WI DoR 1-ES (D-101) 2018 free printable template

Show details

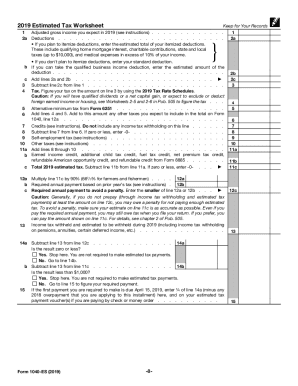

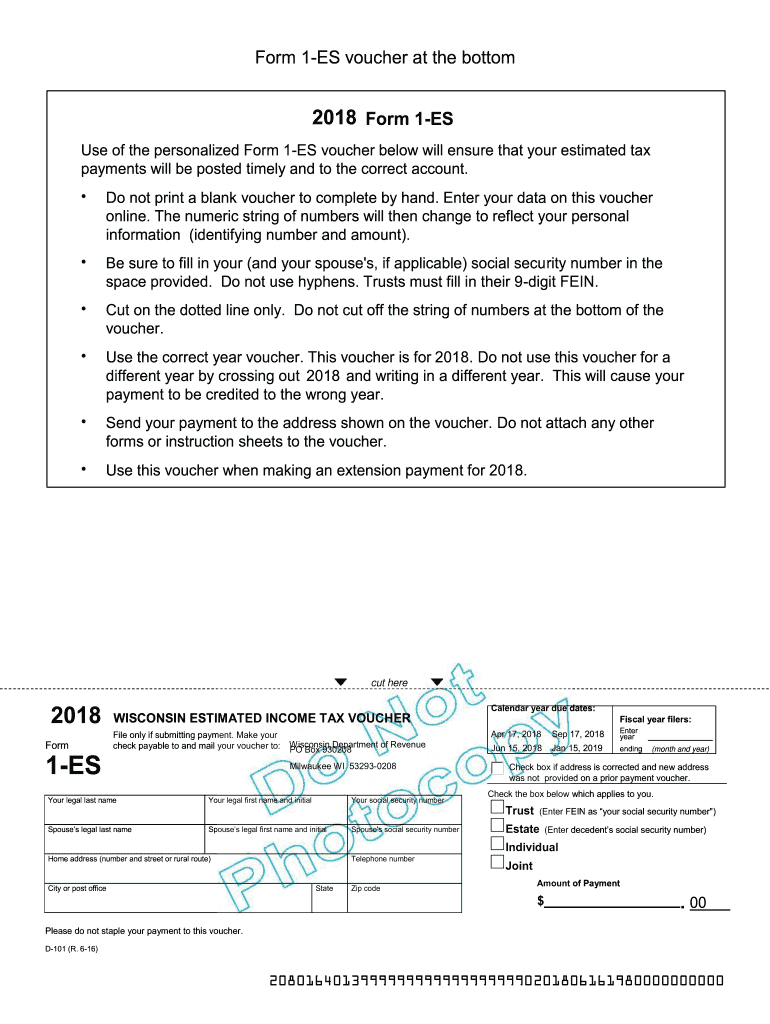

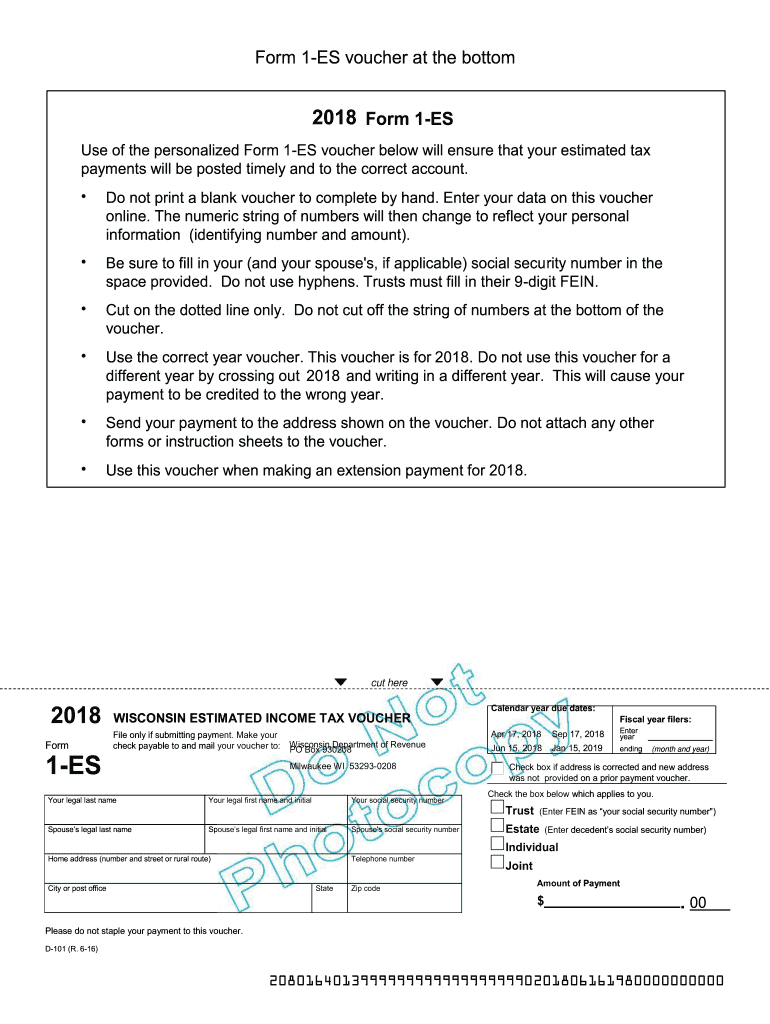

The ink must not spatter or smear. i. The OCR print line should read Form 1-ES for Individuals Form 1-ES for Trusts Form 1-ES for Estates Form 1-ES for Joint Filers j. Of Revenue staff cc 1. Form 1-ES Document Specifications a. Size Form 1-ES must be 8 1/2 x 3 2/3. b. Form 1-ES voucher at the bottom 2018 Form 1-ES Use of the personalized Form 1-ES voucher below will ensure that your estimated tax payments will be posted timely and to the correct account. OCR Scan Line Specifications Form...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI DoR 1-ES D-101

Edit your WI DoR 1-ES D-101 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI DoR 1-ES D-101 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI DoR 1-ES D-101 online

Follow the steps down below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit WI DoR 1-ES D-101. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI DoR 1-ES (D-101) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI DoR 1-ES D-101

How to fill out WI DoR 1-ES (D-101)

01

Download the WI DoR 1-ES (D-101) form from the Wisconsin Department of Revenue website.

02

Fill out the top section with your personal information, including your name, address, and Social Security number.

03

Indicate your filing status by checking the appropriate box (single, married, etc.).

04

Provide your estimated income for the year, including wages, interest, and any other sources of income.

05

Calculate your estimated tax liability based on the income figures you provided.

06

Determine the amount of estimated taxes you have already paid or have been withheld.

07

Subtract any payments from your estimated tax liability to find out how much you need to pay.

08

Sign and date the form before submitting it to the Wisconsin Department of Revenue, along with any payment if required.

Who needs WI DoR 1-ES (D-101)?

01

Individuals who expect to owe $1,000 or more in Wisconsin income tax after subtracting withholding and credits.

02

People who are self-employed or have income not subject to withholding.

03

Taxpayers who have significant income from sources such as rental properties, investments, or additional jobs.

Fill

form

: Try Risk Free

People Also Ask about

What is ITR-1 category?

ITR-7 ITR FormApplicable toExempt IncomeITR-1 / SahajIndividual, HUF (Residents)Yes (Agricultural Income less than Rs 5,000)ITR-2Individual, HUFYesITR-3Individual or HUF, partner in a FirmYesITR-4Individual, HUF, FirmYes (Agricultural Income less than Rs 5,000)3 more rows • 6 days ago

Who can file ITR-1?

Individual taxpayers who meet the criteria of (a) making cash deposits above Rs. 1 crore with a bank or (b) incurring expenses above Rs. 2 lakh on foreign travel, or (c) expenditure above Rs. 1 lakh on electricity should also file ITR-1.

What is the Massachusetts state income tax rate for 2018?

See instructions. 21 TOTAL TAXABLE 5.1% INCOME.

What is Massachusetts Form 1 ES?

Form 1-ES. Massachusetts Estimated Income Tax. General Information. What is the purpose of estimated tax payment vouch ers? The purpose of the payment vouchers is to provide a means for paying any taxes due on income which is not subject to withhold- ing.

What is Wisconsin Form 1 ES?

Form 1 is the general income tax return (long form) for Wisconsin residents. It can be efiled or sent by mail. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Estimated tax payments must be sent to the Wisconsin Department of Revenue on a quarterly basis.

What is ITR1 and ITR2?

To sum up, ITR1 is meant for individuals with simple tax situations, while ITR2 is meant for individuals with more complex tax situations that include multiple sources of income, capital gains, and foreign assets/income.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my WI DoR 1-ES D-101 in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your WI DoR 1-ES D-101 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I complete WI DoR 1-ES D-101 online?

Filling out and eSigning WI DoR 1-ES D-101 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out the WI DoR 1-ES D-101 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign WI DoR 1-ES D-101. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is WI DoR 1-ES (D-101)?

WI DoR 1-ES (D-101) is a form used in Wisconsin for individuals to report and pay estimated income tax.

Who is required to file WI DoR 1-ES (D-101)?

Individuals who expect to owe at least $500 in Wisconsin income tax and who are not subject to withholding are required to file WI DoR 1-ES (D-101).

How to fill out WI DoR 1-ES (D-101)?

To fill out WI DoR 1-ES (D-101), you need to provide your personal information, estimated tax income, and any prior payments or credits. You may also need to include details about your income sources.

What is the purpose of WI DoR 1-ES (D-101)?

The purpose of WI DoR 1-ES (D-101) is to enable taxpayers to report and pay their expected income tax liabilities in advance, thereby avoiding penalties for underpayment.

What information must be reported on WI DoR 1-ES (D-101)?

The WI DoR 1-ES (D-101) requires reporting of personal information, estimated tax liability for the year, prior estimated payments, and any applicable credits.

Fill out your WI DoR 1-ES D-101 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI DoR 1-ES D-101 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.