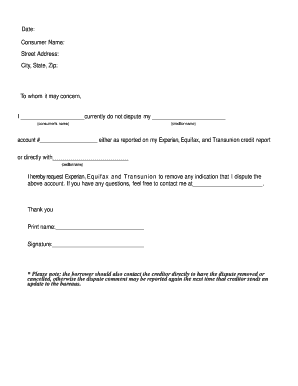

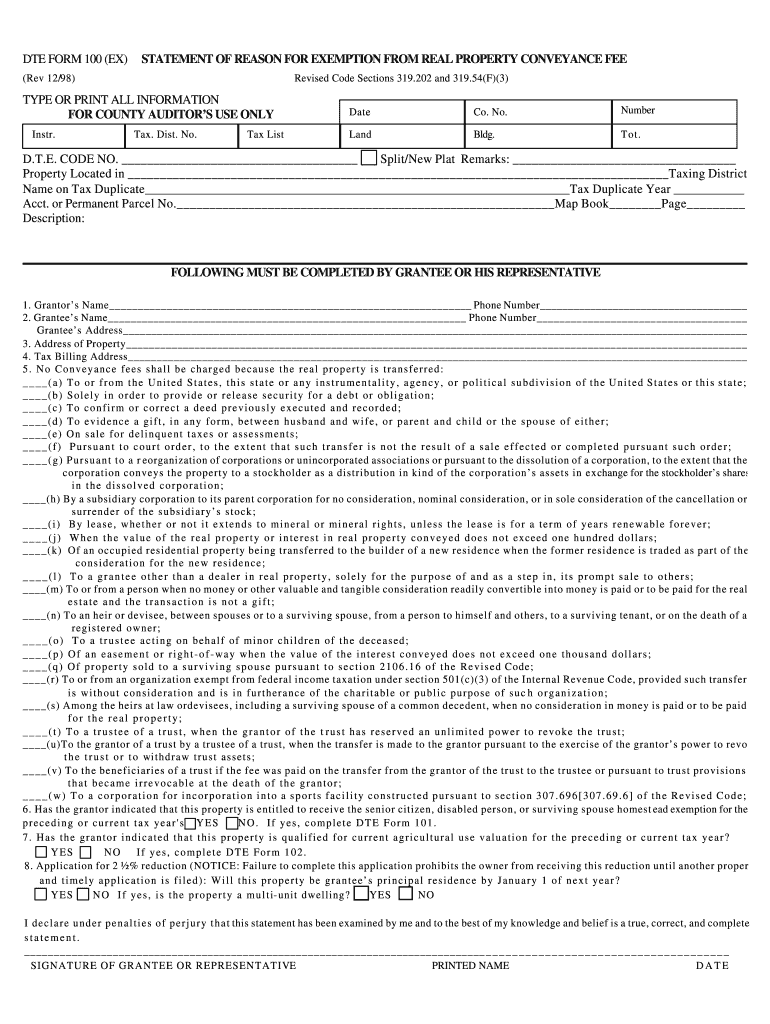

OH DTE 100EX 1998 free printable template

Show details

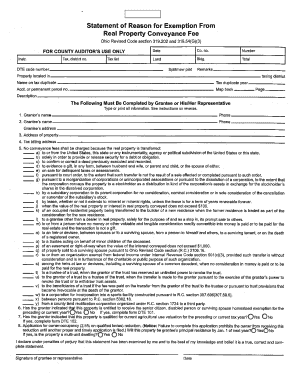

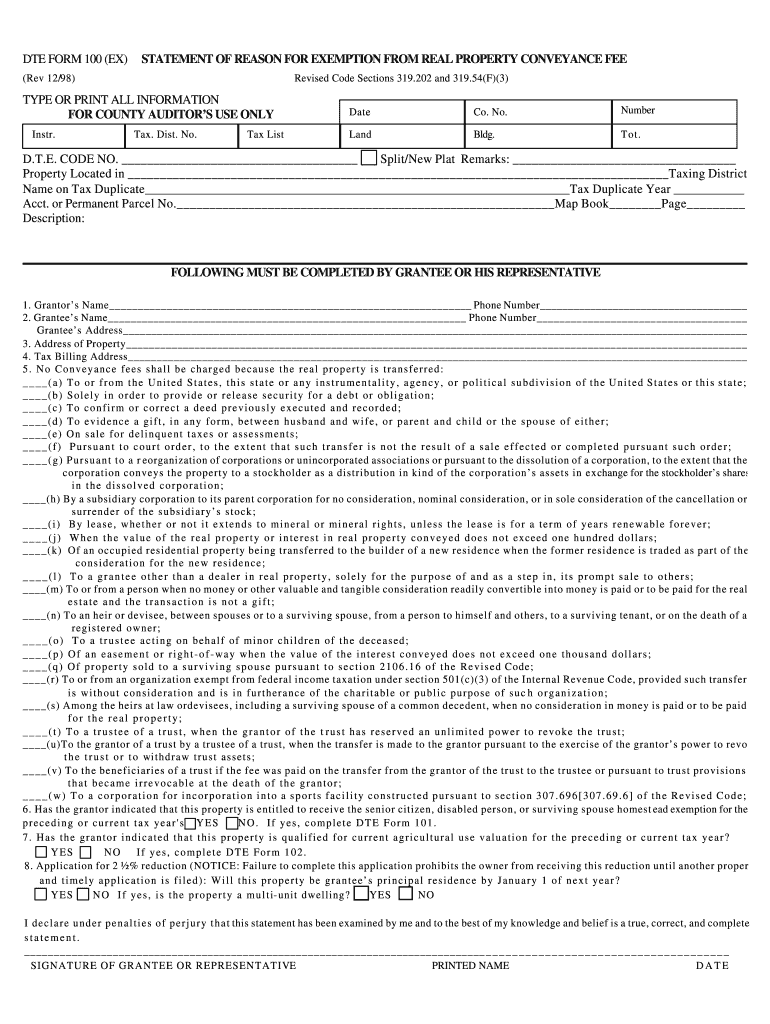

FOLLOWING MUST BE COMPLETED BY GRANTEE OR HIS ... (d) To evidence a gift, in any form, between husband and wife, or parent and child or the ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH DTE 100EX

Edit your OH DTE 100EX form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH DTE 100EX form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OH DTE 100EX online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OH DTE 100EX. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH DTE 100EX Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH DTE 100EX

How to fill out OH DTE 100EX

01

Obtain the OH DTE 100EX form from the Ohio Department of Taxation website or local tax office.

02

Enter your name, address, and contact information in the designated fields.

03

Provide your Social Security number or Federal Identification Number.

04

Indicate the type of entity you are filing for (individual, business, etc.).

05

Complete the income and expense sections as required, detailing your qualifications for exemption.

06

Attach any necessary documentation that supports your claim for exemption.

07

Review the form for accuracy and completeness.

08

Sign and date the form as required.

09

Submit the completed form to the appropriate tax authority by the deadline.

Who needs OH DTE 100EX?

01

Individuals or businesses seeking exemption from certain taxes in Ohio.

02

Non-profit organizations that qualify for tax exemption.

03

Entities that meet specific criteria set by the Ohio Department of Taxation.

Fill

form

: Try Risk Free

People Also Ask about

How much is the conveyance fee in Stark County?

Conveyance fee is $. 004 on purchase price rounded to the next $100.00 plus a $. 50 per tax parcel. The Auditor's Office can ONLY accept check or cash payments.

How much does it cost to transfer a deed in Ohio?

Ohio's conveyance fee is $1.00 for each $1,000 of the real estate's value—typically based on the purchase price of the transferred property. The seller is responsible for paying the conveyance fee unless the parties agree otherwise.

Who pays real estate transfer tax in Ohio?

The real property conveyance fee is paid by persons who make sales of real estate or used manufactured homes. The base of the tax is the value of real estate sold or transferred from one person to another.

What is the conveyance fee for real property in Ohio?

The current rate for the Ohio real property conveyance fee is one mil ($1 per $1,000 of the value of the property sold or transferred.)

Who pays the transfer tax at closing in Ohio?

The tax shall be levied upon the grantor named in the deed and shall be paid by the grantor for the use of the county to the county auditor at the time of the delivery of the deed as provided in section 319.202 of the Revised Code and prior to the presentation of the deed to the recorder of the county for recording.

How much is the conveyance fee in Medina County?

Conveyance Form The real property conveyance fee for Medina County is $3.00 per $1,000 of the sale price.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OH DTE 100EX to be eSigned by others?

To distribute your OH DTE 100EX, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete OH DTE 100EX online?

Completing and signing OH DTE 100EX online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I complete OH DTE 100EX on an Android device?

Use the pdfFiller Android app to finish your OH DTE 100EX and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is OH DTE 100EX?

OH DTE 100EX is a form used in Ohio for reporting the use of certain fuels and exemptions related to the state excise tax on motor fuel.

Who is required to file OH DTE 100EX?

Individuals or businesses that qualify for a fuel tax exemption in Ohio, such as government entities or non-profit organizations, are required to file the OH DTE 100EX form.

How to fill out OH DTE 100EX?

To fill out OH DTE 100EX, you must provide your identification information, specify the type of fuel, detail the amount of fuel used, and indicate the reason for the exemption, along with any supporting documentation.

What is the purpose of OH DTE 100EX?

The purpose of OH DTE 100EX is to allow eligible users to claim exemptions from Ohio's motor fuel excise taxes, thereby ensuring compliance with state tax regulations while avoiding unnecessary taxation.

What information must be reported on OH DTE 100EX?

The information that must be reported on OH DTE 100EX includes the applicant's name, address, identification number, type and quantity of fuel, exemption reason, and any additional details as required by the Ohio Department of Taxation.

Fill out your OH DTE 100EX online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH DTE 100ex is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.