OH DTE 100EX 2014 free printable template

Show details

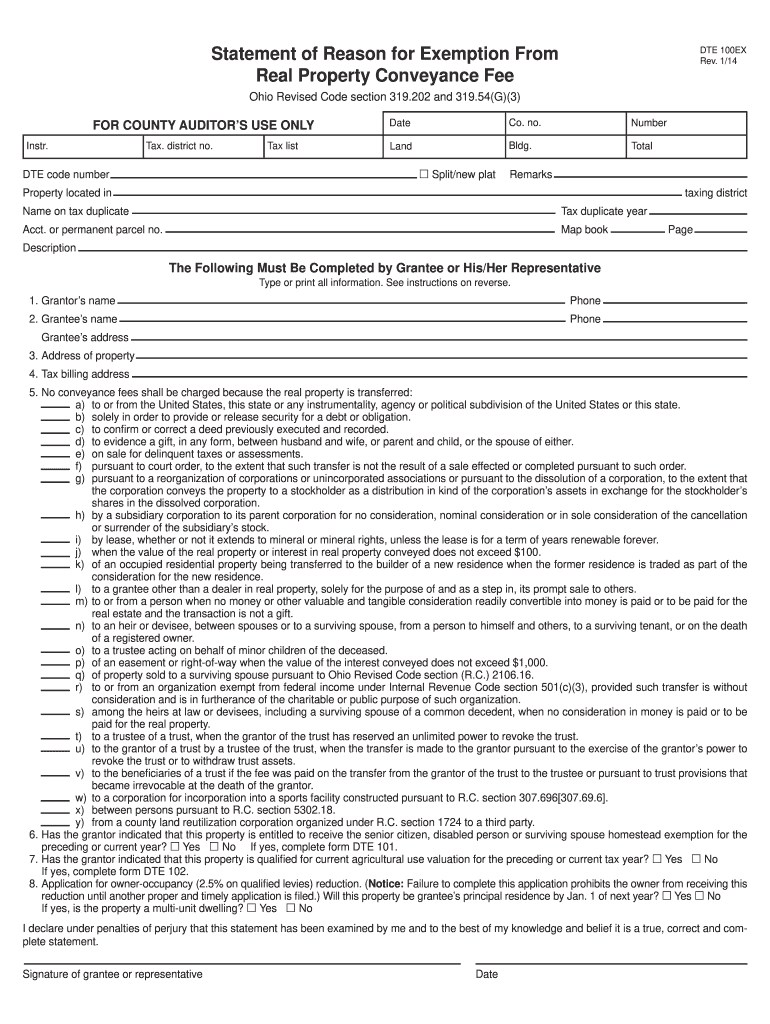

DTE 100EX Rev. 1/14 Statement of Reason for Exemption From Real Property Conveyance Fee Ohio Revised Code section 319. 202 and 319. 54 G 3 FOR COUNTY AUDITOR S USE ONLY Instr* Tax. district no. Tax list Date Co. no. Number Land Bldg. Total Split/new plat DTE code number Remarks Property located in taxing district Name on tax duplicate Tax duplicate year Acct* or permanent parcel no. Map book Page Description The Following Must Be Completed by Grantee or His/Her Representative Type or print...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign exemption conveyance fee 2014

Edit your exemption conveyance fee 2014 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your exemption conveyance fee 2014 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing exemption conveyance fee 2014 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit exemption conveyance fee 2014. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH DTE 100EX Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out exemption conveyance fee 2014

How to fill out OH DTE 100EX

01

Step 1: Download the OH DTE 100EX form from the official website.

02

Step 2: Fill in your personal information, including your name, address, and taxpayer identification number.

03

Step 3: Provide the necessary details about your income sources and any deductions you wish to claim.

04

Step 4: Review the instructions carefully to ensure all required fields are completed accurately.

05

Step 5: Sign and date the form to certify that the information provided is true and correct.

06

Step 6: Submit the completed form to the appropriate tax authority by the specified deadline.

Who needs OH DTE 100EX?

01

Individuals or entities seeking a tax exemption in Ohio.

02

Taxpayers who have been advised to use this form for specific exemptions.

03

Anyone who has qualifying conditions as per the Ohio Department of Taxation guidelines.

Instructions and Help about exemption conveyance fee 2014

Fill

form

: Try Risk Free

People Also Ask about

What is 100EX?

PolySpec® 100EX is a 100% solids, moisture tolerant, penetrating epoxy primer used to prime concrete surfaces for high performance applications. It is commonly utilized as part of a complete TuffRez flooring system and is also suited for use with epoxy novolac lining systems.

What car does Johnny English drive?

Trivia (26) The car that Johnny English used was an Aston Martin DB7 Vantage, which was actually Rowan Atkinson's own car.

Is conveyance fee taxable?

Yes. A short sale is a sale of real estate evidenced by a deed conveying the real estate to a purchaser for consideration. If the value of the consideration paid to purchase the real estate exceeds $100, then the Real Estate Conveyance Tax is due on the amount paid to purchase the property.

What is Form TP 584 used for?

Form TP-584 must be used to comply with the filing requirements of the real estate transfer tax (Tax Law Article 31); the tax on mortgages (Tax Law Article 11), as it applies to the Credit Line Mortgage Certificate; and the exemption from estimated personal income tax (Tax Law Article 22), as it applies to the sale or

Who pays transfer tax in NY buyer or seller?

Who Pays the Real Estate Transfer Tax? In New York, the seller of the property is typically the individual responsible for paying the real estate transfer tax. However, if the seller doesn't pay or is exempt from the tax, the buyer must pay.

Who is exempt from transfer tax in NY?

(a) The following shall be exempt from payment of the real estate transfer tax: 1. The state of New York, or any of its agencies, instrumentalities, political subdivisions, or public corporations (including a public corporation created pursuant to agreement or compact with another state or the Dominion of Canada).

Who must file 2663?

Form IT-2663 must be signed by the nonresident transferor/seller (an individual, a trustee, an executor, or other fiduciary of an estate or trust). If you are married and filing one Form IT-2663, both spouses must sign in the spaces provided.

Does New York State have a capital gains tax on real estate?

Sellers in New York City pay ordinary state and city income tax rates on any real estate capital gains. There are no separate capital gains tax rates for NYC or New York State. This means that any sale profits will be taxed both by New York City and New York State based on your applicable local and state tax brackets.

What is a it 2663 form?

must use Form IT-2663, Nonresident Real Property Estimated. Income Tax Payment Form, to compute the gain (or loss) and. pay the full amount of estimated tax due, if applicable. Use 2023. Form IT‑2663 for sales or transfers of real property that occur after December 31, 2022, but before January 1, 2024.

What taxes do you pay when you sell a house in Hawaii?

What is the actual Hawaii capital gains tax? The Hawaii capital gains tax on real estate is 7.25%. If the collected amount is too large, how do you obtain a refund? If the 7.25% of sales price withholding is too large, the owner files a Hawaii form N-288C after closing.

What is form it-203 New York?

New York Resident, Nonresident, and Part-Year Resident Itemized Deductions. Used by nonresident and part-year resident (Form IT-203) filers who need to report other New York State or New York City taxes, and tax credits other than those reported directly on Form IT-203.

Is Johnny English Rolls Royce real?

The official history is that the V16 was designed after the Phantom had been launched, and was never seriously considered for production. It was, says Rolls-Royce, purely an experiment for project 100EX – the show car that was a precursor to the Phantom Drophead Coupé.

How much is transfer tax in New York State?

The tax rate is an incremental rate between . 25% and 2.9% based on the purchase price. The rates are published in Form TP-584-NYC-I, Instructions for Form TP-584-NYC.

Does a New York home buyer pay taxes?

NY state imposes a mortgage tax rate of 0.5%. It is important to note that the amounts for both mortgage taxes is based on the loan amount and not the purchase price of the real estate transaction. Yes, that's a significant chunk of money coming out of your pocket and is unfortunately paid upfront.

Which Rolls Royce has a V16?

Rolls-Royce 101EX View of the V16 power-unit of the Rolls-Royce 100EX, and featured in the Johnny English Reborn film car.

How much does a phantom cost?

Starting at $460,000 est Highs Peerless ride quality, classic Rolls styling with modern tech, cabin offers the utmost in luxury. Lows Gas-guzzling V-12 engine, it costs half a million dollars, that hefty price doesn't even include a chauffeur.

How do you calculate transfer tax in NYC?

In New York State, the transfer tax is calculated at a rate of two dollars for every $500. For instance, the real estate transfer tax would come to $1,200 for a $300,000 home. New York State also has a mansion tax.

Who pays the conveyance tax in Hawaii?

The person responsible for the tax is generally the transferor, grantor, lessor, sublessor, conveyor, or other person conveying the real property interest (HRS §247-3). The ® standard purchase contract directs escrow to charge the conveyance tax to the seller.

What is it 558 form used for?

Created as a new charitable deduction for those taking the standard deduction on their federal return of up to $300. This amount is required to be added back to income for NY purposes.

What is the Hawaii conveyance tax?

On actual and full consideration paid for the transfer of realty, including leases and subleases, a tax is imposed. The tax ranges from 10¢ per $100 for conveyances under $600,000 to $1.00 per $100 for conveyances in excess of $10 million.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my exemption conveyance fee 2014 in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your exemption conveyance fee 2014 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I make changes in exemption conveyance fee 2014?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your exemption conveyance fee 2014 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I edit exemption conveyance fee 2014 on an Android device?

You can make any changes to PDF files, like exemption conveyance fee 2014, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is OH DTE 100EX?

OH DTE 100EX is a tax form used in Ohio for the purpose of reporting certain tax information related to the distribution of public utility excise taxes.

Who is required to file OH DTE 100EX?

Entities that operate public utility services and meet specific criteria set by the Ohio Department of Taxation are required to file OH DTE 100EX.

How to fill out OH DTE 100EX?

To fill out OH DTE 100EX, you need to provide detailed information about your business, including tax identification numbers, gross receipts, and any applicable deductions, following the instructions provided by the Ohio Department of Taxation.

What is the purpose of OH DTE 100EX?

The purpose of OH DTE 100EX is to enable the state of Ohio to collect accurate public utility tax revenues and to ensure compliance with state tax laws.

What information must be reported on OH DTE 100EX?

The information that must be reported on OH DTE 100EX includes the entity's name, address, tax identification number, gross receipts, taxable amounts, and any deductions or credits applicable to the tax period.

Fill out your exemption conveyance fee 2014 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Exemption Conveyance Fee 2014 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.