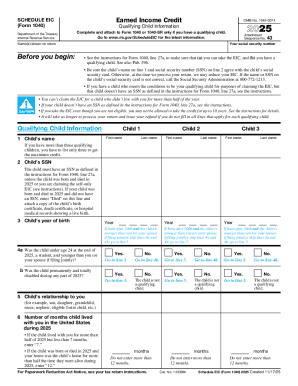

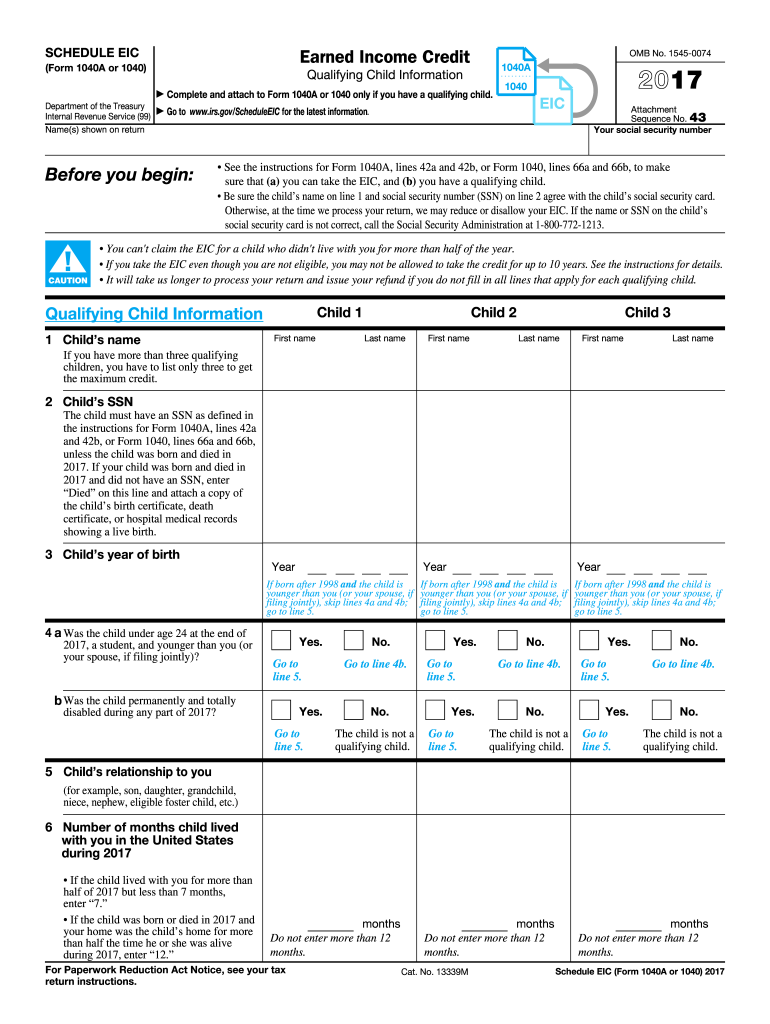

IRS 1040 - Schedule EIC 2017 free printable template

Instructions and Help about IRS 1040 - Schedule EIC

How to edit IRS 1040 - Schedule EIC

How to fill out IRS 1040 - Schedule EIC

About IRS 1040 - Schedule EIC 2017 previous version

What is IRS 1040 - Schedule EIC?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

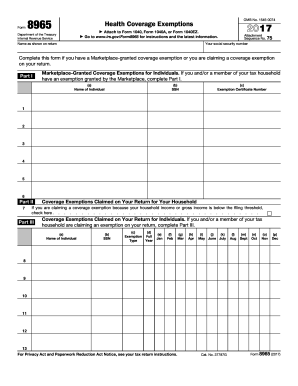

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040 - Schedule EIC

What should I do if I realize I made an error after filing IRS 1040 - Schedule EIC?

If you discover a mistake on your IRS 1040 - Schedule EIC after filing, you should file an amended return using Form 1040-X. Make sure to clearly indicate any corrections and include a revised Schedule EIC if applicable. Keep in mind that this process can take longer for the IRS to process and may require additional documentation.

How can I verify the status of my submitted IRS 1040 - Schedule EIC?

To verify the status of your IRS 1040 - Schedule EIC submission, you can use the IRS 'Where's My Refund?' tool available on their website. It will provide updates about the processing of your return and if any issues have arisen, including e-file rejection codes, which you can rectify.

What common errors should I avoid when filing the IRS 1040 - Schedule EIC?

Common errors when filing the IRS 1040 - Schedule EIC include incorrect Social Security numbers, failing to check eligibility requirements for the Earned Income Credit, and neglecting to attach necessary schedules. Double-check all entries and ensure your calculations are accurate to minimize rejections.

What should I do if I receive a notice from the IRS regarding my Schedule EIC?

If you receive a notice from the IRS about your Schedule EIC, carefully read the communication to understand the issues raised. Take prompt action to address the concerns, which may include providing additional documentation or clarification. It's crucial to respond within the specified timeline to avoid penalties.

Is e-signature acceptable for the IRS 1040 - Schedule EIC, and what are the data security measures?

Yes, e-signatures are acceptable for the IRS 1040 - Schedule EIC when filed electronically, which improves convenience and efficiency. The IRS uses advanced encryption techniques and security protocols to ensure that your personal data remains protected throughout the filing process.

See what our users say