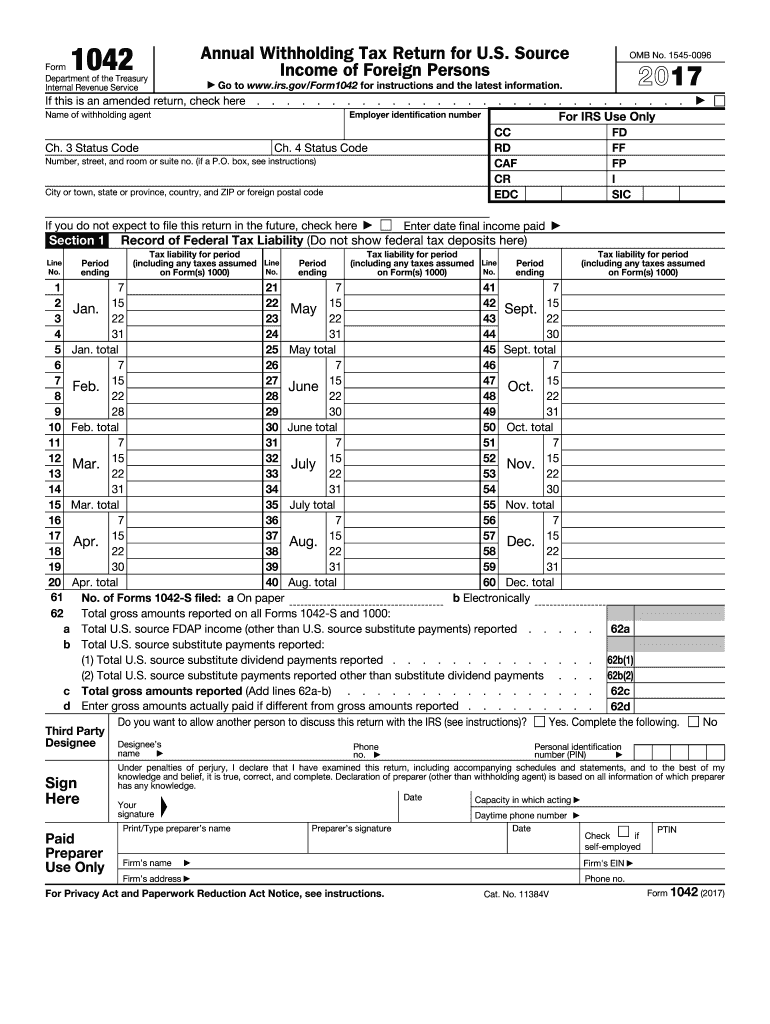

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1042

What should I do if I need to submit an amended form 1042 2017?

If you discover an error after filing your form 1042 2017, you'll need to submit an amended return. Fill out a new form with the corrected information and write 'Amended' at the top. Ensure you're aware of any implications this may have on your tax obligations or payments.

How can I track the status of my submitted form 1042 2017?

To verify receipt or processing of your form 1042 2017, use the IRS online tools or contact their support. Keep your submission confirmation handy to ease the tracking process and troubleshoot any rejections that may occur.

What if I receive an IRS notice regarding my form 1042 2017?

If you receive an IRS notice or letter about your form 1042 2017, carefully review the content. Gather the necessary documentation as requested and respond promptly to avoid any penalties. It may be beneficial to consult a tax professional for guidance.

Are e-signatures accepted for form 1042 2017?

Yes, the IRS recognizes electronic signatures on form 1042 2017 if you e-file the form. However, ensure that your submission complies with all verification requirements and that your records are securely stored.

What are the common errors to avoid when filing form 1042 2017?

Common errors include incorrect taxpayer identification numbers, mismatches between reported amounts and documentation, and failure to retain required records. Double-check all entries and ensure documentation is aligned with the amounts reported.