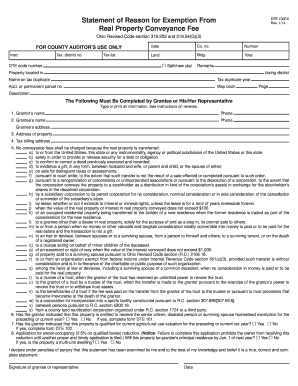

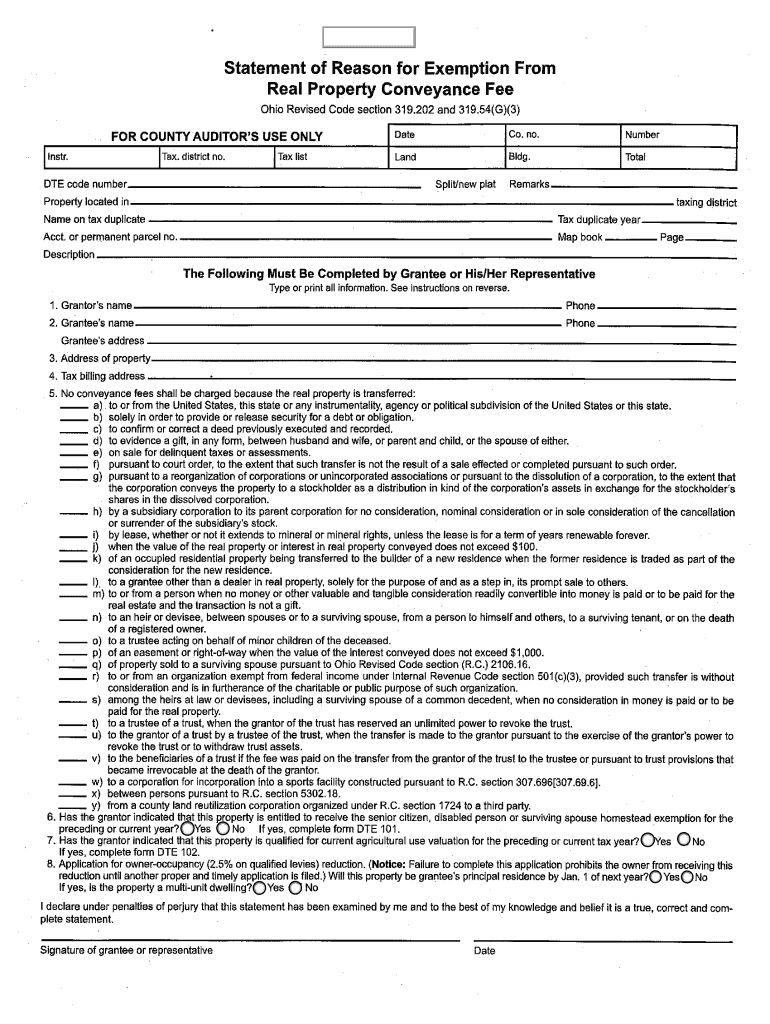

OH DTE 100EX 2016-2025 free printable template

Show details

Reset DUE 100 EX Rev. 08.16-Page 2 DUE 100 EX Rev. 08.16-Page 2

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ohio reason exemption form

Edit your dte 100ex form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ohio reason exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ohio dte 100ex fillable online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit dte 100ex exemption form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH DTE 100EX Form Versions

Version

Form Popularity

Fillable & printabley

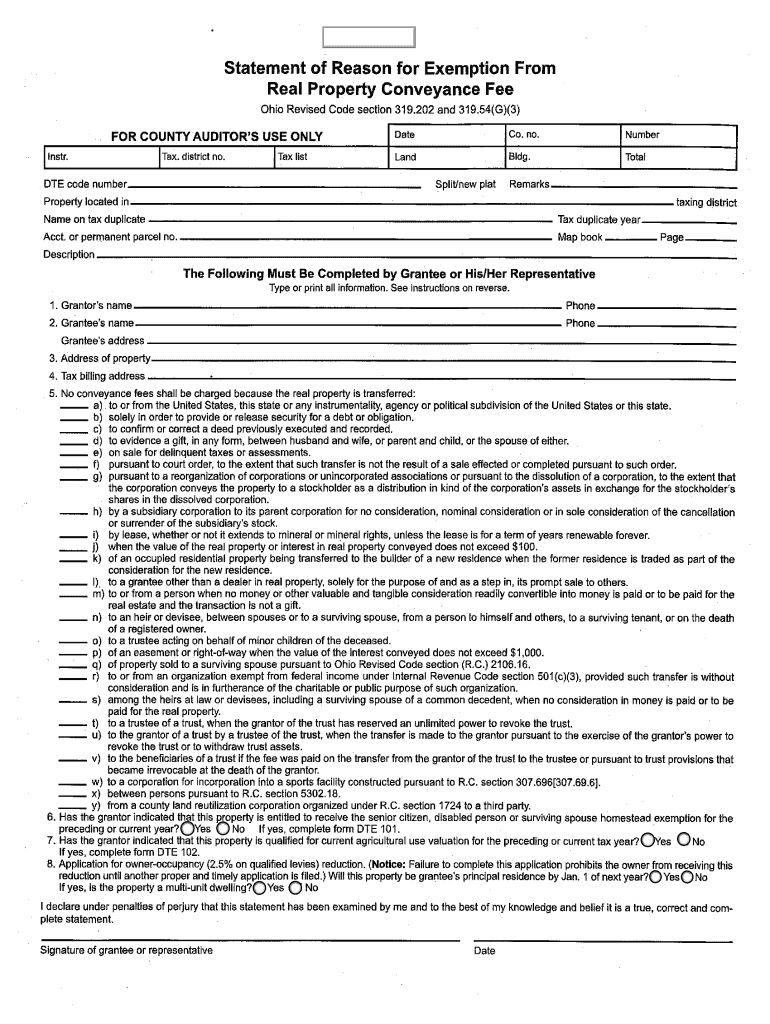

How to fill out ohio real property conveyance form

How to fill out OH DTE 100EX

01

Obtain the OH DTE 100EX form from the official Ohio Department of Taxation website.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information, including name, address, and Social Security number.

04

Indicate the type of exemption being claimed and provide any necessary details or supporting information.

05

Attach any required documentation that supports your exemption claim.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submitting.

08

Submit the form to the appropriate Ohio Department of Taxation office by mail or electronically as instructed.

Who needs OH DTE 100EX?

01

Individuals or businesses seeking an exemption from certain Ohio taxes or fees.

02

Taxpayers who qualify for specific deductions or credits outlined in the exemption form.

03

Organizations or entities that operate in Ohio and are eligible for tax exemptions.

Video instructions and help with filling out and completing dte 100ex statement exemption

Instructions and Help about exemption form conveyance

Fill

dte100ex form

: Try Risk Free

People Also Ask about ohio exemption conveyance

At what age do you stop paying property tax in Ohio?

The Homestead Exemption is a property tax reduction available by application to seniors (age 65 or older) and the disabled (permanent/total). In 1970, Ohio voters approved a constitutional amendment permitting this exemption that reduced property taxes for eligible lower income home owners.

How do I apply for property tax exemption in Ohio?

To apply, complete the application form (DTE 105A, Homestead Exemption Application Form for Senior Citizens, Disabled Persons, and Surviving Spouses), then file it with your local county auditor. The form is available on the Department of Taxation's website and is also available from county auditors.

Who is exempt from real property transfer tax in Ohio?

Major Exemptions The tax does not apply: to sales or transfers to or from the U.S. government or its agencies, or to or from the state of Ohio or any of its political subdivisions. to gifts from one spouse to another, or to children and their spouses. to surviving spouses or to a survivorship tenant.

What is a valid reason for tax exemption in Ohio?

Certain telecommunication services. Satellite broadcasting service. Personal care service, including skin care, application of cosmetics, manicures, pedicures, hair removal, tattoos, body piercing, tanning, massage and other similar services.

What are the requirements for a Homestead Exemption in Ohio?

Who is eligible for the Homestead Exemption? To qualify for the Homestead you must: Own and occupy the home as your primary place of residence as of January 1 of the year for which they apply; and. Be 65 years of age, or turn 65, by December 31 of the year for which they apply; or.

What is exempt from real property tax in Ohio?

Properties owned and operated by a municipal corporation or belonging to the state or federal government and used exclusively for public purpose are exempt from taxation. Public schools, colleges, academies and churches are also exempt from paying real estate taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ohio property conveyance without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your ohio property conveyance form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make edits in statement reason exemption property form without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your ohio dte 100ex, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my ohio exemption conveyance fee in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your exemption real right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is OH DTE 100EX?

OH DTE 100EX is a tax form used in Ohio for reporting specific information related to earnings and income for tax purposes.

Who is required to file OH DTE 100EX?

Individuals or entities that have earned income in Ohio and meet certain criteria as outlined by the Ohio Department of Taxation are required to file OH DTE 100EX.

How to fill out OH DTE 100EX?

To fill out OH DTE 100EX, collect your income information, enter the required details on the form, ensure accuracy, and submit by the deadline set by Ohio tax authorities.

What is the purpose of OH DTE 100EX?

The purpose of OH DTE 100EX is to provide the Ohio tax authority with a record of earnings and income for assessment and taxation.

What information must be reported on OH DTE 100EX?

The information that must be reported on OH DTE 100EX includes personal identification, income details, deductions, and other relevant financial data required for accurate tax assessment.

Fill out your dte 100ex statement exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dte 100ex Fillable is not the form you're looking for?Search for another form here.

Keywords relevant to dte100ex form

Related to dte100ex form conveyance

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.